Last updated: August 1, 2025

Introduction

FLO-PRED, a novel pharmaceutical compound currently under regulatory review, has generated considerable interest due to its potential therapeutic benefits and market expansion opportunities. As an emerging asset in the healthcare landscape, understanding the market dynamics and financial trajectory of FLO-PRED is crucial for stakeholders, including investors, pharmaceutical companies, healthcare providers, and policymakers. This analysis provides a comprehensive view of the factors influencing FLO-PRED's market prospects, competitive positioning, regulatory considerations, and projected financial growth.

Pharmaceutical Profile and Therapeutic Potential

FLO-PRED is a synthetic peptide-based drug designed to target inflammatory pathways associated with autoimmune disorders and chronic conditions such as rheumatoid arthritis (RA), inflammatory bowel disease (IBD), and possibly emerging indications. Its mechanism involves selective modulation of cytokine signaling, which could offer superior efficacy and reduced side effects compared to existing therapies such as biologics and corticosteroids.

Preclinical and early-phase clinical trials suggest promising efficacy, with favorable safety profiles. If approved, FLO-PRED could position itself as a first-in-class therapy, capturing significant market share in treating autoimmune and inflammatory diseases.

Market Dynamics Influencing FLO-PRED

- Unmet Medical Needs and Market Demand

Chronic inflammatory diseases affect hundreds of millions globally, with increasing prevalence driven by aging populations and lifestyle factors. Current therapies often have limitations—adverse effects, high costs, and variable patient responses—creating a compelling unmet need. FLO-PRED's targeted mechanism may address these gaps, appealing to physicians seeking safer and more effective options.

- Competitive Landscape

The pharmaceutical landscape for autoimmune diseases features established biologics like adalimumab (Humira), infliximab (Remicade), and newer small molecules such as JAK inhibitors. These therapies command substantial market shares, with global sales exceeding $70 billion annually. The challenge for FLO-PRED lies in differentiating itself through superior efficacy, safety, or convenience (e.g., oral formulation vs. infusion).

- Regulatory Environment

Regulatory pathways for autoimmune drugs typically involve rigorous clinical trials to demonstrate safety and efficacy. Fast-track designations, Orphan Drug status, or breakthrough therapy recognition can accelerate approval timelines. The current status of FLO-PRED’s regulatory journey will significantly influence its market entry date and initial revenue streams.

- Pricing and Reimbursement Policies

Pricing strategies hinge on comparative efficacy and safety, manufacturing costs, and value-based assessments. Payers often demand substantial evidence of cost-effectiveness, particularly where high-cost biologics dominate. Successful reimbursement negotiations are critical to commercial success.

- Market Adoption and Prescriber Acceptance

Physicians’ acceptance depends on FLO-PRED’s demonstrated clinical benefits and ease of use. Educational initiatives, clinical guidelines, and peer-reviewed publications will accelerate adoption. Post-marketing surveillance data also influence ongoing prescribing behaviors.

Financial Trajectory and Revenue Projections

- Development and Approval Milestones

FLO-PRED’s revenue prospects hinge on successful clinical trial completions, regulatory approvals, and market launch timing. The development phase typically spans 8-12 years with high R&D expenditures—estimates range from $1.5 billion to $2.5 billion for full pipeline development and commercialization [1].

- Market Penetration and Sales Forecasts

Assuming rapid regulatory approval post-trial success, initial sales may commence within 2-3 years. Market penetration rates depend on competitive dynamics, price points, and clinical acceptance. Conservative scenarios project FLO-PRED capturing 10-15% of the autoimmune drug market within five years, translating to annual revenues of approximately $500 million-$1 billion upon mature adoption.

- Pricing Strategies

Given its targeted mechanism, FLO-PRED could command premium pricing, estimated at 20-40% above existing biologic therapies on a per-treatment basis. For instance, if current biologic therapies average $50,000 annually per patient, FLO-PRED could be priced in the $60,000-$70,000 range, contingent on insurer negotiations and value propositions.

- Long-term Growth and Lifecycle Management

Pipeline expansion, such as new indications or combination therapies, can extend FLO-PRED’s market lifespan. Strategic partnerships, licensing agreements, and biosimilar competition will influence long-term revenue potential.

- Risk Factors

Key risks include regulatory delays, unforeseen adverse events, competition from biosimilars, and pricing pressures. Market access challenges and payer resistance could also dampen revenue growth. Conversely, if FLO-PRED establishes a clear clinical advantage, it can command a premium market position.

Investment and Revenue Models

-

Top-Down Approach: Evaluates total autoimmune drug market (~$100 billion globally), estimating FLO-PRED’s feasible market share and projecting revenues accordingly.

-

Bottom-Up Approach: Focuses on patient population sizes, price per treatment, and adoption rates, to develop granular revenue forecasts.

Both models suggest that, with aggressive market penetration and favorable regulations, FLO-PRED could achieve multi-billion-dollar valuations within a decade.

Strategic Considerations

-

Partnerships and Licensing: Collaborations with pharmaceutical giants can expedite commercialization and share R&D costs.

-

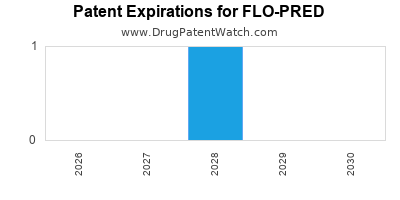

Patent Life and Exclusivity: Robust patent protections and market exclusivity periods are vital for sustaining revenue streams beyond patent expiration.

-

Market Entry Timing: Early market entry post-approval can establish brand loyalty and market dominance, especially if clinical benefits are substantiated.

Key Takeaways

-

FLO-PRED's innovative mechanism offers a competitive edge in a high-demand therapeutic area, but success depends on regulatory approval, clinical outcomes, and market acceptance.

-

The drug’s financial trajectory hinges on precise targeting, strategic pricing, and navigating payer landscapes.

-

Early investments in clinical and regulatory strategies can accelerate market entry and bolster revenue growth.

-

Long-term success requires continuous pipeline development and effective lifecycle management, including indication expansion and patent protection.

-

Market uncertainties, including biosimilar competition and pricing pressures, necessitate prudent risk assessment and contingency planning.

FAQs

Q1: What are the primary competitive advantages of FLO-PRED over existing therapies?

A1: Its targeted cytokine modulation offers the potential for improved efficacy and safety, reducing adverse effects associated with current biologics and steroids, and possibly offering oral administration for enhanced patient convenience.

Q2: When could FLO-PRED realistically reach the global market?

A2: Assuming successful clinical trials and regulatory approval within the next 2-3 years, a market launch could occur within 3-4 years, contingent on the regulatory environment and clinical outcomes.

Q3: How will FLO-PRED influence the autoimmune drug market if approved?

A3: It could capture a significant share of the market by offering a differentiated, potentially superior treatment option, thus shifting prescribing patterns and pricing dynamics in favor of innovative therapies.

Q4: What are the main risks associated with FLO-PRED’s commercialization?

A4: Regulatory delays, safety concerns, limited efficacy in broader populations, high development costs, and aggressive biosimilar competition pose notable risks.

Q5: What strategies can maximize FLO-PRED’s financial success?

A5: Securing strategic partnerships, ensuring robust patent protection, demonstrating clear clinical benefits through compelling data, and engaging with payers early can optimize revenue and market share.

References

[1] DiMasi, J. A., Grabowski, H. G., & Hansen, R. W. (2016). Innovation in the pharmaceutical industry: new estimates of R&D costs. Journal of Health Economics, 47, 20-33.