Keryx Biopharms Company Profile

✉ Email this page to a colleague

What is the competitive landscape for KERYX BIOPHARMS, and what generic alternatives to KERYX BIOPHARMS drugs are available?

KERYX BIOPHARMS has one approved drug.

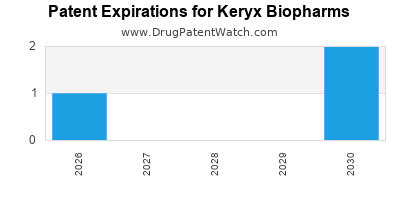

There are fourteen US patents protecting KERYX BIOPHARMS drugs.

There are one hundred and seventeen patent family members on KERYX BIOPHARMS drugs in twenty-three countries.

Summary for Keryx Biopharms

| International Patents: | 117 |

| US Patents: | 14 |

| Tradenames: | 1 |

| Ingredients: | 1 |

| NDAs: | 1 |

Drugs and US Patents for Keryx Biopharms

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | RX | Yes | Yes | 9,387,191 | ⤷ Sign Up | Y | ⤷ Sign Up | |||

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | RX | Yes | Yes | 8,299,298 | ⤷ Sign Up | Y | ⤷ Sign Up | |||

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | RX | Yes | Yes | 7,767,851 | ⤷ Sign Up | Y | Y | ⤷ Sign Up | ||

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | RX | Yes | Yes | 8,901,349 | ⤷ Sign Up | ⤷ Sign Up | ||||

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | RX | Yes | Yes | 9,757,416 | ⤷ Sign Up | Y | Y | ⤷ Sign Up | ||

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | RX | Yes | Yes | 8,846,976 | ⤷ Sign Up | ⤷ Sign Up | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for Keryx Biopharms

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | 8,754,257 | ⤷ Sign Up |

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | 9,328,133 | ⤷ Sign Up |

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | 5,753,706 | ⤷ Sign Up |

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | 8,299,298 | ⤷ Sign Up |

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | 8,901,349 | ⤷ Sign Up |

| Keryx Biopharms | AURYXIA | ferric citrate | TABLET;ORAL | 205874-001 | Sep 5, 2014 | 8,609,896 | ⤷ Sign Up |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for Keryx Biopharms Drugs

Similar Applicant Names

Here is a list of applicants with similar names.