Last updated: July 27, 2025

Introduction

Gentamicin sulfate, an aminoglycoside antibiotic discovered in the 1960s, remains a pivotal drug for treating severe bacterial infections, especially those caused by gram-negative organisms. Despite the proliferation of newer antibiotics, gentamicin sustains relevance owing to its broad-spectrum activity, cost-effectiveness, and well-established clinical applications. This article examines the underlying market dynamics and forecasts the financial trajectory of gentamicin sulfate, considering factors such as global demand, manufacturing landscape, competitive pressures, regulatory influences, and emerging therapeutic trends.

Market Landscape and Key Drivers

Global Demand and Therapeutic Utilization

Gentamicin sulfate's primary market stems from hospital settings, especially intensive care units (ICUs), for infections like septicemia, pneumonia, and urinary tract infections. The growing prevalence of multidrug-resistant organisms underscores a continued reliance on aminoglycosides. According to the World Health Organization, bacterial infections with resistant strains have surged, emphasizing the importance of antibiotics like gentamicin [1].

The surge in healthcare infrastructure in emerging markets, notably Asia-Pacific, propels demand. Hospitals in China, India, and Southeast Asia increasingly incorporate gentamicin into treatment protocols due to its affordability and proven efficacy.

Antibiotic Stewardship and Resistance Trends

Antibiotic stewardship programs aim to optimize drug use and reduce resistance. While gentamicin's broad-spectrum activity is advantageous, resistance development poses challenges. Bacterial mechanisms such as aminoglycoside-modifying enzymes have decreased susceptibility rates, prompting cautious use and influencing demand patterns.

Manufacturing and Supply Chain Considerations

Major pharmaceutical manufacturers, predominantly in India and China, produce gentamicin sulfate, leveraging cost efficiencies. Patent expirations and generic manufacturing have promoted price competitiveness, facilitating broad distribution.

However, supply chain disruptions—exacerbated by global events such as the COVID-19 pandemic—have temporarily affected production and distribution. As manufacturing shifts towards more localized supply chains, regional market dynamics may evolve.

Market Challenges and Competitive Landscape

Competitive Substitutes and Market Elimination

The pharmaceutical landscape features several alternatives—such as amikacin, tobramycin, and newer agents like plazomicin—that often offer improved safety profiles or resistance profiles. Consequently, gentamicin faces stiff competition, especially in settings where drug safety and resistance management are prioritized.

Regulatory Environment

Stringent regulatory requirements by agencies such as the U.S. FDA and EMA influence market access. Generic manufacturers benefit from patent expiries; however, variations in regional regulatory processes can create market entry barriers or delays.

Safety Concerns and Usage Limitations

Nephrotoxicity and ototoxicity associated with gentamicin restrict its use, particularly in chronic settings. These safety concerns influence prescriber preferences and affect sales volume, especially in markets with heightened emphasis on safety.

Financial Trajectory and Market Forecasts

Revenue Trends and Market Size

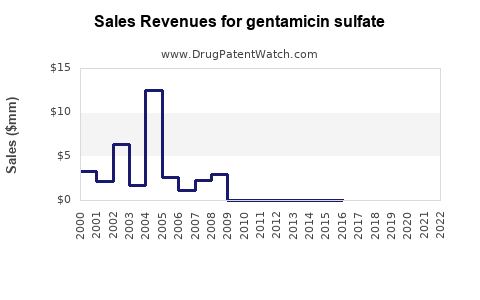

The global generic antibiotics market, estimated to be valued at approximately USD 40 billion in 2022, exhibits a compound annual growth rate (CAGR) of about 4% to 6% over the next five years [2]. Gentamicin sulfate constitutes a significant portion of this segment due to its low-cost efficacy.

Market size estimates for gentamicin specifically hover around USD 200–300 million annually, with regional variations. Growth is primarily driven by rising infection rates, expanding healthcare access, and ongoing reliance on generics.

Growth Opportunities

Emerging markets present lucrative opportunities owing to unmet needs and price sensitivity. Additionally, applications in veterinary medicine—particularly in livestock—are expanding, contributing to revenue streams, although regulatory constraints differ from human pharmaceuticals.

Innovations in drug formulations—such as liposomal gentamicin—aim to reduce toxicity and improve delivery, potentially opening new revenue avenues, albeit with higher development costs.

Pricing and Cost Dynamics

The dominance of generics has created a highly competitive pricing landscape. Prices for gentamicin sulfate vials have declined by approximately 30–50% over the past decade. Although volume-driven, margins are thin, emphasizing the importance of manufacturing efficiencies and supply chain optimization.

Impact of Regulatory and Policy Changes

Policy shifts, such as subsidies for antimicrobial stewardship and antimicrobial resistance (AMR) initiatives, may influence market dynamics. Governments in certain regions are promoting the rational use of antibiotics, potentially curbing overprescription and affecting sales volumes.

In parallel, international efforts to combat AMR could lead to increased investments in new formulations, possibly reducing the reliance on traditional gentamicin sulfate.

Emerging Trends and Future Directions

Innovation and Development

Research efforts focus on developing gentamicin formulations with improved safety profiles and targeted delivery systems. Liposomal gentamicin, for instance, offers promise in reducing toxicity while maintaining efficacy. Such innovations could command premium pricing and expand market share, especially in developed markets.

Drug Resistance Mitigation Strategies

Global health initiatives advocate for judicious use of antibiotics. As resistance patterns evolve, the role of gentamicin may shift, with increased usage in targeted infections or combination therapies to extend drug lifespan.

Market Consolidation

The competitive landscape is consolidating as larger pharma firms acquire smaller generic producers to optimize economies of scale and R&D capabilities. Such consolidation could impact pricing strategies and market access.

Conclusion: The Financial Outlook

Gentamicin sulfate's market is characterized by steady demand driven by its cost-effectiveness and broad-spectrum activity, especially in regions with constrained healthcare budgets. While affordability ensures its continued relevance, challenges such as resistance, safety concerns, and competitive substitutes temper growth prospects.

The financial trajectory over the next five years suggests a modest CAGR of around 3% to 5%, contingent upon regional demand, regulatory developments, and technological innovations. Opportunities lie in developing safer formulations and expanding usage in veterinary and niche applications. However, sustained competition and stringent stewardship policies necessitate strategic positioning for market participants.

Key Takeaways

-

Steady Demand: Gentamicin sulfate remains integral to treating severe bacterial infections, especially in emerging markets, driven by affordability and efficacy.

-

Competitive Pressures: The emergence of safer, more targeted antibiotics may limit growth, despite existing demand.

-

Regulatory and Safety Constraints: Ongoing concerns around toxicity and resistance influence prescribing patterns and market access.

-

Innovation as a Growth Driver: Developing formulations with improved safety profiles can unlock new revenue streams and expand market share.

-

Market Outlook: Overall, gentamicin sulfate’s market is poised for gradual growth, with a focus on optimizing manufacturing, navigating regulatory landscapes, and improving drug safety.

FAQs

1. What is the current global market size for gentamicin sulfate?

The annual global market for gentamicin sulfate is estimated between USD 200 million and USD 300 million, with the largest contributions from low-cost generic manufacturing in Asia.

2. How does antibiotic resistance impact gentamicin’s market?

Resistance mechanisms reduce gentamicin’s efficacy, necessitating careful stewardship and limiting unnecessary use, which can suppress certain market segments but also stimulate innovation.

3. What are the main competitors to gentamicin sulfate?

Competitors include aminoglycosides like amikacin and tobramycin, as well as newer antibiotics with better safety profiles, such as plazomicin, which may replace gentamicin in some indications.

4. Are there ongoing innovations that could influence gentamicin’s market?

Yes, formulations like liposomal gentamicin aim to reduce toxicity and improve delivery, potentially increasing usage and expanding markets.

5. What regional factors influence gentamicin sulfate’s market dynamics?

Emerging markets exhibit strong growth due to infection prevalence and cost sensitivity, whereas developed markets are more influenced by safety profiles and resistance concerns. Regulatory policies and antimicrobial stewardship programs also significantly impact adoption rates.

Sources

[1] World Health Organization. (2021). Global antimicrobial resistance surveillance report.

[2] MarketsandMarkets. (2022). Antibiotics Market Report.