Last updated: July 28, 2025

Introduction

RENAGEL (sevelamer carbonate) is a prescription phosphate binder primarily used to manage hyperphosphatemia in patients with chronic kidney disease (CKD) on dialysis. Since its approval by the U.S. Food and Drug Administration (FDA) in 2013, RENAGEL's market presence has been shaped by evolving clinical guidelines, competitive landscape, and demographic trends within the CKD patient population. Analyzing its market dynamics and projected financial trajectory provides valuable insights for stakeholders in pharmaceutical investment, healthcare policy, and industry innovation.

Market Overview and Industry Context

CKD remains a critical global health challenge, with over 850 million affected individuals worldwide [1]. Hyperphosphatemia, a common complication in CKD, contributes to cardiovascular morbidity and mortality. The primary therapeutic strategy involves phosphate binders, with calcium-based options historically dominant. However, concerns regarding vascular calcification and cardiovascular risks driven by calcium-based binders have increased interest in non-calcium alternatives, including sevelamer.

RENAGEL targets this niche by offering an aluminum-free, non-calcium phosphate binder with additional benefits such as lipid profile improvement and potential reduction of calcification risks. As part of the broader binder market, its performance hinges on regulatory, clinical, and market-driven factors.

Competitive Landscape and Market Shares

The phosphate binder segment features several players, including:

- Renagel (sevelamer carbonate) – marketed by Fresenius Medical Care and Genzyme/Alexion predecessor.

- Fosrenol (lanthanum carbonate) – marketed by AbbVie.

- PhosLo (calcium acetate) – generic, widely used.

- Velphoro (sucroferric oxyhydroxide) – marketed by Reacta/ Vifor Pharma.

- Auryxia (ferric citrate) – marketed by Keryx Biopharmaceuticals.

RENAGEL's market share has fluctuated due to generic competition and newer agents with differing profiles. Its current positioning is bolstered by clinical preference for non-calcium binders in high-risk patients, especially those with vascular calcification.

Market Drivers

-

Clinical Guidelines and Evidence-Based Practice:

The KDIGO 2017 guidelines suggest non-calcium binders as first-choice therapy for hyperphosphatemia, favoring drugs like sevelamer in CKD patients at higher cardiovascular risk [2].

-

Demographic Trends:

Growing CKD prevalence, exacerbated by aging populations and increasing diabetes and hypertension rates, expands the potential patient pool.

-

Regulatory and Reimbursement Policies:

Favorable reimbursement for non-calcium binders in key markets, including the U.S. and Europe, enhances adoption.

-

Clinical Benefits and Safety Profile:

RENAGEL’s reputation for reduced vascular calcification risk compared to calcium-based binders underpins its sustained demand.

Market Challenges

-

Pricing and Reimbursement Pressures:

The emergence of generics and biosimilars pressures pricing, affecting revenue potential.

-

Competition from Emerging Agents:

Sucroferric oxyhydroxide (Velphoro) and ferric citrate (Auryxia) offer added benefits like anemia management, attracting practitioners.

-

Patient Compliance:

Pill burden and gastrointestinal side effects influence adherence.

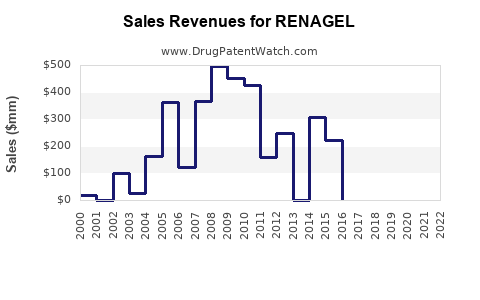

Financial Trajectory and Revenue Outlook

Estimates suggest the global phosphate binder market was valued at approximately $2 billion in 2022, with a compounded annual growth rate (CAGR) forecast of around 4-6% through 2030 [3].

RENAGEL's revenue trajectory is expected to follow this growth, with specific considerations:

-

United States:

As the largest market, revenue growth will hinge on formulary positioning, guideline updates, and competitive pricing policies. The growing preference for non-calcium binders supports steady demand, particularly in high-risk CKD populations.

-

Emerging Markets:

Increasing CKD awareness and healthcare infrastructure expansion create growth opportunities, though pricing and access remain limiting factors.

-

Pipeline and Label Expansion:

Potential additional indications or combination therapies could bolster revenue streams, though current pipeline activity appears limited.

Overall, renewal of patent protections and strategic alliances could safeguard market exclusivity, but the trend toward biosimilars could constrain future profits.

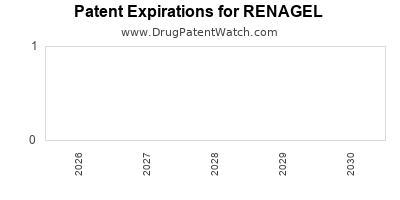

Regulatory and Patent Landscape

Although RENAGEL itself lacks recent patent protections—generic versions are available—its core formulation remains under patent exclusivity in certain jurisdictions. Regulatory bodies like the FDA and EMA continue to prioritize safety and efficacy benchmarks, with post-marketing surveillance influencing market dynamics.

Emerging biosimilars and patent challenges could reshape the competitive landscape, emphasizing the importance of innovation and strategic market access.

Opportunities and Strategic Considerations

-

Pipeline Innovation:

Development of next-generation phosphate binders with improved safety, tolerability, or additional benefits (e.g., lipid modulation) can reinforce market position.

-

Combination Approaches:

Combining RENAGEL with other CKD therapeutics might enhance efficacy and adherence.

-

Personalized Medicine:

Precision dosing and patient-specific therapy optimization could improve clinical outcomes and market penetration.

-

Market Expansion:

Investing in emerging regions with rising CKD prevalence presents growth avenues, contingent on affordability and healthcare infrastructure.

Key Risks

-

Generic Competition:

Widespread availability of generics diminishes pricing power.

-

Market Saturation:

Increasing use of newer agents with added benefits may limit room for RENAGEL growth.

-

Regulatory Changes:

Shifts in treatment guidelines or reimbursement policies could impact demand.

Conclusion

RENAGEL stands at a pivotal point within the phosphate binder landscape. Its future market performance will be primarily driven by demographic trends, evolving clinical guidelines favoring non-calcium binders, and competitive innovations. While near-term revenues are expected to maintain stability, long-term growth prospects require strategic adaptation to the dynamic healthcare environment, including pipeline development and market expansion.

Key Takeaways

- The global phosphate binder market is experiencing steady growth driven by rising CKD prevalence and clinical guideline shifts favoring non-calcium options like RENAGEL.

- Competitive pressures, especially from generics and newer agents, challenge RENAGEL’s revenue stability.

- Regulatory policies emphasizing safety and efficacy are critical; ongoing surveillance and evidence generation influence market acceptance.

- Strategic investments in pipeline innovation and emerging markets are essential for sustained growth.

- Market resilience depends on balancing pricing, clinical positioning, and expanding indications amid patent expiration timelines.

FAQs

1. How does RENAGEL differentiate itself from other phosphate binders?

RENAGEL’s primary advantage lies in its non-calcium formulation, reducing vascular calcification risk, and its additional lipid-lowering benefits, aligning with clinical guidelines favoring safer hyperphosphatemia management strategies.

2. What are the main factors influencing RENAGEL's market share?

Clinical guideline adherence, demographic trends, competition from newer agents, pricing strategies, and reimbursement policies directly impact its positioning within the market.

3. How does the patent landscape affect the financial trajectory of RENAGEL?

Patent expirations and the proliferation of generics limit pricing power, necessitating innovation and market differentiation to sustain revenues.

4. What emerging trends could shape RENAGEL’s future prospects?

Personalized medicine, combination therapies, pipeline innovations, and expanding healthcare access in emerging markets are key growth drivers.

5. What strategic actions should stakeholders consider to enhance RENAGEL’s market position?

Investing in pipeline development, exploring new indications, strengthening market access, and forming strategic alliances are vital for long-term success.

Sources:

[1] Global CKD Prevalence Data, WHO, 2022.

[2] KDIGO Clinical Practice Guideline for Mineral and Bone Disorder in CKD, 2017.

[3] Market Research Future, Phosphate Binder Market Report, 2022.