Last updated: October 4, 2025

Introduction

In the dynamic and highly regulated Canadian pharmaceutical market, Sun Pharma Canada stands as a significant player, leveraging its global footprint and diverse portfolio to attain a competitive edge. As one of the leading generic and specialty pharmaceutical companies, Sun Pharma navigates the complexities of regulatory, pricing, and market access nuances to sustain growth and secure market share. This analysis explores Sun Pharma Canada’s current market positioning, key strengths, competitive dynamics, and strategic pathways in the evolving landscape.

Market Position of Sun Pharma Canada

Sun Pharma Canada holds a prominent position within the Canadian pharmaceutical industry, particularly in generic medicines and over-the-counter (OTC) products. The company's strategic footprint is supported by its extensive portfolio, manufacturing capabilities, and robust distribution channels.

Market Share and Presence

According to IQVIA data (as of 2022), Sun Pharma ranks among the top 10 generic pharmaceutical firms in Canada, commanding approximately 5-7% of the generic drug market share. Its portfolio spans therapeutic areas like cardiovascular, central nervous system (CNS), dermatology, and respiratory conditions, aligning with key healthcare needs across demographics.

Product Portfolio and Innovation

With a portfolio exceeding 400 products, Sun Pharma emphasizes cost-effective generics, branded generics, and OTC products. Recent acquisitions and licensing agreements have enhanced its product pipeline, enabling rapid entry into emerging segments and specialty markets, albeit still primarily focused on generics.

Regulatory Compliance & Market Penetration

Sun Pharma Canada maintains a solid reputation for regulatory compliance, critical for market sustenance in Canada’s strict regulatory environment governed by Health Canada. This compliance, coupled with efficient approval processes, facilitates swift product launches and market expansion.

Strengths of Sun Pharma Canada

1. Extensive Portfolio and Cost Leadership

Sun Pharma’s diversified product offerings allow it to serve a broad spectrum of therapeutic areas, ensuring resilience against market volatility. Its cost-effective manufacturing, supported by global scale, enables competitive pricing strategies, fostering market penetration in a price-sensitive environment.

2. Robust Manufacturing Infrastructure

Having invested in manufacturing facilities in Canada and globally, Sun Pharma ensures quality control, supply chain reliability, and the agility to meet localized demand fluctuations. These capabilities are crucial given Canada's emphasis on quality standards and supply security.

3. Strategic Acquisitions and Licensing

Sun Pharma’s strategic acquisitions, such as the purchase of Actavis Generics in 2017, expanded its product portfolio and market share. Licensing agreements with innovative companies further bolster the pipeline, providing differentiated products that can command higher margins.

4. Focus on Specialty and Over-the-Counter Segments

While primarily a generics company, Sun Pharma’s expansion into OTC and specialty pharmaceuticals positions it to diversify revenue streams, especially as the regulatory environment tightens around generics and biosimilars.

5. Strong Regulatory and Compliance Record

A reputation for adherence to Canadian regulatory standards enhances market confidence and facilitates smoother product approvals, which is vital for sustaining market presence amid aggressive competition.

Competitive Dynamics in the Canadian Market

Key Competitors

- Teva Canada: Recognized for its extensive generic portfolio and aggressive pricing.

- Apotex: A prominent player with a significant market share, especially in biosimilars and complex generics.

- Mylan (now part of Viatris): Offers a broad product range with strong distribution channels.

- Novartis and Pfizer: Focused on innovator drugs, but increasingly competing in biosimilars and specialty segments.

- Lannett and Sandoz: Middle-tier competitors with niche focuses and regional strengths.

Market Challenges

- Pricing Pressures: Canadian public drug plans and private insurers exert downward pressure on prices, challenging profit margins.

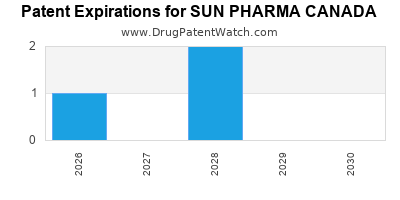

- Regulatory Amendments: Evolving regulations around patent exclusivity and biosimilars create barriers and opportunities.

- Supply Chain Risks: Global disruptions, like those experienced during the COVID-19 pandemic, threaten product availability.

Emerging Opportunities

- Biosimilars and Specialty Drugs: Growing acceptance of biosimilars offers avenues for differentiation.

- Digital & Data-Driven Solutions: Integration of digital health initiatives enhances patient engagement and compliance.

- Private Label Partnerships: Collaborations with pharmacy chains can expand direct market reach.

Strategic Insights for Sun Pharma Canada

1. Emphasize Differentiation through Specialty & Biosimilar Expansion

To move beyond price competition, Sun Pharma should prioritize biosimilars and specialty products, leveraging global R&D capabilities to develop differentiated offerings compliant with Canadian standards.

2. Accelerate Acquisition and Partnership Strategies

Targeted acquisitions of local firms with niche portfolios or distribution strengths can heighten market access. Strategic licensing deals with innovative biotech firms can position Sun Pharma at the forefront of emerging therapies.

3. Invest in Digital and Patient-Centric Initiatives

Adopting digital platforms for clinical support, telehealth integration, and patient adherence programs can build brand loyalty and improve market penetration.

4. Enhance Manufacturing and Supply Chain Resilience

Further investment in local manufacturing, cold chain logistics, and supply chain diversification will mitigate risks related to global disruptions and regulatory challenges.

5. Engage Proactively with Regulatory Bodies

Active participation in policy dialogues and compliance upgrades can facilitate smoother approval pathways for new products and biosimilars, making Sun Pharma a preferred partner for regulators and payers.

Conclusion

Sun Pharma Canada’s competitive outlook remains robust, supported by a resilient portfolio, operational excellence, and strategic adaptation to market trends. As the industry shifts towards biosimilars, specialty medicines, and digital engagement, Sun Pharma's proactive strategies in these domains will determine its future market positioning. Continued investment in innovation, strategic alliances, and supply chain flexibility will be crucial to maintain and expand its foothold in Canada's competitive pharmaceutical landscape.

Key Takeaways

- Sun Pharma Canada maintains a significant position in the generic segment, with a growing footprint in OTC and specialty markets.

- Its strengths lie in a diversified product portfolio, cost-effective manufacturing, strategic acquisitions, and regulatory compliance.

- Competition from domestic and international players remains fierce, emphasizing the need for differentiation through biosimilars and specialty drugs.

- Strategic focus areas include expanding biosimilar offerings, digital health integration, and local manufacturing investments.

- Active engagement with regulatory authorities and supply chain resilience will bolster long-term stability and growth prospects.

FAQs

-

How does Sun Pharma Canada differentiate itself from competitors?

By focusing on cost-effective generics, expanding into biosimilars and specialty medicines, and maintaining robust regulatory compliance, Sun Pharma positions itself as a reliable and innovative player.

-

What are the key growth drivers for Sun Pharma in Canada?

Rising demand for biosimilars, an aging population requiring specialty medications, and digital health adoption serve as primary growth catalysts.

-

How does regulatory environment impact Sun Pharma’s strategic decisions?

Canada's strict regulations necessitate continuous compliance efforts but also present opportunities for expedited approvals for quality-assured products, influencing R&D and market entry strategies.

-

What risks does Sun Pharma face in the Canadian market?

Price competition, regulatory changes, supply chain disruptions, and increasing market share by emerging local players pose ongoing challenges.

-

What strategic moves should Sun Pharma consider to secure future growth?

Accelerating biosimilar development, forging strategic partnerships, investing in local manufacturing, and leveraging digital platforms will position Sun Pharma favorably for sustained growth.

References

[1] IQVIA. (2022). Canadian Pharmaceutical Market Data.

[2] Sun Pharma Annual Report 2022.

[3] Health Canada. (2022). Regulatory Guidelines and Policies.

[4] MarketResearch.com. Canadian Generic Pharma Market Overview.

[5] Deloitte. (2022). Strategic Outlook for Pharmaceuticals in Canada.