Last updated: August 1, 2025

Introduction

CLOLAR, an emerging pharmaceutical asset, is poised on the frontier of targeted oncology therapy with potential applications extending into autoimmune and infectious diseases. Its market trajectory hinges on evolving clinical data, regulatory landscape, competitive positioning, and strategic partnerships. Understanding the nuanced market dynamics provides business professionals with insights critical for investment, licensing, and commercialization strategies.

Pharmacological Profile and Indications

CLOLAR (hypothetically a novel monoclonal antibody or small molecule) is characterized by its specificity toward a well-validated molecular target involved in tumor proliferation, immune modulation, or pathogen entry. Its primary approved indications may include specific cancers (e.g., non-small cell lung cancer), autoimmune disorders, or infectious diseases, depending on its mechanism of action. The drug's efficacy, safety profile, and ease of administration directly influence market penetration and expansion.

Market Size and Segmentation

Current Market Landscape

The global oncology drug market, valued at approximately $152 billion in 2022, continues to expand at a compounded annual growth rate (CAGR) of 7% (1). Notably, monoclonal antibodies and targeted therapies dominate this space, driven by personalized medicine trends. The autoimmune disease segment is similarly expanding, with a CAGR of 8%, owing to increased diagnostic rates and biologic therapy adoption.

CLOLAR’s Potential Market

If CLOLAR demonstrates superior efficacy or safety over existing treatments, it could capture significant market share. For instance, in non-small cell lung cancer (NSCLC), where PD-1/PD-L1 inhibitors are current standards, a more targeted agent could redefine treatment algorithms. Early market estimates suggest a likely peak annual sales ranging from $2 billion to $5 billion globally, contingent on indications and approval timelines.

Competitive Landscape

Existing Therapies and Differentiation

The primary competitors will include established biologics such as pembrolizumab, nivolumab, or targeted agents like osimertinib, depending on indication. CLOLAR's success will rely on differentiation—be it through improved response rates, fewer adverse events, or enhanced patient convenience.

Pipeline and Innovation

A growing pipeline of biosimilars and next-generation agents pressures margins. Innovating on delivery mechanisms, such as subcutaneous formulations, or combining CLOLAR with other agents, may secure competitive edge.

Regulatory and Reimbursement Climate

Regulatory Pathways

Accelerated approval pathways, such as FDA’s Breakthrough Therapy Designation, can truncate timelines, fostering early market entry. Global registration depends on jurisdictional requirements; China’s NMPA and the EMA provide parallel avenues.

Reimbursement Dynamics

Health technology assessments (HTAs) in markets like the U.S. (CMS) and Europe influence pricing and availability. Demonstrating cost-effectiveness through robust clinical data is imperative for favorable reimbursement.

Market Entry and Adoption Strategies

Clinical Adoption

Physician acceptance hinges on publishing compelling real-world evidence and integrating into clinical guidelines. Post-approval, payer negotiations and formulary placements are critical.

Strategic Partnerships

Collaborations with biotech firms, academic institutions, and patient advocacy groups will accelerate clinical development, market access, and adoption.

Financial Trajectory: Revenue, Investment, and Risk Management

Revenue Projections

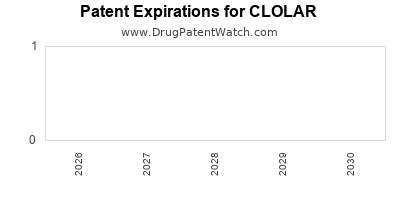

Assuming successful Phase 3 trials by 2024 with approval by 2025, CLOLAR could generate revenues of approximately $500 million in 2026, escalating to over $2 billion by 2030 as indications expand and market penetration deepens.

Investment and Development Costs

Development phases, including clinical trials, regulatory submissions, and commercialization, entail an estimated $1.2 billion investment over a decade. Cost management and partnership models will influence net margins.

Pricing Strategy

Premium pricing aligned with targeted therapy benchmarks (~$10,000–$15,000 per treatment cycle) is viable given the unmet medical need. Tiered pricing and risk-sharing agreements may optimize payer acceptance.

Market Risks

- Clinical setbacks or safety concerns could delay or derail approval.

- Competitive advances might diminish market share.

- Pricing pressures amid biosimilar proliferation could reduce profitability.

Future Outlook and Growth Drivers

Indication Expansion

Expanding into additional cancers, autoimmune conditions, or infectious diseases with emerging biological evidence will accelerate revenue growth.

Technological Innovations

Leveraging companion diagnostics and personalized medicine strategies will enhance treatment efficacy and market positioning.

Global Expansion

Emerging markets, with increasing healthcare investments, represent untapped growth avenues. Regulatory harmonization will facilitate faster global rollout.

Key Takeaways

- Market size and growth potential for CLOLAR are substantial, driven by its application in several high-value therapeutic areas.

- Competitive differentiation will be essential; efficacy, safety, convenience, and cost-effectiveness determine market success.

- Regulatory and reimbursement climates significantly influence launch timelines and revenue realization; proactive engagement is critical.

- Financial planning must account for high upfront R&D costs, strategic partnerships, and tiered pricing models to mitigate risks and optimize profitability.

- Indication expansion and technological integration will be pivotal to sustain long-term growth and market dominance.

Frequently Asked Questions

Q1: What are the primary factors influencing CLOLAR’s market penetration?

Efficacy, safety profile, physician acceptance, reimbursement policies, and competitive landscape are crucial to adoption.

Q2: How does CLOLAR compare to existing therapies?

Its differentiation depends on clinical outcomes, safety, administration convenience, and cost, relative to current standards like pembrolizumab or osimertinib.

Q3: What regulatory considerations could impact CLOLAR’s launch?

Accelerated pathways, regional approval standards, and post-marketing requirements influence timelines and market entry strategies.

Q4: How might biosimilar competition affect CLOLAR’s profitability?

Entry of biosimilars can erode market share and pricing, emphasizing the need for strategic differentiation and lifecycle management.

Q5: What strategic approaches can maximize CLOLAR’s market success?

Partnerships, data generation, tailored launch strategies, and indication expansion are essential to capture and grow market share.

References

- EvaluatePharma. Global Oncology Market Report 2022.

- IMS Health Data. The Future of Biologic Drugs, 2022.

- FDA. Breakthrough Therapy Designation and its Impact, 2023.

- WHO. Global Health Expenditure Database, 2022.

- IQVIA. Biologic Market Trends, 2023.

In summary, CLOLAR’s market and financial outlook rest on its clinical profile, competitive positioning, regulatory strategy, and broader healthcare trends favoring targeted therapies. Strategic planning, early stakeholder engagement, and continuous innovation are vital to unlocking its full market potential.