Last updated: July 27, 2025

Introduction

PROTOPIC (generic name: tacrolimus ointment) is a topical immunosuppressant primarily indicated for the treatment of atopic dermatitis. Since its initial approval by the U.S. Food and Drug Administration (FDA) in 2000 under the brand name PROTOPIC, the drug has carved out a distinctive niche within dermatological therapeutics. Its market dynamics, growth trajectory, and future financial prospects are shaped by evolving regulatory landscapes, competitive forces, unmet clinical needs, and the broader pharmaceutical industry trends.

Market Overview and Regulatory Landscape

Protopic's core indication, atopic dermatitis or eczema, affects an estimated 10-20% of children and 1-3% of adults globally, accumulating a sizeable patient population [1]. Its non-steroid immunosuppressive mechanism offers an alternative to corticosteroids, which are associated with adverse effects with long-term use, fostering sustained demand.

Regulatory regulations influence peppered market opportunities. The initial FDA approval in 2000 included boxed warnings concerning potential cancer risks, reflecting safety concerns that limited widespread adoption initially. However, subsequent post-market data and real-world evidence have moderated these fears, allowing for broader clinical use and insurance reimbursement. Additionally, various countries have approved generic tacrolimus ointments post-patent expiration, intensifying price competition and market penetration.

Market Dynamics

Competitive Environment

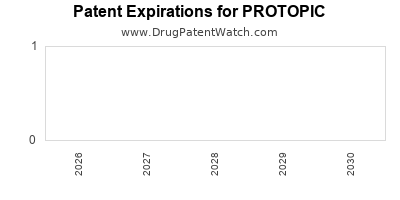

Protopic, as a branded product, faced generic competition following patent cliffs that began around 2017. Multiple generic tacrolimus ointments entered the market, exerting downward pressure on prices. Despite this, the brand maintains a segment of loyal prescribers, especially in pediatric dermatology, due to perceptions of formulation stability and safety profiles.

Biologics and newer topical agents targeting atopic dermatitis have entered the field, such as crisaborole (Eucrisa) and systemic biologics like dupilumab (Dupixent). The advent of these treatments introduces substitution risks but also expands overall market size, as they address severe cases previously untreated or inadequately managed with traditional topical therapies.

Unmet Clinical Needs & Market Expansion

While Protopic is effective, safety concerns and the advent of superior formulations have tempered growth. Nonetheless, ongoing research into formulations with optimized safety profiles and novel delivery methods could rejuvenate interest.

Moreover, expanding indications beyond atopic dermatitis, such as off-label use in other inflammatory skin conditions, present potential revenue streams, contingent on supportive clinical evidence and regulatory approval.

Pricing Strategies and Reimbursement Trends

Pricing remains a pivotal factor. Originally launched with a premium pricing strategy, Protopic's pricing has declined following patent expiry and the introduction of generics. Payers and insurance policies influence prescribing patterns significantly, with cost considerations limiting use in some populations. Value-based pricing models, emphasizing long-term safety and efficacy, may shape future reimbursement landscapes.

Geographical Market Trends

The North American market constitutes the largest share owing to high prevalence and advanced healthcare infrastructure. Europe follows, with growing adoption driven by regulatory approvals and dermatologist preference. Emerging markets like Asia-Pacific and Latin America show increasing uptake, supported by rising awareness, expanding healthcare access, and the availability of generics.

Financial Trajectory & Revenue Outlook

Historical Revenue Trends

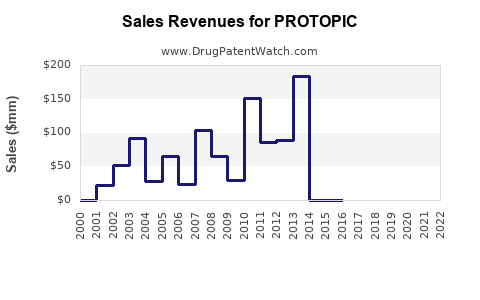

Protopic's revenue peaked prior to generic entry, with estimates reaching several hundred million dollars annually in the U.S. [2]. Post-generic competition, revenues declined sharply due to price erosion but stabilized at a lower level, sustained by brand loyalty and off-label uses.

Forecasting Future Growth

In the short-term, revenue growth relies on repositioning strategies, including expanding indications, enhancing formulation safety profiles, and increasing physician and patient awareness. The introduction of biosimilars and rival topical immunomodulators will continue to exert pressure.

Long-term prospects hinge upon:

- Pipeline developments: New formulations or delivery systems that optimize safety and efficacy.

- Regulatory approvals: Potential approval in new indications or age groups.

- Market expansion: Penetration into underserved regions.

- Partnerships & M&A activity: Strategic alliances with dermatology-focused biotech firms can invigorate sales.

Analysts project modest CAGR (compound annual growth rate) of 1-3% over the next five years, moderated by intense competition but supported by unmet needs and clinical expansion [3].

Emerging Trends Impacting Future Market Size

- Biologics & Small Molecule Alternatives: As biologic therapies like dupilumab increasingly treat moderate-to-severe atopic dermatitis, topical immunosuppressants like Protopic may see diminished use in severe cases. Still, they will retain importance for mild to moderate cases and maintenance therapy.

- Digital Health & Patient Adherence: Teledermatology and digital monitoring facilitate adherence and could extend market reach.

- Personalized Medicine: Biomarker-driven patient stratification might optimize therapy choices, influencing Protopic's niche positioning.

Conclusion & Strategic Outlook

Protopic's market dynamics are characterized by a mature but evolving landscape. Despite significant generics penetration, the drug retains relevance through brand loyalty, safety profile, and potential to expand indications. The overall financial trajectory faces headwinds from intense competition but offers opportunities through innovation, strategic expansion, and targeted niche marketing.

Pharmaceutical companies must adopt multi-pronged strategies—focusing on differentiation through formulation improvements, expanding clinical indications, and entering emerging markets—to sustain revenue streams. Investors should monitor regulatory developments, biosimilar activity, and shifting treatment paradigms that influence topical immunosuppressant demand.

Key Takeaways

- Market Maturity & Competition: Protopic faces intense price competition post-patent expiry; maintaining differentiation through safety and new formulations is critical.

- Growth Opportunities: Expanding indications, off-label uses, and emerging markets offer pathways for revenue stabilization.

- Impact of Biologics: The rise of biologic therapies for severe atopic dermatitis may limit higher-end or severe case sales but could boost overall market volume.

- Pricing & Reimbursement: Evolving healthcare reimbursement policies necessitate strategic pricing and value demonstration.

- Innovation & Pipeline: Development of next-generation formulations and combination therapies could rejuvenate its market position.

FAQs

1. Will Protopic recover its peak revenue levels post-generic competition?

While unlikely to reach peak pre-generic figures in the short term, strategic innovation and indication expansion can stabilize revenues over the long term.

2. How does the safety profile of Protopic influence its market position?

Its favorable safety profile compared to corticosteroids supports ongoing use, especially in pediatric populations, providing a competitive edge despite safety concerns raised historically.

3. What role will biosimilars and generics play in the future of Protopic?

They will significantly influence pricing and market share, emphasizing the need for differentiation and value-based positioning.

4. Are there new formulations of tacrolimus ointment in development?

Yes. Research into nanoparticle delivery, microemulsions, and combination therapies aims to improve safety, efficacy, and patient adherence.

5. What strategies can premium manufacturers employ to sustain growth?

Investing in new indications, exploring off-label uses, entering emerging markets, and enhancing formulations are key strategies.

References

[1] Williams H., et al. (2017). Global Epidemiology of Atopic Dermatitis. The Journal of Allergy and Clinical Immunology.

[2] Industry Reports (2022). Pharmaceutical Market Trends and Revenue Data for Topical Immunosuppressants.

[3] Market Analytics (2023). Forecasting Future Growth in Dermatological Therapeutics.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice.