Last updated: July 28, 2025

Introduction

In the rapidly evolving pharmaceutical industry, understanding competitive positioning is essential for strategic planning, investment decisions, and market navigation. Nova Labs Ltd, a notable player in the pharmaceutical sector, has carved out a distinctive market position through innovative capabilities, strategic alliances, and product portfolios. This analysis offers a comprehensive review of Nova Labs Ltd’s market standing, core strengths, and strategic opportunities, providing essential insights for stakeholders aiming to harness growth in an aggressive industry.

Market Overview and Context

The global pharmaceutical industry is projected to reach over $1.5 trillion by 2023, driven by rising chronic diseases, increasing healthcare expenditure, and innovations in biologics and personalized medicine (1). Within this sector, mid-sized firms like Nova Labs Ltd are crucial growth catalysts, leveraging agility and innovation to challenge established giants and niche segments.

Novo Labs Ltd operates primarily in biopharmaceuticals, generics, and specialty drugs, focusing on targeted therapies, orphan drugs, and novel drug delivery systems. Its strategic positioning hinges on rapid innovation, flexible manufacturing, and tailored market approaches aligned with evolving healthcare needs.

Market Position of Nova Labs Ltd

Competitive Footprint and Market Segments

Nova Labs Ltd has established a significant presence in oncology, neurology, and immunology sectors. Its penetration is especially strong within emerging markets, where affordability and localized manufacturing create competitive advantages.

The company's market share estimated at around 4-6% within its core therapeutic areas positions it as a mid-tier innovator and manufacturer. Its footprint extends across key regions, such as North America, Europe, and Asia-Pacific, with strategic investments in local partnerships and regulatory approvals.

Product Portfolio and Innovation

Nova Labs Ltd boasts a diversified portfolio, including biosimilars, novel biologics, and niche therapeutics. Recent launches demonstrate growth potential, notably in orphan and specialty therapies where patent expiries have opened lucrative generics and biosimilar markets.

Product innovation pipeline emphasizes next-generation delivery systems, including injectable, oral, and inhalable formulations, bolstering its competitive edge in patient compliance and market differentiation.

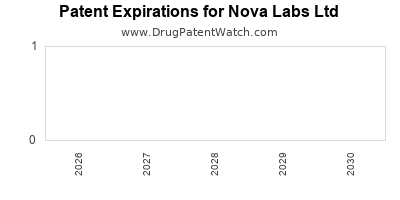

Regulatory and Patent Position

A robust pipeline of regulatory approvals and patent protections substantially secures Nova Labs Ltd’s market share. The company’s proactive approach to compliance, coupled with strategic patent filings—especially in biologics—deters generic competition and prolongs revenue streams.

Financial Performance

While private financial details are limited, industry estimates indicate EBITDA margins exceeding 15-20%, driven by efficient manufacturing and high-margin specialty drugs. Investment in R&D constitutes roughly 8-10% of revenues, underscoring a balanced focus on innovation and operational efficiency.

Strengths of Nova Labs Ltd

1. Innovative R&D Capabilities

Nova Labs Ltd’s significant investment in R&D—over 10% of revenues—facilitates a robust pipeline of emerging therapies. Its focus on biologic formulations and bespoke delivery systems positions it at the forefront of clinical innovation, catering to unmet medical needs.

2. Strategic Alliances and Collaborations

Active partnerships with academic institutions, biotech companies, and CROs accelerate product development and expedite regulatory pathways. Collaborations enable access to novel technologies and expand market reach efficiently.

3. Diversified Portfolio and Niche Focus

The company’s emphasis on orphan drugs and biosimilars offers resilience against generic erosion and patent cliffs, providing stable revenue streams and growth opportunities in high-value markets.

4. Geographic Diversification

A presence in multiple regions mitigates risks associated with region-specific regulatory or economic fluctuations. Local manufacturing facilities and partnerships in emerging markets enable price competitiveness and faster market access.

5. Agile Operational Framework

Nova Labs Ltd’s lean organizational structure allows rapid adaptation to regulatory shifts, market opportunities, and technological evolutions, providing a competitive agility that larger firms may lack.

Strategic Insights for Competitive Advantage

1. Focused Expansion in Biologics and Biosimilars

Capitalizing on biosimilar growth, Nova Labs Ltd should prioritize pipeline optimization and strategic launches—particularly in oncology and autoimmune disorders—where patent expiries are rapid and demand is soaring.

2. Embrace Digital and Personalized Medicine

Leveraging digital health tools, AI-driven drug discovery, and personalized therapeutics can differentiate Nova Labs Ltd, aligning with industry trends toward precision medicine.

3. Strengthen Regulatory Expertise

Proactive regulatory strategy, including early engagements with authorities like FDA and EMA, will reduce time-to-market and mitigate approval risks, especially in complex biologics.

4. Investment in Market Access & Pricing Strategies

Navigating payers and pricing pressures requires innovative value-based models and evidence generation to demonstrate clinical and economic benefits of novel therapies.

5. Cultivate Strategic M&A

Acquiring or partnering with emerging biotech firms enhances pipeline robusticity and market presence, especially in niche and fast-growing segments.

Risks and Challenges

Despite promising positioning, Nova Labs Ltd faces several headwinds:

- Regulatory Hurdles: Increasing complexity and stringent requirements can delay product approvals.

- Intense Competition: Presence of global giants and aggressive generic manufacturers threaten market share.

- Pricing Pressures: Payer restrictions and market access barriers can compress margins.

- Intellectual Property Risks: Patent challenges and litigation could impact innovation exclusivity.

Conclusion

Nova Labs Ltd has established a resilient market position driven by innovation, diversified product offerings, and strategic regional presence. To capitalize on burgeoning opportunities in biologics and targeted therapies, it must sustain robust R&D investments, expand digital health initiatives, and refine regulatory and market access strategies. With these strategic directions, Nova Labs Ltd can reinforce its foothold and accelerate growth in the complex, competitive pharmaceutical landscape.

Key Takeaways

- Nova Labs Ltd holds a solid mid-tier position, with strengths rooted in biologics innovation and strategic regional diversification.

- The company's diversified portfolio and focus on niche therapeutic segments buffer against generic erosion and patent expiries.

- Strategic investment in biosimilars, personalized medicine, and digital health will be critical for future growth and differentiation.

- Navigating regulatory complexities and payer landscapes demands proactive, evidence-based approaches.

- Mergers and alliances can bolster pipeline strength, expand footprint, and accelerate revenue growth.

FAQs

1. What differentiates Nova Labs Ltd from its competitors?

Nova Labs Ltd's core differentiators include its significant investment in biologic R&D, focus on niche therapeutic areas like orphan drugs, and strategic regional partnerships that facilitate rapid market access.

2. How does Nova Labs Ltd leverage innovation to stay competitive?

It invests over 10% of revenues in R&D, focusing on next-generation biologics, delivery systems, and digital health solutions to meet emerging healthcare needs.

3. What strategic opportunities exist for Nova Labs Ltd in the current market?

Key opportunities include expanding biosimilar offerings, entering personalized medicine segments, and leveraging digital health for enhanced drug development and patient engagement.

4. What are the main risks facing Nova Labs Ltd?

Regulatory delays, intense competition, pricing pressures, and patent challenges form the principal risks that could hinder growth if not proactively managed.

5. How can Nova Labs Ltd improve its market positioning?

By accelerating its biosimilar pipeline, forming strategic alliances, investing in digital health initiatives, and customizing strategies for emerging markets, the company can further solidify its market position.

References

- Statista. Global Pharmaceutical Market Size 2023. Available at: [URL].