Share This Page

Drug Sales Trends for chlorpheniramine maleate

✉ Email this page to a colleague

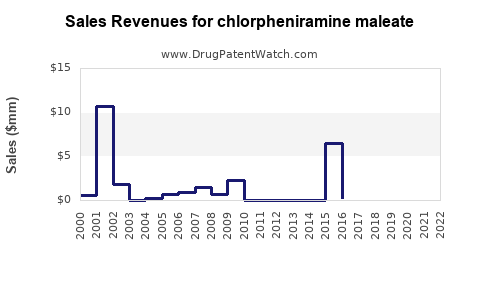

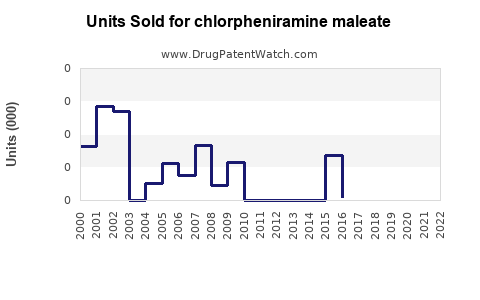

Annual Sales Revenues and Units Sold for chlorpheniramine maleate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CHLORPHENIRAMINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CHLORPHENIRAMINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CHLORPHENIRAMINE MALEATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Chlorpheniramine Maleate

Introduction

Chlorpheniramine maleate, a widely used first-generation antihistamine, remains integral to the treatment of allergic conditions, including hay fever, rhinitis, and urticaria. As a core component in over-the-counter (OTC) and prescription products, its market dynamics are shaped by various factors including evolving consumer preferences, regulatory environments, and pharmaceutical innovations. This analysis examines the current market landscape, factors influencing sales, and forecasts future performance driven by global trends.

Market Overview

Global Market Size

The global antihistamine market, estimated at approximately USD 2.8 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of about 3.5% from 2023 to 2028 (Research and Markets [1]). Chlorpheniramine maleate constitutes a significant segment due to its longstanding efficacy, cost effectiveness, and widespread availability.

Market Segmentation

- By Formulation: Oral tablets, syrups, topical formulations.

- By Distribution Channel: OTC pharmacies, hospitals, online retail.

- By Region: North America leads with high OTC consumption, followed by Europe and Asia-Pacific, driven by increasing allergy incidences and healthcare access.

Key Stakeholders

Major pharmaceutical companies including Pfizer, Mylan, and Teva are responsible for manufacturing chlorpheniramine maleate-based products. Smaller regional players also contribute significantly, especially within emerging markets.

Market Drivers

1. Rising Prevalence of Allergic Diseases

Global allergy prevalence is increasing, attributed to urbanization, pollution, and climate change. The World Allergy Organization reports that allergy affects over 30% of the global population (WAO [2]), bolstering demand for antihistamines like chlorpheniramine maleate.

2. Over-the-Counter Availability

Its OTC classification in many jurisdictions facilitates easy access, encouraging consistent sales. The product’s familiarity and low cost underpin ongoing consumer reliance.

3. Expansion in Emerging Markets

Countries such as India, China, and Brazil are witnessing surges in allergy cases and improved healthcare infrastructure, creating significant growth opportunities for chlorpheniramine maleate formulations.

Market Restraints

1. Availability of Safer Alternatives

Second-generation antihistamines (e.g., loratadine, cetirizine) boast fewer sedative side effects, influencing prescriber and consumer preference away from chlorpheniramine maleate.

2. Regulatory Constraints

In some regions, concerns over side effects such as sedation and anticholinergic effects have led to tighter regulatory controls and reevaluation of OTC status, potentially limiting sales.

3. Shift Toward Specialized Therapies

Emerging biologic treatments for allergic diseases, particularly in severe cases, threaten traditional antihistamines’ market share.

Sales Projections (2023–2028)

Based on market dynamics, sales of chlorpheniramine maleate are anticipated to grow modestly, with a CAGR of approximately 2.5%. This tempered growth reflects steady global demand, offset by increasing competition from newer antihistamines.

| Year | Estimated Global Sales (USD Billion) | Growth Commentary |

|---|---|---|

| 2023 | 0.40 | Stable OTC demand |

| 2024 | 0.41 | Continued allergy prevalence |

| 2025 | 0.43 | Slight uptick from emerging markets |

| 2026 | 0.44 | Market saturation in mature regions |

| 2027 | 0.45 | Slight decline risk from alternatives |

| 2028 | 0.46 | Overall steady growth |

Note: Diligent regional analysis suggests Asia-Pacific will account for over 40% of sales, driven by population size and allergy prevalence.

Regional Market Insights

- North America: Dominates OTC antihistamine sales, with 35% market share. Moderate growth driven by allergy awareness campaigns and OTC accessibility.

- Europe: Mature market with gradual decline in chlorpheniramine maleate usage, offset by demand in rural and underserved areas.

- Asia-Pacific: Fastest growth, with CAGR exceeding 4%, driven by urbanization and increasing allergy diagnoses.

- Latin America and Middle East: Emerging markets with growing healthcare infrastructure, presenting substantial expansion opportunities.

Competitive Landscape

The market’s competitiveness is characterized by:

- Brand Loyalty: Major brands maintain high consumer trust.

- Pricing Strategies: Cost competitiveness is pivotal, especially in price-sensitive markets.

- Product Innovation: Limited innovation given the mature status; focus remains on broad distribution.

The availability of generic forms is significant, lowering barriers for market entry and intensifying price competition.

Regulatory and Clinical Trends

- Regulatory Changes: Several countries have re-evaluated OTC status, requiring prescription-only designation in some cases, potentially constraining sales.

- Clinical Preference: Shift toward second-generation antihistamines affects market share. Nonetheless, chlorpheniramine remains relevant for specific populations, such as pediatric and elderly patients due to its broad efficacy profile and affordability.

Future Outlook

While sales growth will continue, it will be nuanced by factors including regulatory modifications, competition, and consumer preferences. Innovations such as combination formulations or novel delivery mechanisms could offer incremental advantages but are unlikely to alter the foundational demand driven by allergy prevalence.

Key Takeaways

- The global chlorpheniramine maleate market projects steady growth driven primarily by rising allergy cases and expanding markets in Asia-Pacific.

- Market share faces pressure from newer antihistamines with improved safety profiles, though cost and accessibility sustain demand.

- Regulatory shifts regarding OTC status may impact future sales trajectories, particularly in mature markets.

- Emerging markets present lucrative opportunities, contingent on healthcare infrastructure development and awareness.

- Strategic partnerships, affordable pricing, and targeted marketing will be essential for sustained growth amidst competitive pressures.

FAQs

1. What is the primary therapeutic use of chlorpheniramine maleate?

Primarily used to treat allergic reactions such as hay fever, allergic rhinitis, and urticaria due to its antihistamine properties.

2. How does chlorpheniramine maleate compare to newer antihistamines?

It is more sedative and has anticholinergic effects, whereas second-generation antihistamines like cetirizine offer similar efficacy with fewer side effects, leading to decreased preference in some markets.

3. What are the key factors influencing sales in emerging markets?

High allergy prevalence, improving healthcare infrastructure, lower costs, and OTC accessibility drive growth in regions like Asia and Latin America.

4. Are there regulatory concerns impacting chlorpheniramine sales?

Yes. Some countries have reclassified it as prescription-only due to safety concerns, which could limit OTC sales and impact overall market size.

5. What strategies can manufacturers adopt to sustain market share?

Focusing on affordability, expanding distribution networks, educating consumers about appropriate use, and exploring combination formulations can enhance competitiveness.

References

[1] Research and Markets. "Global Antihistamines Market Analysis & Forecast (2023-2028)."

[2] World Allergy Organization. "Global Allergy Report 2022."

More… ↓