Last updated: July 27, 2025

Introduction

Dimethyl fumarate (DMF) has established a pivotal role in the landscape of multiple sclerosis (MS) treatment, as well as potential applications in dermatology and other autoimmune disorders. Its unique mechanism, patent protections, competitive positioning, and evolving regulatory environment influence its market dynamics and financial trajectory. This analysis provides a comprehensive overview of these elements, elucidating current trends and future outlooks for stakeholders and investors.

Pharmacological Profile and Therapeutic Indications

Dimethyl fumarate is an oral immunomodulatory agent primarily approved for relapsing-remitting multiple sclerosis (RRMS). It exerts its effects through modulation of the nuclear factor erythroid 2–related factor 2 (NRF2) pathway, offering anti-inflammatory and neuroprotective benefits [1]. Its favorable oral administration route and safety profile position it favorably compared to injectable MS therapies, fostering widespread adoption.

Beyond MS, investigational uses extend into psoriasis and other inflammatory conditions, although these are presently at experimental stages. The established efficacy and safety record reinforce its market presence, influenced by guideline endorsements and clinician familiarity.

Market Dynamics

Market Size and Growth

The global MS market was valued at approximately USD 24 billion in 2022, with projections reaching USD 36 billion by 2030, reflecting a CAGR of around 5.2% [2]. Dimethyl fumarate, as a leading oral therapy, commands significant market share within this segment. Its penetration is driven by its tolerability and convenience, making it a preferred choice over injectables like interferons and natalizumab.

Regional market performances vary. North America dominates with over 50% market share, supported by high diagnosis rates, robust healthcare infrastructure, and approval of multiple DMF formulations. Europe follows, with similar factors. Emerging markets, including Asia-Pacific, are experiencing rapid growth owing to increasing disease awareness and expanding healthcare access.

Competitive Landscape

Key players include Biogen (commercializing Tecfidera), Novartis (Vumerity), and biosimilar entrants. Biogen’s Tecfidera, approved since 2013, initially held a near-monopoly, but patent expirations and biosimilar entries threaten market share. Novartis’s Vumerity offers a second-generation formulation with improved tolerability, intensifying competition.

The entry of generics has exerted downward pressure on prices. Patent cliff timelines are critical, with Tecfidera’s U.S. patent expiring in 2028. Biosimilar and generic startups are preparing for market entry, potentially eroding revenue streams.

Regulatory Environment and Patent Landscape

Regulatory approvals remain robust; however, patent litigations and expirations influence revenue forecasts. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) maintain stringent safety oversight. Patent strategies and lifecycle management—such as formulation improvements and new indications—are central to revenue sustainability.

Regulatory agencies are also scrutinizing cardiovascular and cancer risks associated with fumarates, prompting post-marketing studies. These factors may influence future label expansions and market access.

Pricing and Reimbursement Trends

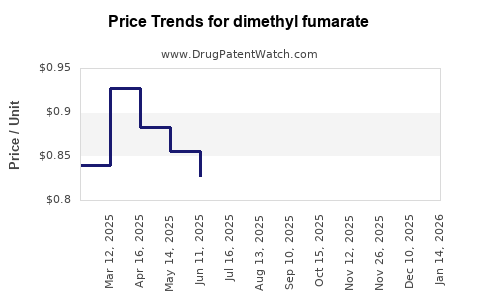

Pricing strategies vary globally. In mature markets, reimbursement policies favor cost-effective therapies, pressuring manufacturers to justify premium pricing through clinical benefits. Managed entry agreements and outcome-based reimbursement models are increasingly common, particularly in Europe.

In the U.S., high drug prices continue to fuel debates but also incentivize innovation. The introduction of biosimilars and generics, along with payer negotiations, forecasts a gradual reduction in DMF’s pricing premium over time.

Emerging Opportunities and Challenges

Research explores formulations with enhanced bioavailability and reduced side effects, aiming to extend patent lives. Investigator-led studies investigating new indications could open additional markets. Conversely, safety concerns, including rare progressive multifocal leukoencephalopathy (PML) cases, pose risks to reputation and market access.

Financial Trajectory Analysis

Revenue Trends

Biogen’s Tecfidera generated peak revenues exceeding USD 4 billion annually during its initial launch phase [3]. Post-patent expiry and biosimilar competition, revenues have declined; recent estimates project a reduction of up to 40% over the next five years. Vumerity, introduced later, contributes additional revenue streams but at a smaller scale.

Investors must consider patent expiries, biosimilar entries, and evolving competitive dynamics when projecting future revenues. A conservative forecast suggests stabilized revenues in mature markets and growth potential in emerging regions, contingent upon regulatory approvals.

Profitability and Cost Structure

Manufacturing costs for DMF are relatively stable, given established synthesis processes. R&D investments focus on formulation innovation and new indications, with clinical trial expenditures sensitive to regulatory and competitive pressures.

Pricing reductions due to biosimilars will impact gross margins. However, strategic cost management and pipeline diversification can mitigate financial impacts.

Market Entry and Expansion Strategies

Market expansion relies on reimbursement negotiations, clinical guideline endorsements, and strategic collaborations. Launching in emerging markets with tailored pricing and long-term partnerships with governments can extend product lifecycle and revenue streams.

Acquisition of biosimilar or adjacent assets diversifies income sources, providing coverage against declines in original product revenues.

Future Outlook and Investment Considerations

The dimethyl fumarate market's future is shaped by patent protections, competitive innovations, and regulatory policies. Strategic patent extensions and lifecycle management remain vital for maintaining financial health. The potential entry of biosimilars post-2028 could accelerate revenue decline unless mitigated by new indications or formulations.

Companies investing in R&D for improved formulations, new indications, or combination therapies could unlock additional value. Conversely, safety concerns and regulatory restrictions require vigilant monitoring.

Key Takeaways

-

Market Position: Dimethyl fumarate remains a major player in RRMS therapy, with strong clinical positioning and regional dominance, especially in North America and Europe.

-

Competitive Risks: Patent expiration and biosimilar developments threaten market share, emphasizing the importance of pipeline innovation and lifecycle management.

-

Pricing Dynamics: Reimbursement pressures and biosimilar entry are driving down prices, challenging profitability but also incentivizing cost-efficient manufacturing and strategic partnerships.

-

Emerging Opportunities: Investigational uses and formulation improvements could hedge against patent cliffs, opening new revenue avenues.

-

Financial Strategy: Maintaining profitability requires proactive patent strategies, pipeline diversification, and geographical expansion, particularly into emerging markets.

FAQs

1. When is the patent expiry for Tecfidera (dimethyl fumarate), and how will it impact the market?

Tecfidera's U.S. patent is slated to expire in 2028. Post-expiry, biosimilar and generic competitors are expected to enter the market, potentially reducing revenue by up to 40-50%. Companies are investing in formulation improvements and new indications to extend market dominance.

2. What are the main safety concerns associated with dimethyl fumarate?

While generally well-tolerated, rare cases of PML have been reported. Moreover, gastrointestinal and flushing side effects are common. Ongoing safety monitoring and formulation adjustments aim to mitigate these issues.

3. How is the global market for dimethyl fumarate evolving?

The market is expanding rapidly in emerging regions like Asia-Pacific due to increased diagnosis and healthcare access. In mature markets, growth is plateauing amid pricing pressures and patent expirations.

4. Are there promising pipeline developments related to DMF?

Yes. Research focuses on optimized formulations for better tolerability, combination therapies, and potential indications in dermatology and other autoimmune conditions. These could extend DMF’s lifecycle and market reach.

5. What strategies can pharmaceutical companies deploy to maximize financial returns?

Strategies include extending patent protections via formulations and indications, expanding into high-growth emerging markets, engaging in strategic licensing, and investing in R&D for next-generation therapies.

Sources

[1] Bianchi, M. et al. "Mechanisms of action of fumarates in multiple sclerosis." Autoimmunity Reviews, 2020.

[2] MarketWatch. "Global Multiple Sclerosis Therapy Market Report," 2022.

[3] Biogen Annual Report, 2022.