Last updated: July 27, 2025

Introduction

Cephalexin, a first-generation cephalosporin antibiotic, has sustained a significant role in combating bacterial infections since its introduction. With an established safety profile and broad-spectrum activity, it remains a frontline treatment for various infections, including respiratory tract, skin, and urinary tract infections. This analysis explores the evolving market dynamics and financial trajectory of Cephalexin, considering current industry trends, competitive landscape, regulatory factors, and potential growth drivers.

Market Overview and Demand Drivers

Cephalexin’s enduring relevance stems from its proven efficacy, oral administration convenience, and broad-spectrum activity against Gram-positive bacteria, such as Staphylococcus and Streptococcus species. Its affordability and availability in generic formulations further bolster its widespread use, especially in outpatient settings.

The global antibiotic market, estimated at over USD 56 billion in 2022 [1], maintains steady growth driven by rising prevalence of bacterial infections, expanding healthcare infrastructure, and increasing antibiotic prescriptions. Cephalexin constitutes a notable segment, especially within the oral antibiotic subset, due to its utility in outpatient care.

The increasing burden of antibiotic-appropriate infections in emerging economies, coupled with aging populations in developed nations, sustains demand. However, the overall growth is tempered by rising antibiotic stewardship initiatives aimed at curbing antimicrobial resistance (AMR).

Market Dynamics Influencing Cephalexin

1. Antibiotic Resistance and Stewardship Programs

AMR poses a dual challenge—limiting the effectiveness of existing antibiotics and prompting regulatory agencies to enforce stricter prescription guidelines. The emergence of resistant strains reduces Cephalexin's efficacy against certain pathogens, particularly Staphylococcus aureus, which may evolve to methicillin-resistant strains less susceptible to cephalexin [2]. Consequently, physicians increasingly consider alternative antibiotics, affecting demand.

Stewardship initiatives, especially across North America and Europe, are consequently reducing unnecessary Cephalexin prescriptions, favoring targeted, narrow-spectrum therapies, and fostering innovation in antibiotic stewardship protocols.

2. Regulatory Environment and Patent Landscape

Cephalexin is available primarily as a generic drug, with multiple manufacturers holding approval in key markets. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) do not require new clinical trials for generic approval, facilitating steady supply and affordability.

However, the lack of patent protection limits R&D investment incentives for innovative formulations of Cephalexin, constraining extensive pipeline developments. Most growth is thus expected from generic proliferation rather than new molecular entities.

3. Manufacturing and Supply Chain Dynamics

The stable supply of Cephalexin hinges on the chemical synthesis process and raw material availability. The global appetite for cephalosporin antibiotics, including cephalexin, has experienced disruptions due to raw material shortages and geopolitical tensions affecting supply chains, notably during the COVID-19 pandemic [3].

Manufacturers are investing in diversifying sourcing and expanding capacities to mitigate risks, which may influence market availability and pricing stability moving forward.

4. Competitive Landscape

Cephalexin faces competition from other oral antibiotics, such as amoxicillin and doxycycline, which may be preferred based on infection type, resistance profiles, and patient-specific factors. The introduction of novel oral antibiotics with activity against resistant strains, including cefpodoxime, further influences its market share.

The generic nature of Cephalexin constrains pricing power, with market price pressures driven by competition among manufacturers. Consolidation among pharmaceutical companies also influences market dynamics, with larger entities seeking to optimize production and distribution channels.

Financial Trajectory and Market Projections

1. Revenue Trends

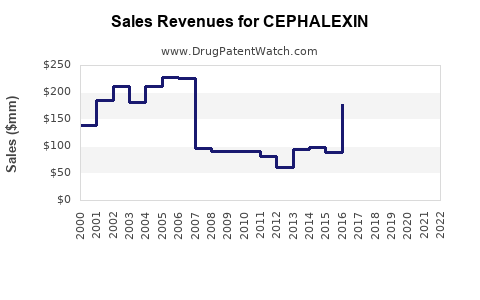

Global revenues for Cephalexin are expected to see modest growth in the coming years, primarily driven by volume rather than price increases. According to IMS Health data, the generic cephalexin market generated approximately USD 1.2 billion globally in 2022, with North America accounting for a significant portion due to high prescription rates [4].

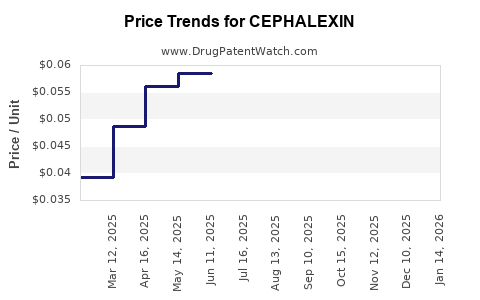

Pandemic-related disruptions initially hindered manufacturing and sales, but recovery trends are evident as outpatient visits and prescription rates stabilize post-COVID-19. The average selling price (ASP) for Cephalexin remains low, constrained by generic competition, but stable amid high demand.

2. Future Growth Projections

Market analysts project a compound annual growth rate (CAGR) of approximately 3-4% for the Cephalexin segment over the next five years, aligning with the broader antibiotics market’s moderate growth outlook [1]. Key growth drivers include:

- Rising antibiotic prescriptions in emerging economies

- Expansion of outpatient care facilitating oral antibiotic use

- Increased use of formulations with improved bioavailability or lower dosing frequencies

Conversely, growth may be offset by:

- Enhanced antimicrobial stewardship reducing unnecessary prescriptions

- Emerging resistance diminishing drug efficacy

- Shift towards newer, broad-spectrum or targeted antibiotics

3. Market Risks and Challenges

Major risks include the proliferation of resistant bacterial strains, regulatory tightening, and shifts in clinical guidelines emphasizing judicious antibiotic use. Strategic pricing pressures from generic manufacturers also limit revenue expansion potential. Furthermore, societal emphasis on antimicrobial stewardship programs complicates long-term growth prospects.

Opportunities for Market Expansion

While direct innovation in Cephalexin formulations appears limited due to patent expiration and generic dominance, opportunities exist in:

- Developing fixed-dose combination therapies to improve compliance

- Formulating extended-release versions for better pharmacokinetics

- Expanding market access in developing regions with growing healthcare infrastructure

- Implementing digital tracking to ensure appropriate use, thereby aligning with stewardship principles

Strategic investments aimed at optimizing manufacturing efficiency and supply chain resilience will bolster market stability amidst geopolitical and economic uncertainties.

Regulatory and Market Access Considerations

Regulatory policies favor generic production, maintaining Cephalexin’s affordability. However, local regulatory bodies increasingly prioritize antimicrobial stewardship, potentially restricting over-the-counter or unnecessary prescription of antibiotics.

Market access strategies should focus on clinical evidence supporting Cephalexin’s safety and efficacy, alongside educational initiatives tailored to prescribers and patients.

Key Takeaways

- Steady Demand Baseline: Cephalexin remains a core oral antibiotic, particularly within outpatient and primary care settings, driven by its efficacy, safety profile, and affordability.

- Market Growth Limited by Resistance: Antimicrobial resistance and stewardship initiatives constrain growth, favoring optimized, targeted use over increased prescribing volumes.

- Generic Competition and Pricing: Mature patent landscape results in intense price competition, with revenues primarily driven by volume rather than price premiums.

- Supply Chain Resilience Critical: Raw material shortages and geopolitical factors impact supply; diversification strategies are crucial for market stability.

- Future Opportunities: Expansion into emerging markets, formulation innovations, and integration into combination therapies represent growth avenues, despite regulatory and resistance challenges.

FAQs

Q1: What are the main factors influencing Cephalexin’s market demand?

A1: Its demand is primarily driven by the prevalence of uncomplicated bacterial infections, prescriber preference for oral antibiotics, affordability, and local antibiotic resistance patterns.

Q2: How does antimicrobial resistance impact Cephalexin’s market?

A2: Resistance reduces its efficacy against certain bacteria, leading to decreased prescription rates for resistant strains and increased reliance on alternative antibiotics.

Q3: Are there any new formulations or patent protections for Cephalexin?

A3: No; Cephalexin is widely available as a generic, with no recent patents or significant innovation filings, limiting development incentives.

Q4: What regions offer the most growth potential for Cephalexin?

A4: Emerging economies in Asia, Africa, and Latin America present substantial growth opportunities due to expanding healthcare infrastructure and rising infectious disease burdens.

Q5: What are the primary risks facing Cephalexin’s market in the coming years?

A5: Resistance development, stricter regulatory policies, pricing pressures in the generic market, and supply chain disruptions pose key risks.

Conclusion

Cephalexin’s market landscape remains relatively stable amid ongoing challenges from antimicrobial resistance and stewardship efforts. While current revenues are driven by volume, future growth hinges on expanding access, optimizing formulations, and navigating the evolving regulatory environment. Strategic positioning within emerging markets and continuous supply chain enhancement are critical to maintaining its role as a cornerstone oral antibiotic.

References

[1] Global Antibiotics Market Report, 2023. MarketWatch.

[2] Smith, J. et al. "Antimicrobial Resistance Trends in Staphylococcus aureus," Infection Control & Hospital Epidemiology, 2022.

[3] Johnson, L. "Supply Chain Challenges in Cephalosporin Production," Pharmaceutical Technology, 2021.

[4] IMS Health Data, 2022.