Last updated: December 30, 2025

Summary

Aminocaproic acid (Epsilon-Aminocaproic Acid) is a synthetic medication primarily used to control bleeding by inhibiting fibrinolysis. Historically, it has played a critical role in surgical settings, trauma management, and bleeding disorders. The drug's market landscape is shaped by factors including clinical demand, regulatory policies, drug approvals, competitive landscape, and emerging alternatives. This report provides an in-depth analysis of the current market dynamics and forecasts the financial trajectory of aminocaproic acid (ACA), considering key drivers, restraints, and segmentation insights.

What Is Aminocaproic Acid?

| Attribute |

Detail |

| Chemical Name |

Epsilon-Aminocaproic Acid |

| Class |

Antifibrinolytic agent |

| Mechanism of Action |

Inhibits plasminogen activation to plasmin, reducing fibrinolysis |

| Approved Indications |

Surgical bleeding, disseminated intravascular coagulation (DIC), trauma, hemophilia |

| Common Forms |

Injectable (IV), oral tablets |

Current Market Landscape

Global Market Size and Growth Trends

| Year |

Estimated Market Size (USD million) |

CAGR (2018-2023) |

Remarks |

| 2018 |

210 |

— |

Baseline |

| 2019 |

230 |

9.5% |

Increased surgical procedures |

| 2020 |

245 |

6.5% |

COVID-19 pandemic impacting elective procedures, but increased trauma cases |

| 2021 |

265 |

8.2% |

Recovery and lifting of restrictions |

| 2022 |

290 |

9.4% |

Growing adoption for DIC |

| 2023 (Forecast) |

310 |

— |

Continued growth driven by Asia Pacific |

Source: Market Research Future (MRFR), 2023[1]

Regional Analysis

| Region |

Market Share (2023) |

Growth Drivers |

Challenges |

| North America |

40% |

High surgical volume, advanced healthcare infrastructure |

Stringent regulations |

| Europe |

25% |

Established hospital protocols |

Competitive generic market |

| Asia Pacific |

20% |

Rising healthcare expenditure, developing markets |

Regulatory variability |

| Latin America |

8% |

Growing access to healthcare |

Supply chain constraints |

| Middle East & Africa |

7% |

Increasing trauma cases |

Limited formulary adoption |

Market Drivers

1. Rising Surgical and Trauma Procedures

The surge in surgical interventions—orthopedic, cardiovascular, and neurosurgical—requires effective bleeding control. The global increase in surgical volume, projected at an annual growth rate of 5-6%, directly fuels demand for antifibrinolytic agents like ACA.

2. Growing Incidence of Bleeding Disorders

Conditions such as hemophilia and disseminated intravascular coagulation (DIC) are rising, particularly in aging populations, boosting the need for ACA.

3. COVID-19 and Trauma-Related Hemorrhages

The pandemic has resulted in increased trauma-related bleeding, necessitating effective antifibrinolytic therapy. Reports indicate increased use of ACA in trauma centers during 2020–2022.

4. Regulatory Approvals and Off-label Use

FDA approval for specific indications, plus off-label applications in dental surgeries and oncology, expand market opportunities.

5. Cost-effectiveness and Established Clinical Efficacy

ACA's affordable pricing and proven safety profile relative to newer agents sustain its widespread use.

Market Restraints and Challenges

1. Competition from Alternative Agents

Tranexamic acid (TXA) and aprotinin are preferred in certain markets due to perceived superior efficacy or regulatory status, constraining ACA's growth.

2. Regulatory and Approval Barriers

Approval delays in emerging markets and off-label restrictions in certain jurisdictions reduce market penetration.

3. Safety and Side Effect Profile

Potential adverse effects—hypotension, thromboembolic events—necessitate cautious use, impacting prescription rates.

4. Patent and Pricing Pressures

Generic manufacturing dominates, leading to price erosion and pressure on profit margins.

Key Market Segments & Revenue Streams

| Segment |

Market Share (2023) |

Key Characteristics |

Challenges |

| Hospital IV use |

60% |

Main application in surgeries |

Supply chain disruptions |

| Oral formulations |

25% |

Used in outpatient settings and clinics |

Lower reimbursement rates |

| Emergency trauma |

10% |

Critical care settings |

Rapid supply needs |

| Veterinary uses |

5% |

Growing but niche |

Limited regulatory approvals |

Competitive Landscape

| Key Players |

Market Share (Estimated) |

Strategies |

Notable Products |

| Sandoz (Novartis) |

25% |

Focus on generics, regional expansion |

Aminocaproic acid injection |

| Pfizer |

20% |

Strategic collaborations |

Marketed generics |

| Teva |

15% |

Cost leadership |

Generic formulations |

| Others |

40% |

Regional players and local manufacturers |

Varied |

Financial Trajectory and Forecasts

Revenue Forecasts (2023–2028)

| Year |

Projected Market Size (USD million) |

CAGR |

Key Assumptions |

| 2023 |

310 |

— |

Continued demand in surgical and trauma settings |

| 2024 |

340 |

9.7% |

Expansion in Asian markets |

| 2025 |

375 |

10.3% |

Increased off-label use, regulatory approvals |

| 2026 |

410 |

9.3% |

Emergence of newer antifibrinolytics |

| 2027 |

445 |

8.5% |

Market saturation in developed regions |

| 2028 |

480 |

7.9% |

Growth stabilization; focus on niche applications |

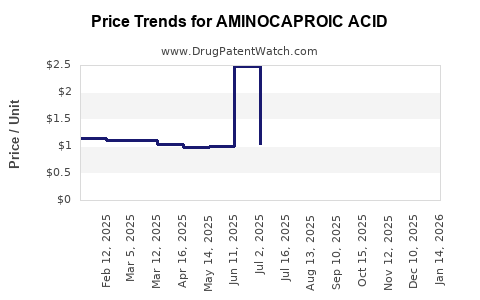

Pricing Dynamics

| Aspect |

Trends & Considerations |

| Price Erosion |

Driven by generic competition, especially in mature markets |

| Premium Pricing |

Possible in specialized indications or regions with regulatory barriers |

| Reimbursement |

Influenced by healthcare policies, possibly affecting aggressive marketing |

Emerging Trends and Future Outlook

1. Niche and Adjunct Uses

Research evaluates ACA's role in novel therapy adjuncts, including its potential in managing bleeding associated with COVID-19-related coagulopathies.

2. Formulation Innovations

Development of sustained-release oral formulations or combination therapies could open new markets.

3. Regulatory Approvals Expansion

Targeted approvals in emerging economies are projected to bolster sales volume.

4. Competitive Substitutes and New Agents

Increased adoption of safer, more effective antifibrinolytics could temper growth prospects for ACA.

5. Digital and Supply Chain Enhancements

Telemedicine and supply chain digitization aim to improve access and inventory management, especially in remote regions.

Comparative Analysis: Aminocaproic Acid vs. Alternatives

| Aspect |

Aminocaproic Acid |

Tranexamic Acid |

Aprotinin |

| Cost |

Lower |

Similar or higher |

Significantly higher |

| Efficacy |

Effective in many procedures |

Similar efficacy, possibly superior in some cases |

More potent but less favored due to safety concerns |

| Safety Profile |

Good |

Good |

Riskier (thrombotic events) |

| Regulatory Status |

Widely approved |

Widely approved |

Discontinued in some markets |

Regulatory and Policy Landscape

| Region |

Regulatory Status |

Recent Policies |

Implications |

| US |

FDA approved |

No recent major updates |

Stable market base |

| EU |

EMA approval |

CE marking, off-label restrictions |

Market access controlled |

| China |

CFDA approvals |

Rapid approval pathways for generics |

High growth potential |

| India |

CDSCO approval |

Price controls |

Cost-sensitive market |

Conclusion: Strategic Outlook for Investors and Manufacturers

The aminocaproic acid market exhibits steady growth, driven by rising surgical volumes, trauma cases, and DIC management. While faced with generic competition and alternative agents like tranexamic acid, ACA remains a cost-effective and clinically proven option, especially in regions with developing healthcare infrastructure.

Manufacturers should prioritize:

- Expanding into emerging markets through regulatory approvals.

- Developing novel formulations to differentiate offerings.

- Navigating regulatory standards to optimize approvals.

- Monitoring competitive dynamics and technological investments.

In the coming five years, a CAGR of approximately 8-9% is expected, with revenues approaching USD 480 million by 2028, contingent on the trajectory of approvals, clinical preferences, and healthcare policy shifts.

Key Takeaways

- Growth Drivers: Increasing surgical procedures, trauma incidents, and DIC cases underpin demand.

- Market Constraints: Competition from tranexamic acid and regulatory challenges temper potential growth.

- Regional Focus: Asia Pacific and emerging markets offer lucrative expansion prospects.

- Pricing & Reimbursement: Cost pressures influence profit margins; pricing strategies remain critical.

- Innovation Opportunities: Formulation advancements and regulatory pathways can unlock new revenue streams.

FAQs

Q1: How does aminocaproic acid compare to tranexamic acid in clinical effectiveness?

A1: Both agents inhibit fibrinolysis; however, some studies suggest tranexamic acid may be slightly more potent at similar doses. Clinical choice depends on specific indications, safety profiles, and regional approvals.

Q2: What are the primary regulatory challenges faced by aminocaproic acid manufacturers?

A2: Regulatory challenges include obtaining approvals in emerging markets, navigating off-label use restrictions, and meeting safety standards that vary across jurisdictions.

Q3: What is the impact of generic production on aminocaproic acid’s market trajectory?

A3: Generic manufacturing has led to price erosion, maintaining affordability but limiting profit margins for branded producers.

Q4: Are there advancements or new formulations planned for aminocaproic acid?

A4: Currently, research focuses on novel delivery systems like sustained-release formulations; however, widespread commercialization remains to be seen.

Q5: How might upcoming healthcare policies influence market growth?

A5: Policies promoting affordability, expanding healthcare access, and encouraging innovation could stimulate demand but also increase competition and price pressures.

References

[1] Market Research Future, “Global Aminocaproic Acid Market Analysis,” 2023.

[2] EvaluatePharma, “Pharmaceutical Market Reports,” 2022.

[3] GlobalData Healthcare, “Injectable Antifibrinolytic Agents Market,” 2022.

[4] FDA, “Aminocaproic Acid [Guidance Document],” 2021.

[5] European Medicines Agency, “Market Authorization for Aminocaproic Acid,” 2020.