Last updated: July 28, 2025

Introduction

Vertex Pharmaceuticals Inc. stands as a pioneering entity in the biotechnology sector, primarily focusing on transformative treatments for serious, life-threatening diseases. As a leader in cystic fibrosis (CF) therapies, Vertex is expanding its portfolio through strategic collaborations, innovative R&D, and global market expansion. This analysis delineates Vertex’s current market positioning, core strengths, competitive advantages, and strategic pathways amid an increasingly crowded and innovative pharmaceutical landscape.

Market Position of Vertex Pharmaceuticals Inc.

Global Footprint and Revenue Streams

Vertex's revenue predominantly originates from its cystic fibrosis franchise, notably the CFTR modulator portfolio comprising drugs like Trikafta, Symdeko, and Orkambi. In 2022, the company reported approximately $7.4 billion in total revenue, with CF treatments constituting over 85% of total sales, showcasing its market dominance in this niche (Vertex Annual Report 2022).

The company's strategic geographic expansion includes key markets across the US, Europe, and emerging territories such as Japan and South Korea. Vertex has adapted its market approach to meet local regulatory standards, exemplified by its successful approval and commercialization of CF therapies in multiple jurisdictions.

Pipeline and Diversification

While CF remains the core revenue driver, Vertex is progressively diversifying through investments in other therapeutic areas, including pain management, multiple sclerosis, and rare diseases such as sickle cell disease through gene-editing approaches (CRISPR/Cas9 technology). The recent acquisition of certain gene-editing assets underscores its ambition to future-proof its portfolio.

Competitive Landscape in CF and Beyond

Vertex faces competition from pharma giants like Novartis, AbbVie, and Moderna, especially as gene therapies and personalized medicine gain prominence. Nonetheless, Vertex’s unparalleled expertise in CF and its early-mover advantage position it as an industry leader, expected to maintain its foothold through ongoing innovation and market expansion.

Strengths of Vertex Pharmaceuticals

1. Market Leadership in CF

Vertex’s breakthrough CFTR modulators—especially Trikafta, which gained FDA approval in 2019—have transformed treatment paradigms, significantly improving patient outcomes. Trikafta's status as a best-in-class therapy consolidates Vertex’s competitive edge, with over 20,000 patients treated globally.

2. Robust R&D and Innovation Capability

Vertex invests approximately 20% of its revenues into R&D, supporting a pipeline that extends beyond CF. Its leadership in gene editing (notably with CRISPR-based approaches) offers potential to expand therapeutic horizons into rare genetic and non-genetic indications.

3. Strategic Collaborations & Licensing Agreements

Partnerships with academic institutions and biotech firms, such as CRISPR Therapeutics, facilitate cutting-edge research. These collaborations foster accelerated development of gene-editing therapies, broadening Vertex’s pipeline.

4. Strong Financial Position

With sustained revenues and profitability, Vertex maintains a resilient financial profile enabling continued investment in innovation and expansion. It also enables strategic acquisitions and licensing deals aligned with its growth objectives.

5. Focused Niche Strategy with Global Reach

Vertex’s laser-focused approach in cystic fibrosis has yielded a loyal patient base and strong payer relationships. Its expanding global footprint ensures sustained revenue streams amidst market dynamics.

Strategic Insights and Competitive Advantages

Innovation-Driven Growth

Vertex leverages its deep scientific expertise and innovative platform to develop next-generation therapies, notably in gene editing and gene therapy fields. Its commitment to personalized medicine aligns with industry shifts toward tailored treatments.

Market Expansion in Rare and Orphan Diseases

Leveraging its experience in CF, Vertex aims to penetrate other rare diseases—e.g., sickle cell disease—through targeted clinical programs and regulatory engagement. Such diversification reduces dependence solely on CF revenue and opens new markets.

Pipeline Optimization via Strategic Alliances

Strategic collaborations, especially in gene editing, serve as multipliers for innovation. For example, Vertex’s partnership with CRISPR Therapeutics accelerates the development of curative therapies, positioning it ahead of competitors lacking such capabilities.

Global Market Penetration & Access Strategies

Vertex’s proactive engagement with health authorities worldwide enhances access to its therapies. Initiatives such as patient assistance programs and pricing strategies support adoption in emerging markets, broadening its global footprint.

Operational Efficiency & Patent Portfolio

An efficient manufacturing process and a robust patent portfolio reinforce Vertex’s market exclusivity, safeguarding revenue streams against generic competition.

Competitive Challenges & Risks

Despite its strengths, Vertex faces several challenges:

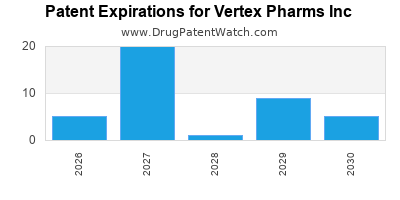

- Patent Expirations and Biosimilar Competition: Future patent cliffs threaten revenue sustainability, especially as biosimilars enter the market.

- Pricing and Reimbursement Pressures: Increasing global scrutiny over drug pricing may impact profit margins.

- Pipeline Risk: Breakthrough therapies entail high R&D costs and uncertain outcomes.

- Regulatory Hurdles in New Indications: Expanding into new therapeutic areas requires navigating complex regulatory landscapes.

Strategic Recommendations for Sustained Leadership

-

Diversify beyond CF: Continued investment in rare disease pipelines and gene editing can reduce dependence on CF revenues and establish Vertex as a leader across multiple therapeutic domains.

-

Accelerate Global Market Access: Tailoring strategies for emerging markets will unlock additional revenue streams and enhance brand presence.

-

Strengthen Intellectual Property: Ongoing patent filings and legal defenses are critical, especially as biosimilar entrants emerge.

-

Leverage Data and Digital Tools: Integrating real-world evidence and digital health platforms can optimize clinical development and patient engagement.

-

Invest in Next-Generation Technologies: Focusing on gene editing, RNA therapeutics, and precision medicine will position Vertex at the forefront of innovation.

Conclusion

Vertex Pharmaceuticals Inc. exemplifies a resilient and innovative biotech leader with a dominant position in cystic fibrosis treatment and expanding ambitions in gene therapy and rare diseases. Its strategic focus on innovation, global expansion, and diversification sustains its competitive advantage amid a rapidly evolving pharmaceutical landscape. Maintaining investment in R&D, navigating patent and regulatory challenges, and broadening market reach are pivotal for Vertex’s continued leadership over the coming decade.

Key Takeaways

- Vertex’s market leadership in CF, driven by successful modulators like Trikafta, secures its dominant position.

- Its significant investments in R&D and strategic alliances propel future innovation, particularly in gene editing.

- Diversification into other rare and genetic diseases mitigates revenue risks from patent expirations and market saturation.

- Global expansion and tailored access strategies amplify market reach, especially in emerging economies.

- Proactive patent and regulatory management are essential for safeguarding competitive advantages.

FAQs

Q1: How sustainable is Vertex's market position given the patent expirations of key CF drugs?

While patent expirations pose risks, Vertex’s pipeline focusing on gene editing and new therapeutic modalities aims to offset potential revenue decline. Strategic patent management and pipeline diversification are crucial for sustainability.

Q2: What are Vertex's most promising pipeline candidates beyond CF?

Gene-editing therapies for sickle cell disease and beta-thalassemia, along with novel treatments for pain and rare neurodegenerative disorders, are among the promising candidates currently in clinical development.

Q3: How does Vertex’s global market strategy enhance its competitive edge?

Localized regulatory engagement, pricing strategies, and patient access programs in emerging markets enable Vertex to expand its revenue base and establish a global presence beyond its traditional markets.

Q4: What are the primary risks facing Vertex in the next five years?

Patent cliffs, biosimilar competition, pricing pressures, pipeline uncertainties, and regulatory hurdles in new therapeutic areas are key risks.

Q5: How does Vertex’s innovation culture compare to its competitors?

Vertex’s strong focus on R&D, collaboration with cutting-edge biotech firms, and in-house expertise in gene editing position it ahead of many competitors in pioneering therapies.

Sources:

- Vertex Pharmaceuticals Annual Report 2022

- FDA and EMA Regulatory Approvals Data

- Industry Reports and Market Analyses (EvaluatePharma, IQVIA)

- Corporate Press Releases and Strategic Investment Announcements