Last updated: July 29, 2025

Introduction

Ferring Pharmaceuticals Inc. stands as a distinguished player in the global biopharmaceutical sector, primarily focusing on reproductive health, urology, orthopedics, gastroenterology, and maternal health. As the pharmaceutical industry becomes increasingly competitive amidst rapid innovation and regulatory dynamism, understanding Ferring’s market position, strategic strengths, and operational insights is essential for stakeholders, investors, and competitors. This analysis dissects Ferring's competitive positioning, delineates its core strengths, and offers strategic considerations to navigate the evolving pharmaceutical landscape.

Market Position Overview

Ferring Pharmaceuticals, founded in 1950 and headquartered in Saint-Prex, Switzerland, quietly asserts a robust global footprint through its focused therapeutic portfolio. Its strategic emphasis on niche markets—such as reproductive medicine, urology, and gastroenterology—has allowed Ferring to carve out a unique position in a crowded pharmaceutical landscape.

According to recent market data, Ferring ranks among the prominent mid-size pharmaceutical companies, with an estimated global revenue exceeding $2 billion in 2022 [1]. Its regional presence spans North America, Europe, and parts of Asia, bolstered by a well-developed direct sales force and a strong pipeline of specialty products. While not as large as industry giants like Pfizer or Novartis, Ferring’s market positioning benefits from its specialization, high-margin products, and consistent R&D investment.

In competitive terms, Ferring competes with specialized biotech firms and other niche pharmaceutical companies focusing on reproductive and urological therapeutics, including Merck KGaA, Ferring’s longstanding competitor in reproductive health markets.

Core Strengths

Specialized Product Portfolio

Ferring’s core strength resides in its highly focused portfolio of specialty pharmaceuticals. Its flagship products, such as Rebiogel (hormonal therapy), Ferring’s fertility medications, and urological agents like Prostin VR Pediatric, command strong brand loyalty and clinician preference. Its emphasis on niche markets reduces direct competition, establishing a defensible market segment.

Robust R&D Pipeline

Ferring has consistently allocated approximately 15-20% of its revenue to research and development, a notable commitment for a mid-sized company. Its R&D efforts target innovative therapies, biosimilars, and next-generation formulations, enhancing its competitive edge. Notable pipeline candidates include biologics for reproductive and gastrointestinal indications, positioning Ferring for future growth as new therapies gain regulatory approval [2].

Global Footprint with Localized Expertise

The company’s strategic regional subsidiaries enable tailored marketing and distribution, improving penetration in key markets. Its presence in emerging markets such as China and Brazil provides growth opportunities, leveraging local regulatory expertise and customer relationships.

Regulatory and Market Access

Ferring’s longstanding history and reputation contribute to relatively streamlined regulatory approval processes, particularly in Europe and North America. Its strategic collaborations with health authorities bolster market access and facilitate faster product launches.

Corporate Focus and Agility

Compared to multinational pharmaceutical giants, Ferring’s smaller size affords it a degree of operational agility, allowing for quick strategic pivots and personalized customer engagement—vital in an increasingly fragmented healthcare environment.

Strategic Insights and Challenges

Innovation and Clinical Development

Continued investment in innovative therapeutics remains paramount. Ferring’s focus on biologics and biosimilars aligns with industry trends favoring targeted, personalized treatments. Strategic partnerships with biotech firms could accelerate development timelines and expand its pipeline.

Market Expansion and Diversification

While Ferring's niche focus is a strength, diversification through expanding indications, geographic penetration, or new delivery modalities can mitigate risks associated with market saturation or regulatory changes. The company could consider acquisitions or licensing agreements to rapidly expand its portfolio, especially in high-growth emerging markets.

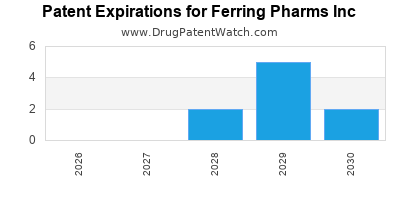

Regulatory Environment and Patent Strategy

Patent expiry on key products can pose risks; proactive patent management and early lifecycle planning are critical. Strengthening regulatory expertise and maintaining high-quality clinical data are essential to defend existing assets and facilitate successful new product approvals.

Competitive Landscape

Ferring faces competition from global pharmaceutical companies, biotech startups, and generic manufacturers. Larger players might leverage economies of scale to undercut prices, especially in commoditized segments. Strategic collaborations, differentiating innovation, and efficient cost management are solutions to sustain its market share.

Digital Transformation and Patient Engagement

Adapting to digital health trends—such as telemedicine, digital therapeutics, and data analytics—can enhance patient adherence, optimize supply chains, and improve clinical outcomes. Investing in digital initiatives can create a competitive advantage and deepen patient insights.

Conclusion

Ferring Pharmaceuticals Inc. maintains a strong position in specialized pharmaceutical markets, underpinned by a focused product portfolio, committed R&D, and regional expertise. Its strategic strength in niche therapies allows it to navigate competitive pressures effectively. However, sustaining growth requires ongoing innovation, strategic expansion, and navigating regulatory complexities.

Stakeholders should monitor Ferring’s R&D pipeline developments, regional growth strategies, and potential partnerships to gauge future trajectory. For competitors, understanding Ferring’s niche focus and agility offers insights into alternative models of success within the pharmaceutical industry.

Key Takeaways

- Ferring’s specialization in niche markets provides a defensible competitive position amidst major industry players.

- Continued investment in biologics, biosimilars, and innovative delivery mechanisms is critical for future growth.

- Expansion into emerging markets and acquisition opportunities could diversify revenue streams and accelerate growth.

- Managing patent protections and navigating complex regulatory environments are vital to safeguarding current assets.

- Embracing digital health initiatives can optimize operations, enhance patient engagement, and strengthen competitive advantages.

FAQs

1. How does Ferring Pharmaceuticals differentiate itself from larger competitors?

Ferring’s focus on niche therapeutic areas like reproductive health and urology offers high-margin, specialized products with less direct competition, allowing it to build strong clinician loyalty and maintain a targeted market presence.

2. What are Ferring's primary growth prospects?

Key growth avenues include expanding its biologics and biosimilars pipeline, increasing footprint in emerging markets, and forming strategic partnerships or acquisitions to diversify its portfolio.

3. How does Ferring manage regulatory challenges across different regions?

Leveraging its extensive regional subsidiaries and long-standing relationships with health authorities, Ferring streamlines approval processes and adapts its clinical development strategies to regional regulations.

4. What risks does Ferring face in maintaining its competitive position?

Risks include patent expiries, intense industry competition, regulatory hurdles, and potential shifts in healthcare policies that could affect reimbursement and market access.

5. How can Ferring leverage digital health trends?

By integrating digital therapeutics, patient engagement platforms, and data analytics into its strategic framework, Ferring can improve treatment adherence, optimize supply chains, and deepen patient insights for personalized care.

Sources:

[1] 2022 Ferring Financial Reports & Industry Data

[2] Clinical Pipeline Reports, Ferring Pharmaceuticals