Last updated: July 28, 2025

Introduction

Nevirapine, a non-nucleoside reverse transcriptase inhibitor (NNRTI), has played a pivotal role in the management of HIV/AIDS since its approval in the late 1990s. As an antiretroviral drug, nevirapine's market trajectory is influenced by evolving guidelines, competitors, manufacturing landscapes, and emerging innovations in HIV treatment. This analysis delineates the current market dynamics and forecasts the financial trajectory of nevirapine, offering critical insights for stakeholders across the pharmaceutical supply chain.

Historical Context and Regulatory Landscape

Originally developed by Boehringer Ingelheim, nevirapine received FDA approval in 1996, establishing itself as one of the first oral antiretroviral agents. Its utility was particularly significant in resource-limited settings owing to affordability and ease of use. The drug's mechanism—binding directly to reverse transcriptase—complemented combination antiretroviral therapy (cART) regimens.

Regulatory shifts, including updates from the WHO and national agencies, have continually shaped its application. Notably, the WHO endorsed nevirapine for preventing mother-to-child transmission (PMTCT), fueling demand in global health initiatives. However, advances in HIV therapy have introduced more potent and tolerable agents, impacting nevirapine's market share.

Current Market Dynamics

Global Adoption and Usage Trends

Despite its historical prominence, nevirapine’s market share has declined in developed countries, primarily due to safety concerns—particularly hepatotoxicity and hypersensitivity reactions—and the availability of alternative agents such as efavirenz and integrase inhibitors. Conversely, in low- and middle-income countries (LMICs), nevirapine remains relevant, primarily driven by cost-effectiveness and simplified cold chain requirements, fortifying its position within global HIV programs.

Manufacturing and Supply Chain Aspects

Multiple generic manufacturers operate across Asia and Africa, contributing to widespread access. Patent expirations in key jurisdictions have facilitated generic proliferation, leading to reduced prices—an advantageous factor for public health contracts but exerting downward pressure on revenue for original patent holders. However, geopolitical factors and supply chain disruptions—exacerbated during the COVID-19 pandemic—have occasionally hindered consistent availability.

Competitive Landscape

Nevirapine faces stiff competition from newer agents boasting better tolerability, such as rilpivirine, dolutegravir, and bictegravir. The latter have garnered growing preference due to fewer adverse effects and simplified dosing schedules. Nonetheless, in resource-constrained environments, nevirapine persists due to its affordability and established efficacy.

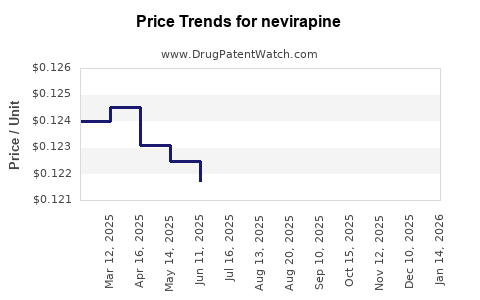

Pricing and Reimbursement Dynamics

Pricing strategies are heavily influenced by generic competition. In LMICs, nevirapine is often supplied at prices well below $10 per tablet, making it an appealing option for national HIV programs. International donors, including PEPFAR and the Global Fund, heavily subsidize procurement, reinforcing its market presence.

Regulatory Challenges and Adverse Effects

Adverse effect profiles—particularly hepatotoxicity and skin reactions—have led to restrictions in certain populations (e.g., women with higher CD4 counts). Regulatory authorities have issued warnings and updated usage guidelines, compelling prescribers to weigh risks and benefits carefully.

Financial Trajectory Analysis

Revenue Trends and Forecasts

Historically, global sales of nevirapine peaked during the early 2000s, driven by widespread adoption in LMICs. As newer agents gained ground and guidelines shifted towards integrase inhibitor-based regimens, revenue growth plateaued and declined in high-income markets.

Forecasts indicate that the global market for nevirapine will continue to decline modestly, mainly due to the gradual phasing out in developed countries. However, in LMICs, it is projected to remain a staple component of HIV treatment programs for at least the next decade, supported by its cost advantages and ongoing procurement commitments.

Impact of Patent Expiries and Generics

Patent expirations in major jurisdictions—such as India and Africa—have spurred a surge in generic production, significantly reducing drug prices. This proliferation diminishes profit margins for patent-holding companies but ensures broader access and sustained revenues for generic manufacturers.

Emerging Opportunities and Challenges

Despite declining revenue in mature markets, opportunities exist within neglected markets and specialized pediatric formulations. Conversely, challenges include the potential for regulatory restrictions due to safety concerns, and the dominance of newer agents which threaten continued market share.

Research and Development Outlook

Given evolving treatment paradigms, investment in novel formulations or combination therapies incorporating nevirapine appears limited. Most R&D efforts are increasingly pivoting toward drugs with improved safety profiles and resistance management, reducing nevirapine’s future growth potential.

Key Market Drivers

- Global Health Initiatives: Sustained donations and subsidies in LMICs uphold nevirapine’s market presence.

- Generic Manufacturing: Price competition drives demand, ensuring continued access.

- Treatment Guidelines: Prescriptions in resource-limited settings primarily depend on affordability and logistical factors.

- Regulatory Environment: Warnings and restrictions influence prescribing patterns and market viability.

Key Market Barriers

- Safety Concerns: Hepatotoxicity and skin hypersensitivity limit use, especially where safer options exist.

- Market Competition: Availability and preference for integrase inhibitors and other NNRTIs diminish demand.

- Patent and Regulatory Challenges: Patent expiries and safety restrictions impact profitability.

- Emerging Resistance: Potential for resistance development necessitates careful prescribing, possibly affecting usage.

Concluding Remarks

Nevirapine's market trajectory embodies the classic lifecycle of a pioneering antiretroviral agent: robust uptake in initial years, gradual decline in developed markets, and sustained demand in resource-poor settings. Its financial future hinges on global health policies, manufacturing trends, and ongoing competition from superior agents. Strategic positioning within HIV management, especially in LMICs, will determine its long-term commercial viability.

Key Takeaways

- Market Decline in Developed Countries: Due to safety issues and competition from newer agents, sales are expected to decline further in high-income markets.

- Sustained Presence in LMICs: Cost-effectiveness and existing infrastructure will uphold its role in resource-limited HIV programs.

- Impact of Generics: Expiry of patents has democratized access, pressuring branded sales but expanding global reach.

- Regulatory and Safety Constraints: Ongoing safety concerns may limit expansion and influence prescribing practices.

- Innovation Barriers: Limited R&D activity suggests a declining role for nevirapine in future HIV therapy developments.

FAQs

1. Will nevirapine regain market share with new formulations?

Unlikely. The current trend favors agents with better safety and efficacy profiles, and no significant formulations of nevirapine are anticipated that could reverse its decline.

2. How do patent expiries affect nevirapine’s profitability?

Patent expiries enable generic manufacturers to produce lower-cost versions, reducing prices and profit margins for original developers but increasing global access.

3. Is nevirapine still viable for new HIV patients?

In high-income countries, probably not, due to safety concerns and superior alternatives; however, in resource-limited settings, it remains a practical option.

4. What impact have safety concerns had on regulatory status?

Regulatory agencies have implemented warnings and restrictions, which influence prescribing patterns and limit wider adoption.

5. What are the prospects for nevirapine in the next decade?

Its role is expected to diminish further in developed markets but remain relevant in LMICs, primarily driven by global health funding and procurement policies.

Sources:

[1] WHO Treatment Guidelines and Policy Documents

[2] IMS Health Data Reports (2022)

[3] Boehringer Ingelheim Annual Reports

[4] Global Fund Procurement Data

[5] Recent Clinical Guidelines on HIV Treatment