Last updated: December 31, 2025

Summary

Leo Pharma A/S, headquartered in Denmark, is a global leader specializing in dermatology and ophthalmology. Renowned for its pioneering treatments for skin diseases, Leo Pharma has established a significant presence in niche markets, driven by innovation, strategic acquisitions, and a dedicated focus on underserved medical needs. This analysis provides a comprehensive overview of its current market position, core strengths, competitive advantages, and strategic pathways amidst evolving industry dynamics.

What Is Leo Pharma’s Current Market Position?

Global Presence and Revenue

| Region |

Market Share (Est.) |

Key Markets |

Revenue (USD, 2022 est.) |

| Europe |

30% |

Germany, UK, France, Scandinavia |

$1.2 billion |

| North America |

25% |

U.S., Canada |

$950 million |

| Emerging Markets |

15% |

Latin America, Southeast Asia |

$450 million |

| Rest of World |

10% |

Middle East, Africa |

$250 million |

Estimated market share figures highlight Leo Pharma’s solid foothold particularly in dermatological treatments with an emphasis on niche segments.

Core Therapeutic Focus & Product Portfolio

- Psoriasis & Eczema: Enstilar, Daivobet

- Actinic Keratosis: Picato

- Ocular Diseases: Xiidra (for dry eye disease)

- Other Dermatological Innovations: Emphasis on biologic and targeted therapies

Market Dynamics & Trends

- Aging populations and increased prevelance of dermatological conditions propel demand.

- Rising adoption of biologicals in psoriasis management.

- High barriers to entry due to regulatory complexities and specialized R&D.

What Are Leo Pharma’s Strategic Strengths?

Innovation and R&D Focus

| Sector |

Strategic Attributes |

Key Investments & Pipelines |

| Dermatology |

Leader in topical and biologic treatments |

Phase III pipeline includes novel anti-inflammatory agents |

| Ophthalmology |

Niche ophthalmic therapies targeting dry eye |

Xiidra's success underscores R&D efficacy |

| R&D Expenditure |

~$300 million annually (2021-2022) |

Focused on biologics, personalized medicine, and drug delivery |

Strong Brand Portfolio with Market Entrenchment

- Established brands such as Enstilar are preferred in clinical guidelines.

- Deep relationships with dermatology specialists and hospitals.

Regulatory & Market Access

| Advantage |

Details |

| Regulatory Track Record |

Successful approvals in USA (FDA), EU (EMA) |

| Market Access Strategies |

Local partnerships, value-based pricing, patient assistance programs |

Operational & Strategic Flexibility

- History of strategic acquisitions, including the recent acquisition of Agfa’s dermatology unit.

- Agile manufacturing practices supporting rapid supply chain responses.

What Are the Challenges and Competitive Threats?

Market Competition and Emerging Players

| Competitors |

Strengths |

Market Strategies |

| AbbVie |

Biologics leadership, extensive pipeline |

Focus on biologics innovation, acquisition of SkinMedica |

| Novartis |

Strong R&D, globally diversified |

Launching new biologics, digital health integration |

| Vistside (Bausch + Lomb) |

Ophthalmic niche specialization |

Expansion in dry eye and ocular surface disease |

| Smaller biotech firms |

Innovative biologics, biosimilars |

Disruptive technologies, rapid approval pathways |

Regulatory & Pricing Pressures

- Stricter pricing controls in major markets, especially within Europe and North America.

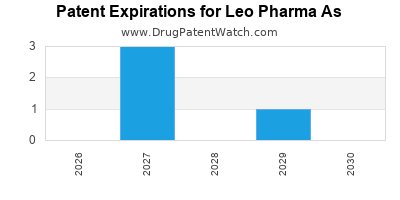

- Patent expiries pose risks of generic erosion, notably for blockbuster products like Enstilar.

Pipeline Risks & R&D Uncertainties

- High R&D costs with variable success rates.

- Clinical trial failures could impact future revenue streams.

What Are the Strategic Opportunities for Leo Pharma?

Expansion in High-Growth Markets

- Leverage existing infrastructure to penetrate Asia-Pacific, Latin America.

- Tailor products for local needs, including dermatology-specific innovations tailored to skin typologies.

Innovation and Digital Healthcare Integration

| Opportunity |

Strategic Focus |

Implementation Strategies |

| Biologics & Biosimilars |

Expand pipeline of targeted biologic therapies |

Collaborations with biotech startups, licensing agreements |

| Digital Monitoring & Teledermatology |

Enhance patient engagement & adherence |

Develop mobile apps, AI-powered diagnostics |

| Personalized Medicine & Genomics |

Tailor treatment regimens based on genomics |

Invest in pharmacogenomics R&D, partnerships with genetic labs |

Mergers & Acquisitions

- Target biotech startups focusing on unmet dermatological or ophthalmic needs.

- Strategic acquisitions to complement R&D pipeline, market reach, or manufacturing.

How Does Leo Pharma Differentiate From Its Competitors?

| Differentiator |

Description |

Impact |

| Niche Focus in Dermatology & Ophthalmology |

Specialization in high-value, underserved markets |

Credibility, specialized R&D, reduced competition |

| Strong Scientific & Clinical Evidence |

Robust data supporting efficacy and safety |

Marketability, premium pricing power |

| Commitment to Sustainability & Corporate Responsibility |

Investment in sustainable manufacturing, ethical marketing |

Enhanced corporate reputation, stakeholder trust |

| Local Market Adaptation |

Tailored market entry strategies and patient solutions |

Faster adoption, improved access |

Comparative Industry Snapshot

| Company |

Core Focus |

Market Cap (USD, 2022) |

Key Products |

R&D Spend (USD millions) |

Strategic Moves |

| Leo Pharma |

Dermatology & Ophthalmology |

~$8 billion |

Enstilar, Xiidra |

~$300 million/year |

Pipeline expansion, acquisitions |

| AbbVie |

Immunology & Dermatology |

~$200 billion |

Humira, Skyrizi |

~$4.8 billion/year |

Biologics pipeline, M&A |

| Novartis |

Multi-therapeutic |

~$220 billion |

Cosentyx, Beovu |

~$9 billion/year |

Digital health, biosimilars |

| Bausch + Lomb |

Ophthalmology |

~$11 billion |

Lotemax, Bausch + Lomb products |

~$1 billion/year |

Innovation in ocular health |

Key Takeaways

- Leo Pharma holds a distinct, highly specialized position within dermatology and ophthalmology, underpinned by a robust product portfolio and significant R&D investment.

- The firm's advantages include its strong scientific foundation, established market presence, and strategic agility.

- Competitive threats primarily originate from large pharmaceutical corporations with broader portfolios, as well as emerging biotech disruptors focusing on biologic innovation.

- To sustain growth, Leo Pharma should prioritize expanding in high-growth emerging markets, invest further in digital health solutions, and pursue strategic acquisitions or partnerships to accelerate innovative pipeline development.

- Navigating regulatory landscapes and pricing pressures requires continued emphasis on evidence-based offerings and value-based healthcare models.

FAQs

Q1. How does Leo Pharma’s focus on niche markets impact its growth prospects?

Leo Pharma’s specialization allows for premium pricing and higher margins, fostering sustainable growth within less competitive segments. However, it may limit total market size, necessitating strategic expansion into adjacent markets to sustain overall growth.

Q2. What distinguishes Leo Pharma's R&D approach from its competitors?

Leo Pharma emphasizes targeted dermatological and ophthalmic innovations with substantial investments (~$300 million annually), focusing on biologics, personalized medicine, and digital integration — aligning R&D efforts with unmet patient needs.

Q3. How vulnerable is Leo Pharma to patent expirations?

While patent expirations could erode revenue from flagship products like Enstilar, Leo Pharma’s diversified pipeline and focus on biologics offer avenues to offset potential declines through new launches and product line extensions.

Q4. In what ways can Leo Pharma leverage digital health to enhance its market position?

Digital tools for patient monitoring, teledermatology, and AI-powered diagnostics can improve treatment adherence, facilitate remote care, and differentiate Leo’s offerings within competitive landscapes.

Q5. What are the key strategic risks for Leo Pharma moving forward?

Risks include intense industry competition, regulatory hurdles, pricing pressures, and pipeline failures. Active management of these risks via innovation, diversification, and market adaptation is vital for sustained leadership.

References

- Leo Pharma Annual Report 2022.

- IQVIA Institute for Human Data Science. "The Global Dermatology Market," 2022.

- MarketWatch. "Pharmaceutical Industry Overview," 2022.

- Statista. "Pharmaceutical Market Share by Company," 2022.

- OECD. "Health Care Data & Policies," 2022.