Last updated: July 29, 2025

Introduction

Aminocaproic acid (EACA) is a synthetic derivative of the amino acid lysine, primarily used as an antifibrinolytic agent to control bleeding in various clinical settings. Its primary indications include hemorrhagic conditions such as postoperative bleeding, bleeding related to fibrinolytic therapy, and traumatic bleeding. The global demand for aminocaproic acid is intricately linked to surgical procedures, trauma management, and hematological therapies. As the healthcare landscape evolves, understanding the market dynamics and future pricing trends of aminocaproic acid becomes crucial for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Size

The global market for aminocaproic acid was valued at approximately USD 250 million in 2022, with steady growth driven by increasing surgical procedures and enhanced awareness about bleeding management. The Asia-Pacific region exhibits rapid growth owing to expanding healthcare infrastructure, rising surgical volumes, and favorable regulatory environments[1]. North America and Europe dominate the market, contributing around 65% of global sales due to widespread healthcare facilities and high adoption rates.

Key Growth Drivers

- Expanding Surgical Procedures: The rise in cardiovascular surgeries, dental surgeries, and trauma-related interventions heightens demand for antifibrinolytics like aminocaproic acid.

- Trauma and Hemophilia Management: Increased attention to bleeding control protocols in trauma and bleeding disorders bolsters market growth.

- Regulatory Approvals and Generic Access: Post-patent expiration of branded formulations has increased the availability of generic aminocaproic acid, reducing costs and enhancing accessibility.

- COVID-19 Impact: The pandemic accentuated the need for effective bleeding control due to increased ICU admissions and coagulopathy-associated complications[2].

Market Segmentation

Based on formulation, the market includes:

- Injectable Aminocaproic Acid: Predominant in hospitals for acute bleeding management.

- Oral Formulations: Used for long-term hemorrhage control, albeit less prevalent.

By application, segments comprise:

- Surgical Bleeding

- Hematological Disorders

- Trauma-related Bleeding

- Others (e.g., dental procedures)

Competitive Landscape

Major players include:

- Fresenius Kabi

- Sigma-Aldrich (Merck)

- Sandoz (Novartis)

- Teva Pharmaceuticals

- Hikma Pharmaceuticals

These companies leverage manufacturing scale, distribution networks, and regulatory filings to maintain market share. The increasing trend toward generics has intensified competition, contributing to price reductions.

Regulatory and Patent Landscape

While aminocaproic acid’s basic formulation is off-patent in most regions, patent protections may still exist for specific formulations or delivery mechanisms. Regulatory approvals for various indications vary annually, affecting market access and pricing strategies. The FDA and EMA approval processes influence both supply and pricing in respective regions.

Price Analysis and Projections

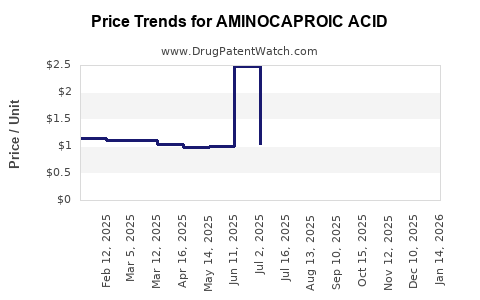

Current Price Trends

Prices for aminocaproic acid vary significantly:

- Injectable formulations average USD 3-5 per gram in North America and Europe.

- Oral formulations are typically less expensive, ranging USD 1-3 per gram.

Brand-name products remain priced higher than generics, which dominate the market.

Factors Influencing Pricing

- Generic Competition: The expiration of patent protections has resulted in multiple generic manufacturers, exerting downward pressure on prices.

- Manufacturing Costs: Raw material prices, quality standards, and economies of scale impact production costs and, consequently, pricing.

- Regulatory Environment: Stringent quality requirements or import/export restrictions influence manufacturing and pricing strategies.

- Market Demand Dynamics: Fluctuations in surgical volumes and trauma cases directly affect supply and pricing.

Future Price Projections (2023-2028)

Analysts project a gradual decline in average prices for aminocaproic acid due to escalating generic competition:

- Injectable form prices are expected to decrease by approximately 10-15% over five years, reaching USD 2.5-4 per gram by 2028.

- Oral formulations could see a 5-10% decline, with prices stabilizing around USD 0.9-2.7 per gram depending on market penetration.

Emerging markets are likely to observe more significant price reductions owing to increased importation of generic products and local manufacturing initiatives. Conversely, in developed markets, price stabilization may occur due to established supply chains and regulatory standards.

Impact of Market Factors on Future Pricing

- Technological Advancements: Development of alternative hemostatic agents and targeted therapies could reduce demand, impacting prices.

- Regulatory Changes: Tightening quality standards or new safety regulations might increase manufacturing costs temporarily, affecting prices.

- Supply Chain Disruptions: Global events such as pandemics or geopolitical tensions could impact raw material availability, influencing prices variably.

Strategic Considerations for Stakeholders

Pharmaceutical firms must navigate a crowded, price-sensitive market, emphasizing cost-efficient manufacturing and robust distribution. Healthcare providers should weigh the cost-benefit ratio of generic versus branded formulations, especially considering efficacy, safety, and supply stability. Policymakers could influence market prices through regulatory policies and incentive structures promoting accessibility.

Conclusion

The aminocaproic acid market is characterized by steady growth, supported by increased surgical procedures and trauma management. Pricing pressures from generic competition and regional regulatory landscapes position prices for gradual decline over the next five years. Stakeholders should consider regional demand, formulation preferences, and competitive dynamics for strategic planning.

Key Takeaways

- The global aminocaproic acid market was valued at USD 250 million in 2022, with significant growth driven by surgical and trauma-related applications.

- Generic formulations dominate the market, exerting downward pressure on prices.

- Injectable aminocaproic acid prices are expected to decrease by approximately 10-15% over five years, stabilizing around USD 2.5-4 per gram.

- Emerging regions offer substantial growth opportunities but may experience more pronounced price reductions.

- Strategic stakeholders should monitor regulatory developments, manufacturing costs, and competitive dynamics to optimize market positioning.

FAQs

1. What are the primary applications of aminocaproic acid?

Aminocaproic acid is primarily used to control bleeding in postoperative settings, trauma care, hemophilia management, and during fibrinolytic therapy.

2. How does the patent landscape affect aminocaproic acid pricing?

Since the basic formulation is generally off-patent, generic manufacturers can produce and market aminocaproic acid, leading to competitive pricing and downward pressure.

3. What regional factors influence aminocaproic acid market growth?

Regions with expanding healthcare infrastructure, high surgical volumes, and favorable regulatory environments (like Asia-Pacific) exhibit faster growth and increased price competition.

4. Are there any significant regulatory hurdles affecting aminocaproic acid?

Regulatory agencies require monitored manufacturing standards, stability data, and approval for specific indications, which can influence market entry and pricing.

5. What future trends could impact aminocaproic acid prices?

Development of alternative hemostatic agents, supply chain disruptions, and regional regulatory changes are key factors that could alter price trajectories.

References

[1] Market Research Future, "Aminocaproic Acid Market Analysis," 2022.

[2] WHO, "Blood safety and availability," 2021.