TABRECTA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Tabrecta, and when can generic versions of Tabrecta launch?

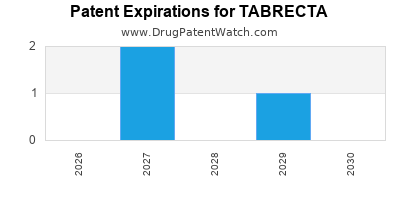

Tabrecta is a drug marketed by Novartis Pharm and is included in one NDA. There are seven patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and eighty-two patent family members in forty-five countries.

The generic ingredient in TABRECTA is capmatinib hydrochloride. One supplier is listed for this compound. Additional details are available on the capmatinib hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Tabrecta

Tabrecta was eligible for patent challenges on May 6, 2024.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be July 22, 2035. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TABRECTA?

- What are the global sales for TABRECTA?

- What is Average Wholesale Price for TABRECTA?

Summary for TABRECTA

| International Patents: | 182 |

| US Patents: | 7 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 83 |

| Clinical Trials: | 1 |

| Drug Prices: | Drug price information for TABRECTA |

| What excipients (inactive ingredients) are in TABRECTA? | TABRECTA excipients list |

| DailyMed Link: | TABRECTA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TABRECTA

Generic Entry Date for TABRECTA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for TABRECTA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Timothy Burns | Phase 2 |

| Novartis | Phase 2 |

Pharmacology for TABRECTA

Paragraph IV (Patent) Challenges for TABRECTA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| TABRECTA | Tablets | capmatinib hydrochloride | 150 mg and 200 mg | 213591 | 1 | 2024-05-06 |

US Patents and Regulatory Information for TABRECTA

TABRECTA is protected by seven US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TABRECTA is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,596,178.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Novartis Pharm | TABRECTA | capmatinib hydrochloride | TABLET;ORAL | 213591-001 | May 6, 2020 | RX | Yes | No | 12,084,449 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Novartis Pharm | TABRECTA | capmatinib hydrochloride | TABLET;ORAL | 213591-002 | May 6, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Novartis Pharm | TABRECTA | capmatinib hydrochloride | TABLET;ORAL | 213591-001 | May 6, 2020 | RX | Yes | No | 12,208,101 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for TABRECTA

When does loss-of-exclusivity occur for TABRECTA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 1286

Patent: FORMULACIÓN EN FORMA DE TABLETA DE UN INHIBIDOR DE C-MET

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 15293539

Patent: Tablet formulation of 2-fluoro-N-methyl-4-(7-(quinolin-6-ylmethyl)imidazo(1,2-b)(1,2,4)triazin-2-yl)benzamide

Estimated Expiration: ⤷ Get Started Free

Patent: 18207947

Patent: Tablet formulation of 2-fluoro-N-methyl-4-(7-(quinolin-6-ylmethyl)imidazo(1,2-b)(1,2,4)triazin-2-yl)Benzamide

Estimated Expiration: ⤷ Get Started Free

Patent: 20200912

Patent: Tablet formulation of 2-fluoro-N-methyl-4-(7-(quinolin-6-ylmethyl)imidazo(1,2-b)(1,2,4)triazin-2-yl)Benzamide

Estimated Expiration: ⤷ Get Started Free

Patent: 21202500

Patent: Tablet formulation of 2-fluoro-N-methyl-4-(7-(quinolin-6- ylmethyl)imidazo(1,2-b)(1,2,4)triazin-2-yl)Benzamide

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2017000953

Patent: formulação de comprimido de 2-flúor-n-metil-4-[7-(quinolin-6-il-metil)imidazo[1,2-b][1,2,4]triazin-2-il]benzamida

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 54840

Patent: FORMULATION DE COMPRIME DE 2-FLUORO-N-METHYL-4-[7-(QUINOLINE -6-YLMETHYL) IMIDAZO[1,2-B] [1,2,4]TRIAZINE -2-YL]BENZAMIDE (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17000180

Patent: Formulacion en forma de tableta de 2-fluor-n-metil-4-[7-(quinolin-6-ilmetil)imidazo[1,2-b][1,2,4]triazin-2-il]benzamida.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 6714784

Patent: 2‑氟‑N‑甲基‑4‑[7‑(喹啉‑6‑基甲基)咪唑并[1,2‑b][1,2,4]三嗪‑2‑基]苯甲酰胺的片剂制剂 (Tablet formulation of 2-fluoro-n-methyl-4-[7-(quinolin-6-ylmethyl)imidazo[1,2-b][1,2,4]triazin-2-yl]benzamide)

Estimated Expiration: ⤷ Get Started Free

Patent: 5364061

Patent: C-MET抑制剂的片剂制剂 (Tablet formulations of C-MET inhibitors)

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 17000586

Patent: Formulación en forma de tableta de 2-fluor-n-metil-4-[7-(quinolin-6-ylmetil)imidazo[1,2-b][1,2,4]triazin-2-il]benzamida

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 72209

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 17011672

Patent: FORMULACIÓN EN FORMA DE TABLETA DE 2-FLUOR-N-METIL-4-[7-(QUINOLIN-6-YLMETIL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-IL]BENZAMIDA

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 9220

Patent: СОСТАВ ТАБЛЕТКИ 2-ФТОР-N-МЕТИЛ-4-[7-(ХИНОЛИН-6-ИЛМЕТИЛ)ИМИДАЗО[1,2-b][1,2,4]ТРИАЗИН-2-ИЛ]БЕНЗАМИДА (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-b][1,2,4]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Patent: 1790259

Patent: СОСТАВ ТАБЛЕТОК 2-ФТОР-N-МЕТИЛ-4-[7-(ХИНОЛИН-6-ИЛМЕТИЛ)ИМИДАЗО[1,2-b][1,2,4]ТРИАЗИН-2-ИЛ]БЕНЗАМИДА

Estimated Expiration: ⤷ Get Started Free

Patent: 2191301

Patent: СОСТАВ ТАБЛЕТОК 2-ФТОР-N-МЕТИЛ-4-[7-(ХИНОЛИН-6-ИЛМЕТИЛ)ИМИДАЗО[1,2-b][1,2,4]ТРИАЗИН-2-ИЛ]БЕНЗАМИДА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 72209

Patent: FORMULATION DE COMPRIMÉ DE 2-FLUORO-N-MÉTHYL-4-[7-(QUINOLINE -6-YLMÉTHYL) IMIDAZO[1,2-B][1,2,4]TRIAZINE -2-YL]BENZAMIDE (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Patent: 48376

Patent: FORMULATION DE COMPRIMÉ D'UN INHIBITEUR DE C-MET (TABLET FORMULATION OF A C-MET INHIBITOR)

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1058

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 1700007

Patent: FORMULACIÓN EN FORMA DE TABLETA DE 2-FLUOR-N-METIL-4-[7-(QUINOLIN-6-YLMETIL)IMIDAZO[1,2-B] [1,2,4]TRIAZIN-2-IL]BENZAMIDA

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 53346

Estimated Expiration: ⤷ Get Started Free

Patent: 200054

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 0166

Patent: פורמולצית טבליה של 2-פלואורו-n-מתיל-4-[7-(קווינולינ-6-ילמתיל)אימידזו[1, 2-b][1,2,4]טריאזינ-2-יל]בנזאמיד (Tablet formulation of 2-fluoro-n-methyl-4-[7-(quinolin-6-ylmethyl)imidazo[1,2-b][1,2,4]triazin-2-yl]benzamide)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 70946

Estimated Expiration: ⤷ Get Started Free

Patent: 02587

Estimated Expiration: ⤷ Get Started Free

Patent: 17521469

Patent: 2−フルオロ−N−メチル−4−[7−(キノリン−6−イルメチル)イミダゾ[1,2−B][1,2,4]トリアジン−2−イル]ベンズアミドの錠剤

Estimated Expiration: ⤷ Get Started Free

Patent: 20114852

Patent: 2−フルオロ−N−メチル−4−[7−(キノリン−6−イルメチル)イミダゾ[1,2−B][1,2,4]トリアジン−2−イル]ベンズアミドの錠剤 (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL) IMIDAZO [1,2-B] [1,2,4] TRIAZIN-2-YL] BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Patent: 22046659

Patent: 2-フルオロ-N-メチル-4-[7-(キノリン-6-イルメチル)イミダゾ[1,2-B][1,2,4]トリアジン-2-イル]ベンズアミドの錠剤

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 18

Patent: صيغة قرص2-فلورو-Nميثيل -4 -[7-(كوينولين-6-يل ميثيل)اميدازو[2,1-B] [4,2,1] تريازين-2-يل] بنزاميد (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2,B] [1,2,4]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 7276

Patent: TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 9279

Patent: FORMULACION EN FORMA DE TABLETA DE 2-FLUOR-N-METIL-4-[7-(QUINOLIN-6-YLMETIL) IMIDAZO[1,2,B] [1,2,4]TRIAZIN-2-IL]BENZAMIDA. (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Patent: 17001177

Patent: FORMULACION EN FORMA DE TABLETA DE 2-FLUOR-N-METIL-4-[7-(QUINOLIN- 6-YLMETIL) IMIDAZO[1,2,B] [1,2,4]TRIAZIN-2-IL]BENZAMIDA. (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL )IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE.)

Estimated Expiration: ⤷ Get Started Free

Patent: 21000595

Patent: FORMULACION EN FORMA DE TABLETA DE 2-FLUOR-N-METIL-4-[7-(QUINOLIN- 6-YLMETIL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-IL]BENZAMIDA. (TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL )IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE.)

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1208

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 8089

Patent: Tablet formulation of 2-fluoro-n-methyl-4-[7-(quinolin-6-ylmethyl)imidazo[1,2-b][1,2,4]triazin-2-yl]benzamide

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 22058

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 170523

Patent: FORMULACION EN FORMA DE TABLETA DE 2-FLUOR-N-METIL-4-[7-(QUINOLIN-6-YLMETIL)IMIDAZO[1,2- B][1,2,4]TRIAZIN-2-IL]BENZAMIDA

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 017500121

Patent: TABLET FORMULATION OF A C-MET INHIBITOR

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 72209

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 72209

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201900648S

Patent: TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE

Estimated Expiration: ⤷ Get Started Free

Patent: 201700147S

Patent: TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-(QUINOLIN-6-YLMETHYL)IMIDAZO[1,2-B][1,2,4]TRIAZIN-2-YL]BENZAMIDE

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 72209

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2581121

Estimated Expiration: ⤷ Get Started Free

Patent: 170039211

Patent: 2-플루오로-N-메틸-4-[7-이미다조[1,2-B][1,2,4]트리아진-2-일]벤즈아미드의 정제 제제 (2--N--4-[7--6-[12-B][124]-2-] TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-QUINOLIN-6-YLMETHYLIMIDAZO[12-B][124]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Patent: 230136693

Patent: 2-플루오로-N-메틸-4-[7-이미다조[1,2-B][1,2,4]트리아진-2-일]벤즈아미드의 정제 제제 (2--N--4-[7--6-[12-B][124]-2-] TABLET FORMULATION OF 2-FLUORO-N-METHYL-4-[7-QUINOLIN-6-YLMETHYLIMIDAZO[12-B][124]TRIAZIN-2-YL]BENZAMIDE)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 57523

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 24993

Estimated Expiration: ⤷ Get Started Free

Patent: 1613595

Patent: Tablet formulation of a C-MET inhibitor

Estimated Expiration: ⤷ Get Started Free

Patent: 2200148

Patent: Tablet formulation of a C-MET inhibitor

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TABRECTA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Taiwan | 200835481 | ⤷ Get Started Free | |

| Croatia | P20181622 | ⤷ Get Started Free | |

| Israel | 276928 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TABRECTA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2099447 | C02099447/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: CAPMATINIB; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 67648 26.04.2021 |

| 3172209 | C202230060 | Spain | ⤷ Get Started Free | PRODUCT NAME: CAPMATINIB O UNA SAL FARMACEUTICAMENTE ACEPTABLE DEL MISMO; NATIONAL AUTHORISATION NUMBER: EU/1/22/1650; DATE OF AUTHORISATION: 20220620; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/22/1650; DATE OF FIRST AUTHORISATION IN EEA: 20220620 |

| 2099447 | PA2022527,C2099447 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: KAPMATINIBAS ARBA JO FARMACINIU POZIURIU PRIIMTINA DRUSKA; REGISTRATION NO/DATE: EU/1/22/1650 20220620 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TABRECTA (Erdafitinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.