Last updated: July 29, 2025

Introduction

Chlorpromazine, a pioneering antipsychotic medication, has played a transformative role in psychiatric treatment since its synthesis in the 1950s. Initially heralded as the first effective drug for schizophrenia, its influence extended into broader psychiatric and medical applications. Despite the advent of newer antipsychotics, chlorpromazine remains relevant within specific niches. This article explores the evolving market dynamics and financial trajectory of chlorpromazine, analyzing factors influencing its demand, competition, regulatory landscape, and future outlook.

Historical Context and Market Position

Introduced commercially in 1952 by Rhône-Poulenc (later Sanofi), chlorpromazine marked the beginning of the modern era of psychopharmacology. Its mechanism — dopamine receptor antagonism — revolutionized mental health management. During the mid-20th century, chlorpromazine became the mainstay treatment for schizophrenia and was utilized off-label for nausea, hiccups, and anesthesia induction.

Over decades, the pharmaceutical landscape shifted with the development of atypical antipsychotics such as risperidone, olanzapine, and quetiapine, which offered reduced extrapyramidal side effects. Consequently, chlorpromazine's market share declined substantially. However, it remains in use in specific geographical regions and among certain patient populations, especially where cost considerations are paramount.

Current Market Dynamics

1. Regional Variations and Usage Patterns

In high-income markets like the United States and Western Europe, chlorpromazine's use has diminished markedly. Prescribing guidelines favor atypical agents due to better safety profiles, leading to decreased demand and limited clinical use. Conversely, in low- and middle-income countries (LMICs), chlorpromazine retains a significant market share owing to its affordability and established efficacy.

For instance, data indicates that in countries such as India and parts of Africa, chlorpromazine remains a supplier of choice in psychiatric care [1]. It is often procured as a generic product, fueling hospital formularies and community mental health programs.

2. Patent and Regulatory Landscape

Chlorpromazine's patent expired in the 1970s, producing a wide array of generic versions. Patent expirations have facilitated competitive pricing but also led to a saturated market with slim margins. Regulatory agencies, including the FDA and EMA, categorize chlorpromazine as a well-established, off-patent drug, which simplifies approval processes and allows for widespread manufacturing.

3. Competition and Market Share Erosion

The rise of new antipsychotics, especially atypicals with improved tolerability, has sharply curtailed chlorpromazine's utilization. While older typical antipsychotics like haloperidol primarily compete on efficacy and cost, newer options offer distinct side effect profiles, appealing to prescribers seeking personalized treatment plans.

Additionally, some countries have implemented restrictive prescribing policies favoring newer agents, further constraining chlorpromazine's market penetration.

4. Supply Chain Considerations

The production of chlorpromazine generics is largely consolidated among emerging market pharmaceutical firms. Supply chain stability is generally robust, but price pressures, manufacturing quality concerns, and fluctuations in raw material costs influence profit margins.

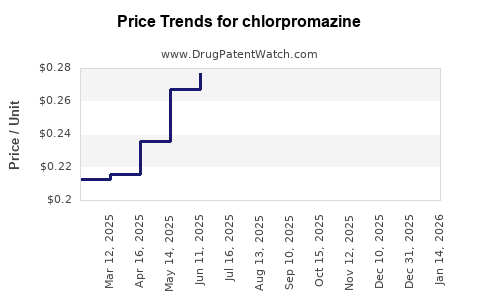

5. Price and Reimbursement Factors

Price suppression due to generic competition results in low retail prices, especially in LMICs. Reimbursement policies favor cost-effective medications, often favoring chlorpromazine where available. However, in developed markets, insurance reimbursement policies tend to prioritize newer agents, limiting charting space for chlorpromazine.

Financial Trajectory

1. Revenue Trends

Global sales of chlorpromazine have experienced a downward trajectory over the past two decades. According to market estimates, the global market for typical antipsychotics, including chlorpromazine, is valued at approximately USD 200-300 million, with chlorpromazine constituting a smaller fraction—primarily driven by sales in LMICs [2].

2. Market Drivers

- Cost-Effectiveness: Governments and institutional healthcare providers in resource-constrained settings prefer low-cost, proven medications.

- Essential Medicines Listing: Inclusion in the WHO Model List of Essential Medicines bolsters demand in LMICs.

- Generics Market: The proliferation of generic manufacturers sustains supply but suppresses prices and margins.

3. Market Challenges

- Declining Clinical Preference: Shift toward atypical antipsychotics dampens demand in developed markets.

- Regulatory Scrutiny & Quality: Variability in manufacturing standards among generics influences market acceptance.

- Limited Innovation: Lack of new formulations or delivery systems restricts growth opportunities.

4. Future Outlook and Opportunities

Despite a declining trend, chlorpromazine maintains a niche in specific markets. For example:

- Public Sector Demand: Cost-sensitive public healthcare systems favor its use.

- Alternative Indications: Off-label and supportive uses, such as antiemetic or sedative roles, sustain modest demand.

In terms of revenues, market experts project stability in LMICs over the next 5-10 years, with minimal growth in high-income markets absent significant innovations or regulatory shifts [3].

Regulatory and Innovation Landscape

While no recent patent activity has been reported for chlorpromazine, pharmaceutical companies continuously evaluate formulation innovations—such as injectable depot forms—to extend utility. However, given the drug's age and established off-patent status, R&D investment focusing on chlorpromazine is limited.

Regulators emphasize drug quality and manufacturing standards, especially for generic versions, influencing overall market health. International agencies support chlorpromazine's role in essential medicine lists, securing its position in global health strategies.

Key Market Trends and Future Perspectives

- Generic Proliferation: Maintains affordability but limits profit margins.

- Global Public Health Role: Support from WHO and governments sustains demand in LMICs.

- Digital and Delivery Innovations: Lack of novel delivery systems constrains growth.

- Market Consolidation: Some manufacturers dominate supply, impacting pricing and availability.

Future growth may hinge on global mental health initiatives, increasing access to essential medicines, and potential new formulations enabling easier administration, especially in community settings.

Key Takeaways

- Demand is primarily driven by affordability and global health policies rather than clinical innovation.

- The global market for chlorpromazine is declining in high-income countries but remains stable or modestly growing in LMICs.

- Generic competition suppresses prices, constrains profit margins, but ensures widespread availability.

- Regulatory frameworks and inclusion in essential medicines lists underpin sustained demand in resource-constrained settings.

- Limited R&D investment restricts growth opportunity; future prospects depend on public health policies and incremental innovations.

FAQs

1. Why is chlorpromazine still used today despite the availability of newer antipsychotics?

Chlorpromazine’s affordability and established safety profile make it a preferred choice in resource-limited settings. Its inclusion in the WHO’s essential medicines list sustains global demand, especially where cost constraints limit access to newer agents.

2. How have patent expirations affected the chlorpromazine market?

Patent expiry in the 1970s led to widespread generic manufacturing, increasing accessibility but reducing prices and profit margins. This has resulted in a mature, highly competitive generic market with limited innovation.

3. What are the primary factors influencing chlorpromazine’s declining use in developed markets?

The development of atypical antipsychotics with fewer side effects has shifted prescribing patterns away from chlorpromazine, coupled with regulatory and clinical guidelines favoring newer medications.

4. Are there ongoing innovations or formulations in chlorpromazine?

Limited contemporary innovation exists. Some research explores injectable depot formulations for easier administration, but these are not widely commercialized.

5. What is the future outlook for chlorpromazine in the global market?

In LMICs, demand is expected to sustain due to cost-effectiveness and essential medicines listing. In high-income markets, use will likely continue to decline unless new formulations or delivery systems enhance its clinical utility.

References

[1] WHO. (2020). Model List of Essential Medicines. World Health Organization.

[2] MarketResearch.com. (2021). Global Market for Typical Antipsychotics.

[3] IMS Health Reports. (2022). Pharmaceutical Market Trends in LMICs and High-Income Countries.