Last updated: July 27, 2025

Introduction

Ferring Pharmaceuticals stands as a notable player in the global biopharmaceutical industry, specializing in reproductive health, urology, gastroenterology, endocrinology, and orthopedics. This privately-held company, founded in Denmark in 1950, has expanded its footprint across multiple markets through innovative therapies, strategic acquisitions, and a focus on niche therapeutic areas. As the pharmaceutical sector becomes increasingly competitive and innovation-driven, understanding Ferring’s market position, strengths, and strategic trajectory provides essential insights for stakeholders, investors, and competitors.

Market Positioning and Global Footprint

Ferring’s primary positioning revolves around specialized, high-margin therapeutic niches rather than broad-spectrum mass-market drugs. The company's core areas include fertility treatments, gastrointestinal biologics, urology, and maternal health. Its global footprint spans over 100 countries, with significant operations in Europe, North America, and emerging markets such as Asia and Latin America.

While Ferring doesn’t command the same scale as industry giants like Pfizer or Johnson & Johnson, its focused strategy allows it to maintain a robust presence in high-growth segments. In reproductive health and urology, Ferring's products are considered scientifically respected, often used as first-line therapies in clinics worldwide. Its emphasis on innovation, combined with a strategic approach to regional markets, reinforces its unique positioning.

Market Strengths

1. Specialized Therapeutic Focus

Ferring's strategic focus on niche therapies offers a competitive advantage, allowing it to develop highly targeted products with less direct competition. Its expertise in reproductive health and urology has cultivated a strong brand reputation among clinicians, ensuring high product loyalty and preference.

2. Innovation and R&D Capabilities

Investment in research and development remains central to Ferring’s growth. The company dedicates approximately 20-25% of its revenue to R&D activities, fostering a pipeline of biologics and innovative formulations. Notable recent developments include biologics for gastrointestinal indications and novel formulations in reproductive medicine.

3. Robust Product Portfolio

Ferring’s portfolio includes well-established products like Gonasi (hCG) for infertility, and innovative biologics such as Narcan in urology. Its pipeline emphasizes biologics and biosimilars, aligning with industry trends towards precision medicine and personalized therapies.

4. Strategic Acquisitions and Collaborations

Ferring has bolstered its product offerings through acquisitions, including the 2017 purchase of merchandise rights to serelaxin for acute heart failure, and collaborations with biotech firms that expand its technological capabilities. These strategic moves facilitate access to new markets and enhance R&D productivity.

5. Focused Regional Strategies

Ferring's tailored regional strategies enable effective market penetration, especially in emerging markets where healthcare systems are expanding and demand for specialized therapies is rising. Its local partnerships aid regulatory navigation and distribution.

Strategic Insights

1. Emphasis on Biologics and Biosimilars

Ferring is actively developing biologics and biosimilars, which are pivotal growth drivers in the pharmaceutical industry. Its biologics pipeline targets gastrointestinal, reproductive, and urological diseases, aiming to capture high-value segments with complex, patent-protected products.

2. Digital Transformation and Data-driven Approaches

The company is investing in digital health initiatives, including data analytics for patient stratification and telemedicine solutions, aligning with industry trends towards digital therapeutics and remote patient management. These initiatives can improve treatment adherence and real-world evidence collection.

3. Geographic Expansion in Asia-Pacific and Latin America

Ferring’s focus on expanding into high-growth markets such as Asia-Pacific (notably China, India, and Southeast Asia) and Latin America aims to leverage demographic shifts, increasing birth rates, and improving healthcare infrastructure. Local manufacturing and partnerships will be crucial to navigate regional regulatory landscapes.

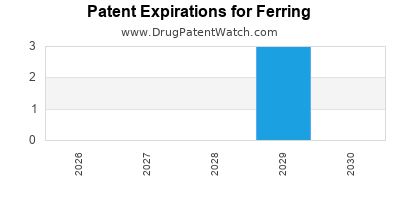

4. Navigating Patent and Market Entry Challenges

The shifting landscape of patent expiries and increasing biosimilar competition poses risks. Ferring's strategy involves creating lifecycle management plans, innovating around existing molecules, and pursuing new therapeutic indications to mitigate patent expirations.

5. Commitment to Sustainability and Corporate Responsibility

In line with industry best practices, Ferring emphasizes sustainable manufacturing processes, ethical marketing, and social responsibility initiatives. Such commitments can strengthen stakeholder trust, notably in regions with rising healthcare accountability expectations.

Competitive Dynamics and Industry Challenges

Despite these strategic strengths, Ferring faces intense competition from multinational pharmaceutical companies, biotech startups, and generic manufacturers, especially within biologics and biosimilars. Market entry barriers include regulatory approval complexities, high R&D costs, and patent litigations. Additionally, the shift towards personalized medicine necessitates substantial investment in diagnostics and companion devices, areas where Ferring’s capabilities could be further expanded.

Emerging market dynamics, including regulatory reforms and reimbursement changes, also influence Ferring's growth trajectory. The COVID-19 pandemic underscored the need for agile supply chains, digital health adoption, and flexible clinical trial management—areas Ferring is actively improving.

SWOT Analysis Summary

| Strengths |

Weaknesses |

| Focused niche expertise |

Limited scale compared to giants |

| Strong R&D dedication |

Dependence on specific therapeutic segments |

| Innovative biologic pipeline |

Potential vulnerability to biosimilar erosion |

| Strategic regional expansion |

Limited consumer-facing marketing capacity |

| Opportunities |

Threats |

| Growing demand in emerging markets |

Intense competition from biosimilar entrants |

| Pipeline expansion in biologics |

Regulatory hurdles and reimbursement reforms |

| Digital health deployment |

Patent cliffs and market genericization |

Conclusion

Ferring Pharmaceuticals maintains a distinctive competitive edge through its concentrated therapeutic focus, robust R&D pipeline, and strategic regional growth initiatives. Its commitment to innovation, especially in biologics and biosimilars, positions it well to capitalize on industry trends. However, ongoing industry challenges such as biosimilar competition, regulatory complexities, and market access hurdles necessitate vigilant strategic planning. By leveraging its strengths and addressing vulnerabilities, Ferring can sustain its niche dominance and unlock new growth opportunities within the evolving pharmaceutical landscape.

Key Takeaways

-

Niche Expertise is a Competitive Advantage: Ferring’s focus on reproductive health, urology, and gastroenterology allows for specialized product development, fostering brand loyalty within targeted markets.

-

Investment in Innovation Ensures Future Growth: A significant R&D commitment facilitates pipeline development in biologics and biosimilars, aligning with industry shifts toward precision medicine.

-

Strategic Global and Regional Expansion is Critical: Diversification across emerging markets, with localized strategies, enhances growth prospects amid global healthcare reforms.

-

Industry Trends Favor Biologics and Digital Health: Embracing biologics, biosimilars, and digital health solutions positions Ferring as an innovative leader in its niches.

-

Competitive Challenges Require Adaptive Strategies: Patent expiries, biosimilar entrants, and regulatory shifts demand continuous innovation, lifecycle management, and market agility.

FAQs

1. How does Ferring differentiate itself from larger pharmaceutical companies?

Ferring differentiates through its specialized focus on niche therapeutic areas, prioritizing innovative biologics and precision therapies within reproductive health, urology, and gastroenterology. Its agility, personalized approach, and regional strategies allow it to compete effectively despite a smaller scale.

2. What are Ferring’s key growth areas moving forward?

Biologics and biosimilars represent primary growth drivers, supported by pipeline investments and regional expansion into emerging markets. Digital health integration also offers opportunities to enhance treatment efficacy and patient engagement.

3. How significant is Ferring’s research and development in its overall strategy?

R&D is integral, with approximately 20-25% of revenue reinvested into pipeline development—primarily biologics and biosimilars—to sustain innovation and competitive differentiation.

4. What challenges does Ferring face regarding market competition?

Intense biosimilar competition, patent expirations, regulatory complexities, and the need for continued innovation pose ongoing threats. The company must adapt through lifecycle management, strategic acquisitions, and diversification.

5. How is Ferring approaching digital transformation?

Ferring is investing in data analytics, remote patient management tools, and digital health collaborations to streamline clinical development, improve patient outcomes, and stay ahead in the digital era.

References

[1] Ferring Pharmaceuticals Annual Report 2022.

[2] Industry Analysis Reports, Deloitte Life Sciences and Healthcare 2023.

[3] Market Intelligence Data, EvaluatePharma, 2023.