Last updated: July 27, 2025

Introduction

Telmisartan, marketed predominantly under the brand name Micardis by Boehringer Ingelheim, is an angiotensin II receptor blocker (ARB) primarily prescribed for hypertension and cardiovascular risk management. Since its approval, telmisartan has established itself as a significant player within the ARB segment, driven by its unique pharmacological properties and expanding therapeutic indications. This report analyzes the current market landscape, drivers and restraints influencing its growth, and forecasts its financial trajectory over the upcoming years.

Pharmacological Profile and Therapeutic Indications

Telmisartan functions by selectively blocking angiotensin II type 1 (AT1) receptors, leading to vasodilation and blood pressure reduction. Its high lipophilicity confers prolonged plasma half-life, enabling once-daily dosing and improving patient adherence. Besides hypertension, telmisartan has received approval for cardiovascular event risk reduction in high-risk patients and is being investigated for additional indications such as metabolic syndrome and diabetic nephropathy. The drug’s favorable safety profile has also contributed to its widespread acceptance.

Market Landscape and Competitive Positioning

The global ARB market, which exceeds USD 25 billion as of 2022, features prominent drugs like losartan, valsartan, irbesartan, and telmisartan. Telmisartan's market share remains robust, particularly in regions favoring once-daily dosing and benefits in metabolic profiles. Its differentiation lies in its long half-life and potential benefits in metabolic parameters, positioning it favorably against competitors.

Major manufacturers like Boehringer Ingelheim, along with generic producers, dictate market dynamics through patent protections and subsequent off-patent generic availability. The expiration of telmisartan's primary patent in most regions has facilitated generics' entry, significantly impacting sales and pricing strategies.

Market Dynamics Influencing Telmisartan

-

Patent Expiry and Generic Competition

The patent expiry in key markets, including the EU and the US (around 2019-2020), led to increased availability of generics, precipitating a sharp decline in branded sales. Despite this, the marketed formulations continue to see demand due to physician familiarity and perceived clinical efficacy.

-

Regulatory Approvals and Expanded Indications

Regulatory agencies have approved telmisartan for additional uses, particularly for cardiovascular risk reduction. Ongoing clinical trials exploring benefits in metabolic syndrome and diabetic nephropathy could further expand its prescription base, influencing long-term growth.

-

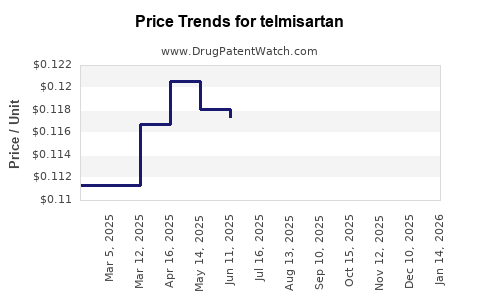

Pricing Strategies and Reimbursement Policies

Generic entry has drastically reduced prices, making telmisartan a cost-effective option. Reimbursement policies in major markets favor first-line antihypertensives, bolstering sales volume, though price pressures persist.

-

Emerging Market Penetration

Countries in Asia, Latin America, and Africa exhibit increasing hypertension prevalence and income growth, creating expanding markets for telmisartan. Local manufacturers amplify competition but also pose opportunities for market share growth through affordable pricing strategies.

-

Physician Prescribing Trends

The preference for ARBs over other antihypertensives due to superior tolerability sustains demand. However, the increasing preference for newer agents with additional benefits (e.g., ARNI drugs) may influence prescription patterns.

Financial Trajectory and Forecasting

-

Historical Performance

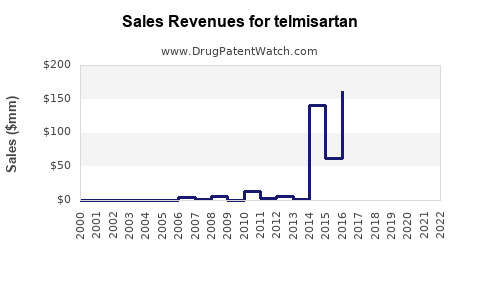

Prior to patent expiration, telmisartan's global sales peaked around USD 3.5 billion annually, driven primarily by the branded formulation. Post-patent expiry, sales declined sharply, with generics capturing a significant market share. Boehringer Ingelheim's revenues from telmisartan in 2018 (~USD 2.8 billion) saw a decline of approximately 35% by 2022, aligning with the generic market saturation.

-

Impact of Generic Competition

Generics, now accounting for over 80% of the market share, have reduced average prices by up to 70%. As a result, the overall market volume remains stable or slightly increased due to the rising prevalence of hypertension, but revenues for original branded versions decline.

-

Forecasting Future Trends

-

Near-term (2023-2025): The market volume for telmisartan is projected to stabilize or modestly grow, driven by increased hypertension awareness and the expanded use in metabolic and nephrological conditions. However, revenue growth for branded formulations remains limited unless differentiated offerings or combination therapies emerge.

-

Medium to Long-term (2026-2030): Growth prospects hinge on clinical validation of new indications, strategic partnerships to develop combination drugs, and potential repositioning in non-hypertensive cardiovascular conditions. Nonetheless, the core market is expected to be mature, facing stiff price competition from generics.

-

Potential for Biosimilars or Next-Generation ARBs: The advent of biosimilar or innovative ARBs with enhanced efficacy or safety profiles could alter the competitive landscape, possibly revitalizing demand for telmisartan or its successors.

-

Strategic Opportunities

- Market Expansion: Targeting emerging markets with increasing hypertension prevalence.

- Value-added Formulations: Developing combination therapies or novel delivery mechanisms.

- Differentiated Marketing: Emphasizing telmisartan's unique pharmacology and benefits in metabolic parameters.

Regulatory and Patent Considerations

Patent protections for telmisartan have largely expired worldwide. Boehringer Ingelheim's strategy has focused on maintaining market share through pipeline development, such as fixed-dose combinations, and expanding clinical indications. Regulatory challenges in certain markets—especially regarding off-label uses—may influence future sales trajectories.

Conclusion and Outlook

The telmisartan market exemplifies the lifecycle dynamics prevalent in blockbuster pharmaceuticals. After the initial high-revenue phase cultivated during patent exclusivity, the market transitioned into a generic-dominated landscape with constrained revenue growth. Moving forward, opportunities for growth will depend on clinical expansion, strategic innovation, and geographic penetration, primarily within emerging markets. Policymakers, pharma companies, and healthcare providers must adapt to evolving competition, driven by pricing pressures and incremental therapeutic innovations.

Key Takeaways

- Patent expiry triggered a shift from branded to generic dominance, significantly impacting revenues.

- Long-term growth depends on expanding indications, combination formulations, and emerging markets.

- Pricing strategies and reimbursement policies are critical to sustaining profitability amid intense competition.

- Clinical validation of new therapeutic uses can create differentiation and open new revenue streams.

- Emerging markets offer substantial growth potential for telmisartan, driven by demographic and epidemiological trends.

FAQs

-

What are the primary factors influencing telmisartan's market share post-patent expiry?

Generic availability, pricing pressures, physician prescribing habits, and expansion into new indications significantly influence its market share after patent expiration.

-

Are there any notable clinical developments that could revive telmisartan sales?

Ongoing research into its benefits beyond hypertension, such as in metabolic syndrome and diabetic nephropathy, could support increased indications and sales.

-

How does telmisartan compare to other ARBs in terms of efficacy and safety?

Telmisartan's long half-life and favorable metabolic profile differentiate it favorably, though efficacy is broadly comparable among ARBs. Safety profiles are similar, with tolerability being a key advantage.

-

What strategies are pharmaceutical companies adopting to sustain revenues for telmisartan?

Companies are focusing on developing fixed-dose combinations, expanding indications, targeting emerging markets, and investing in clinical research for new therapeutic uses.

-

What is the outlook for telmisartan in the global hypertension market?

The outlook suggests maturation with limited revenue growth in developed markets but sustained demand through volume increases and market expansion in emerging regions.

References

[1] Market research reports on ARB global market size and trends.

[2] Boehringer Ingelheim annual financial disclosures.

[3] Regulatory agency approvals and clinical trial databases.

[4] Industry analyses on patent expirations and generic market impacts.