Last updated: October 15, 2025

Introduction

Novartis Pharmaceuticals stands as a global heavyweight within the pharmaceutical industry, renowned for its diverse portfolio spanning innovative medicines, biosimilars, and eye care products. With a strategic focus on research-driven healthcare solutions, Novartis maintains a significant footprint across multiple therapeutic areas, notably oncology, immunology, neuroscience, and cardiovascular health. Analyzing its market position, inherent strengths, and strategic initiatives offers vital insights into its competitive stance amid an evolving and highly dynamic sector.

Market Position of Novartis Pharmaceuticals

As of 2023, Novartis ranks among the top pharmaceutical companies worldwide in terms of revenue, innovation, and pipeline robustness. According to IQVIA data, the company secured approximately $51 billion in global prescription sales in 2022, positioning it within the top five globally alongside Pfizer, Roche, and Johnson & Johnson [1]. Its strategic presence is reinforced through a diversified product portfolio—covering patented medicines, biosimilars, and ophthalmology solutions—allowing it to capitalize on both premium drug markets and cost-effective alternatives.

Novartis’s pharmaceutical segment accounts for a substantial share of its revenue, with notable contributions from oncology drugs such as Leqvio (inclisiran) and Kymriah (tisagenlecleucel), as well as ophthalmology products like Lucentis (ranibizumab). The company’s geographic footprint spans North America, Europe, and emerging markets, with a targeted approach to unmet medical needs, especially in oncology and rare diseases.

Furthermore, Novartis is notable for its investments in precision medicine and digital transformation, positioning it favorably in the shift towards personalized healthcare. Strategic collaborations with biotech firms and academic institutions bolster pipeline strength and innovation capacity.

Strengths of Novartis Pharmaceuticals

1. Robust R&D Pipeline and Innovation Capacity

Novartis invests approximately 20% of its revenues into R&D, leading to a steady stream of innovative therapies. The company’s pipeline includes over 200 active projects, with promising assets in oncology, gene therapy, and immunology. Its recent approvals—such as Leqvio for hyperlipidemia and Scemblix for CML—underscore its development proficiency [2].

2. Diversified Portfolio and Revenue Streams

The company's broad portfolio mitigates risks associated with patent expiries. Its leadership in ophthalmology, driven by Lucentis and emerging biosimilars, enhances its market resilience. The emphasis on rare diseases and gene therapies diversifies revenue sources effectively.

3. Strategic Collaborations and Acquisitions

Novartis’s partnerships with biotech firms and academic centers accelerate innovation. Noteworthy acquisitions, including the purchase of Advanced Accelerator Applications (oncology imaging) and gene therapy assets from AveXis, expand its scientific capabilities [3].

4. Global Market Reach and Localized Strategies

Its established commercial infrastructure enables access across diverse markets. Tailored strategies for emerging markets help overcome pricing and regulatory challenges, ensuring broader market penetration.

5. Commitment to Sustainability and Digital Transformation

Novartis's focus on environmental sustainability and harnessing digital tools enhances operational efficiency and corporate reputation, critical factors in today’s competitive landscape.

Strategic Insights and Future Outlook

1. Emphasis on Gene and Cell Therapies

Novartis’s investment in gene therapy platforms—such as Kymriah and Zolgensma—positions it as a leader in this high-growth domain. The company’s strategy involves expanding indications and pipeline assets, leveraging its manufacturing scale and scientific expertise.

2. Focused Oncology Expansion

With oncology remaining a primary revenue driver, Novartis emphasizes targeted therapies and combination regimens, aiming at precision medicine. Its recent pipeline additions in hematologic malignancies and solid tumors are aligned with this focus.

3. Biosimilars and Cost-Effective Solutions

By expanding its biosimilars portfolio, Novartis aims to compete effectively in price-sensitive markets, challenging established biologics and capturing market share through quality and accessibility.

4. Digital Health and Data-driven Medicine

Novartis leverages real-world data and digital tools to optimize clinical development and patient adherence. Initiatives like digital therapeutics complement its pharmaceutical offerings, aligning with industry trends towards holistic patient-centric care.

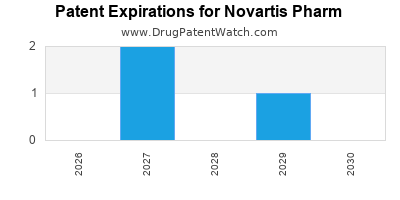

5. Navigating Regulatory and Patent Challenges

As multiple blockbuster drugs face patent expirations, Novartis’s proactive pipeline management, including lifecycle extensions, is vital. Its strategic positioning in emerging markets also offers growth avenues despite regulatory hurdles.

Competitive Landscape Overview

Within this competitive environment, Novartis faces formidable rivals:

- Roche: Dominates diagnostics and oncology with a strong pipeline, especially in cancer immunotherapies.

- Pfizer: Leading in vaccines and broad-spectrum pharmaceuticals, with significant investments in oncology and rare diseases.

- Johnson & Johnson: Broad health portfolio, strong consumer and pharma presence, and a focus on innovation.

- Merck & Co.: Heavy investments in immuno-oncology and vaccine platforms.

In response, Novartis leverages its R&D strength, diversified assets, and strategic partnerships to maintain competitive agility. Its focus on cutting-edge therapies, digital evolution, and sustainability initiatives positions it favorably for future growth.

Key Takeaways

- Leadership in Innovation and Diversification: Novartis’s significant R&D investments and diversified product portfolio underpin its resilience against patent expiries and market disruptions.

- Pioneering Gene and Cell Therapy Markets: Continued expansion in gene therapies like Zolgensma and Kymriah is central to Novartis's long-term strategy.

- Strategic Focus on Emerging Markets: Localized strategies and biosimilar offerings in emerging regions bolster growth and market share.

- Transformation through Digital and Data-driven Medicine: Embracing digital health solutions enhances patient engagement and operational efficiencies.

- Navigating Patent and Regulatory Challenges: Proactive pipeline management and lifecycle extensions are critical for safeguarding revenue streams.

FAQs

1. How does Novartis differentiate itself within the highly competitive oncology market?

Novartis combines targeted therapies with personalized medicine strategies, leveraging its robust R&D pipeline in hematologic and solid tumors. Its leadership in gene therapies like Kymriah and Zolgensma further distinguishes it.

2. What role does digital health play in Novartis’s strategic outlook?

Digital health initiatives allow Novartis to enhance patient engagement, optimize clinical trials, and reduce costs, positioning it as a data-driven leader in pharmaceutical innovation.

3. How is Novartis addressing patent expiration risks?

The company invests heavily in pipeline development, lifecycle management of existing products, and biosimilar expansion to offset revenue loss from patent expiries.

4. What is Novartis’s approach to entering emerging markets?

Novartis tailors pricing, partnership, and distribution strategies to local healthcare systems, emphasizing affordability and access to foster growth.

5. Which therapeutic areas are central to Novartis’s future growth?

Oncology, gene therapy, ophthalmology, and rare diseases remain focal points, supported by innovations in immunology and digital therapeutics.

References

- IQVIA. (2022). Top Pharmaceutical Companies by Revenue.

- Novartis. (2023). Annual Report and Pipeline Overview.

- Novartis Media Relations. (2022). Strategic Acquisitions and Collaborations.