Last updated: July 28, 2025

Introduction

Chlorpheniramine maleate, a first-generation antihistamine, has been a staple in the management of allergic conditions for over six decades. Its widespread use in over-the-counter (OTC) formulations and prescription medications underscores its significance within the pharmaceutical landscape. This analysis explores the evolving market dynamics and financial trajectory of chlorpheniramine maleate, considering factors such as regulatory changes, patent status, clinical preferences, manufacturing trends, and emerging competition.

Market Overview

Chlorpheniramine maleate’s market value predominantly stems from its role in alleviating allergic rhinitis, hay fever, and other allergic manifestations. Traditionally, it has been employed in various dosage forms, including tablets, syrups, and injectables. Despite the emergence of newer antihistamines, chlorpheniramine maintains a considerable market share owing to its affordability, accessibility, and longstanding efficacy.

The global antihistamines market was valued at approximately USD 4.4 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of around 4% through 2028, driven by increasing prevalence of allergic diseases and expanding healthcare access in emerging markets. Chlorpheniramine specifically accounts for a significant portion within this segment, especially in OTC sectors.

Market Drivers

1. Cost-Effectiveness and Accessibility

Chlorpheniramine maleate’s low production cost and widespread availability contribute substantially to its ongoing market dominance, especially in developing economies. As OTC medication, it appeals to consumers seeking affordable allergy relief, maintaining its sales volume.

2. Prescribed and OTC Formulations

Its inclusion in multiple combination therapies and single-ingredient OTC products sustains demand. Regulatory agencies like the FDA and EMA continue to approve chlorpheniramine for OTC use, reinforcing its market position.

3. Growing Allergic Disease Prevalence

An upward trend in allergic conditions globally, driven by environmental pollution, urbanization, and climate change, sustains demand for antihistamines, including chlorpheniramine.

4. Distribution through Emerging Markets

Emerging economies, including India, China, and Brazil, offer expanding markets due to increasing healthcare expenditure, rising awareness, and favorable regulatory frameworks, bolstering sales.

Market Challenges

1. Safety and Side Effect Profile

Compared to second-generation antihistamines such as loratadine and cetirizine, chlorpheniramine’s sedative effects and anticholinergic side effects limit its use, particularly in populations requiring alertness (e.g., drivers, machine operators). Regulatory warnings in certain markets have further restricted its OTC availability.

2. Competition from Safer Alternatives

Pharmacovigilance concerns related to sedation and cognitive impairment have led to preferential prescribing of newer antihistamines, affecting demand for chlorpheniramine.

3. Patent and Regulatory Landscape

While chlorpheniramine’s original patents have long expired, ongoing formulations depend on manufacturing agreements and regulatory approvals that can vary by region, affecting market access and pricing strategies.

4. Market Cannibalization

The proliferation of combination drugs, including other antihistamines combined with decongestants or corticosteroids, impacts standalone chlorpheniramine formulations.

Manufacturing and Supply Chain Trends

Major pharmaceutical firms and generic manufacturers dominate chlorpheniramine maleate production. The compound’s chemical synthesis is well-established and cost-efficient, ensuring stable supply. However, regulatory compliance (e.g., GMP standards) and quality assurance are critical, influencing manufacturing costs and market entry barriers.

The move toward sustainable manufacturing practices has led some companies to optimize processes or shift to more eco-friendly solvents and reagents, potentially impacting supply and costs marginally.

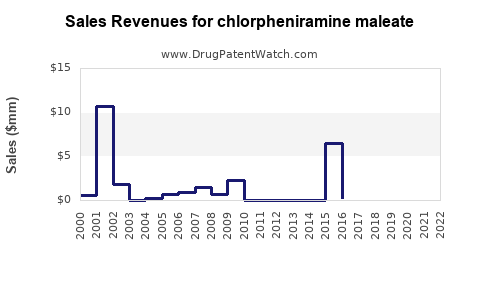

Financial Trajectory and Future Outlook

1. Revenue Stability in Mature Markets

In developed regions (U.S., Europe), chlorpheniramine’s market share is gradually declining due to safety concerns and consumer preferences for second-generation antihistamines. Nonetheless, sales remain steady within budget-conscious demographics and OTC channels.

2. Growth Opportunities in Emerging Markets

High growth is anticipated in Asia-Pacific, Latin America, and Africa, where increasing healthcare infrastructure and regulatory approvals are expanding OTC access. The affordability factor continues to drive substantial sales volumes.

3. Impact of Regulatory Changes

Stringent regulations, particularly concerning sedative effects and indications, influence future formulation strategies. Companies may diversify portfolios or innovate delivery mechanisms (e.g., sustained-release formulations) to sustain patents and market relevance.

4. Innovation and New Formulations

Research into combination therapies and alternative delivery forms presents opportunities. Additionally, efforts to mitigate side effects could restore competitiveness against newer antihistamines.

Competitive Landscape

Global leaders like Sanofi, GSK, and generic manufacturers such as Mylan and Teva produce chlorpheniramine maleate. Their strategies encompass maintaining low prices, ensuring supply chain stability, and complying with evolving regulatory standards. Entry barriers remain high due to the compound’s long patent expiration, emphasizing supply chain reliability over innovation.

Regulatory and patent considerations

While chlorpheniramine maleate lacks recent patent protections, regulatory compliance remains pivotal. Agencies continually review safety data, leading to restrictions or modifications in labeling and indications, influencing market access and sales.

Emerging Trends Impacting Market and Financial Outcomes

a. Digital and e-commerce channels have expanded distribution, especially in regions with limited pharmacy infrastructure, facilitating OTC sales.

b. Enhanced pharmacovigilance and safety warnings have slightly tempered demand but opened avenues for reformulation and safer derivatives.

c. Industry shifts toward personalized medicine signaling potential development of tailored antihistamine therapies could reshape future formulations and market segments.

Key Takeaways

- Market stability remains in the OTC segment, particularly within emerging markets, driven by affordability and accessibility.

- Safety profile limitations of chlorpheniramine maleate restrict its use in certain jurisdictions, leading to a gradual decline in some developed markets.

- Growth prospects are strong in emerging economies, where widening healthcare access and regulatory acceptance support sales.

- Innovation strategies—such as combination therapies and reformulated versions—are critical to maintaining market relevance.

- Regulatory vigilance and safety concerns will continue to influence manufacturing, marketing, and formulation strategies in the future.

Conclusion

Chlorpheniramine maleate’s market is characterized by stability in longstanding sectors and growth opportunities in emerging economies. The financial trajectory depends on strategic responses to regulatory pressures, safety concerns, and competitive dynamics. Companies that leverage manufacturing efficiencies, explore innovative formulations, and expand distribution channels will position themselves favorably in a competitive landscape that balances legacy efficacy with evolving safety standards.

FAQs

Q1: How does the safety profile of chlorpheniramine maleate impact its market?

A1: The sedative effects and anticholinergic side effects restrict its use in certain populations, prompting regulatory restrictions and a gradual shift toward safer second-generation antihistamines, thereby impacting overall market share.

Q2: What are the main growth drivers for chlorpheniramine maleate in emerging markets?

A2: Factors include increasing healthcare infrastructure, rising consumer affordability, regulatory approvals for OTC sale, and demand-driven by environmental and lifestyle factors contributing to allergy prevalence.

Q3: Are there any recent innovations in chlorpheniramine formulations?

A3: Innovations include sustained-release formulations and combination products designed to reduce side effects and enhance compliance, although large-scale adoption remains limited due to safety concerns.

Q4: How does generic manufacturing influence the financial outlook for chlorpheniramine maleate?

A4: The expiration of patents encourages generic manufacturers, lowering prices and increasing accessibility but exerting pressure on profit margins for branded formulations.

Q5: What regulatory trends could influence the future of chlorpheniramine maleate?

A5: Increased safety warnings, restrictions on OTC accessibility, and guidelines favoring second-generation antihistamines are key regulatory trends shaping its future market landscape.

References

- MarketResearch.com. (2022). Global Antihistamine Market Analysis.

- IMS Health. (2022). Over-the-counter medication sales trends.

- U.S. FDA. (2021). Regulatory updates on antihistamines.

- European Medicines Agency. (2022). Safety review of first-generation antihistamines.

- GlobalData. (2023). Emerging Markets Pharmaceutical Outlook.