Last updated: July 29, 2025

Introduction

Exelixis Inc., a biotechnology company headquartered in Alameda, California, specializes in discovering, developing, and commercializing innovative therapies for cancer. As of 2023, Exelixis's key drug, Cabometyx, has solidified its position in the oncology market, particularly for renal cell carcinoma (RCC) and other tumor types. This landscape analysis evaluates Exelixis's current market position, competitive strengths, challenges, and strategic directions, providing stakeholders with critical insights into its trajectory within a fiercely competitive pharmaceutical arena.

Market Position and Portfolio Overview

Core Product: Cabometyx (cabozantinib)

Cabometyx stands as Exelixis's flagship product, a tyrosine kinase inhibitor (TKI) targeting MET, VEGFR2, AXL, and other pathways involved in tumor progression. It is predominantly indicated for advanced or metastatic RCC, hepatocellular carcinoma (HCC), and other solid tumors. The drug generated approximately $1.7 billion in sales in 2022, underscoring its importance in Exelixis's revenue stream [1].

Regulatory Milestones and Collaborations

Beyond its primary indications, Exelixis has expanded Cabometyx's label via strategic partnerships and ongoing clinical trials, notably with Ipsen, facilitating broader European access. The company also has a burgeoning pipeline including cabozantinib-based combination therapies and novel candidates targeting oncology and non-oncology indications.

Market Share and Competitive Position

In RCC, Cabometyx competes directly with drugs like Bayer's Axitinib (Inlyta), Pfizer's Sunitinib (Sutent), and Merck's Pembrolizumab (Keytruda) in combination regimens. As of 2023, Cabometyx maintains a market share of roughly 25% in the second-line RCC segment within the U.S., reflecting steady growth due to its efficacy and tolerability profile. Its position is bolstered by recognition of its survival benefits demonstrated in pivotal trials such as CABOSUN [2].

Strengths of Exelixis in the Industry

1. Robust Clinical Data and Aromatic Therapy Profile

Exelixis benefits from strong evidentiary support, with multiple Phase III trials validating Cabometyx’s efficacy, safety, and quality of life improvements. Its differentiated profile includes a manageable safety profile compared to competitors, which fosters better patient adherence and clinician preference.

2. Focused Oncology Portfolio and Pipeline Diversification

Unlike diversified pharma giants, Exelixis maintains a disciplined focus on oncology, optimizing resource deployment. Its pipeline includes cabozantinib-based combinations with immunotherapies like nivolumab—a key strategic move aligning with the industry shift toward combination regimens.

3. Strategic Alliances and Global Market Expansion

Partnerships, particularly with Ipsen and other regional distributors, extend global reach, especially into Europe and Asia-Pacific markets. These collaborations mitigate market entry barriers and local regulatory challenges, enhancing Exelixis’s international footprint.

4. Cost-Effective Manufacturing and R&D Efficiency

Exelixis’s streamlined R&D operations allow rapid progression from preclinical to clinical phases, reducing time-to-market for new indications or formulations. This agility, supported by strategic licensing, sustains the company's innovation momentum.

Challenges and Competitive Risks

1. Market Saturation and Competition

The aggressive landscape of oncology therapeutics results in high competition, especially from 1L immunotherapy combinations like Tecentriq + Avastin or Keytruda + Lenvima, which are becoming the standard of care across several indications [3]. These regimens may erode Cabometyx’s market share in second-line settings.

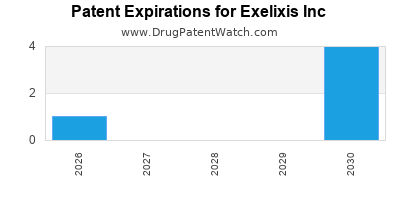

2. Patent Expiry and Generic Threats

While Cabometyx’s patents provide exclusivity until 2027-2029, upcoming patent expirations could open opportunities for generics, exerting downward pressure on prices, especially in price-sensitive markets.

3. Clinical Development Risks

Exelixis’s pipeline, including candidates like cabozantinib in non-oncology indications, carries inherent clinical and regulatory risks, with potential delays, failed trials, or unmet endpoints affecting long-term strategic growth.

4. Reimbursement and Market Access Nuances

In many regions, especially Europe and Asia, navigating diverse healthcare systems and reimbursement processes presents ongoing barriers. Price negotiations and formulary restrictions influence sales trajectories.

Strategic Outlook

Growth through Combination Therapies

Exelixis's emphasis on combination regimens positions it well in the evolving landscape, where immunotherapies integrated with TKIs constitute first- and second-line standards. The ongoing phase III trials with nivolumab (CheckMate 9ER) and other agents aim to cement Cabometyx’s role in frontline and combination settings [4].

Pipeline Expansion and Diversification

Investments into novel combo partners and next-generation kinase inhibitors aim to address resistance mechanisms and extend the company's lifecycle. The focus remains on reinforcing its pipeline with data-driven, high-value assets.

International Market Penetration

Expanding access in Emerging Markets via its partnerships, notably in Asia and Latin America, continues to be a priority, seeking to offset stagnating growth in mature markets.

Operational Efficiency and Cost Management

Continued streamlining of R&D and manufacturing processes, alongside strategic licensing, supports sustainable margins amid competitive pressures and potential pricing reforms.

Key Takeaways

-

Market Leadership: Cabometyx remains a leading second-line RCC therapy, thanks to robust clinical data and strategic collaborations that enhance its positioning regionally and globally.

-

Competitive Edge: Its differentiated efficacy, safety profile, and focus on combination therapies position Exelixis favorably amidst increasing competition from immunotherapy-centric regimens.

-

Facing Challenges: Patent cliffs, competitive dynamics, and reimbursement hurdles necessitate vigilant portfolio management and innovation.

-

Growth Strategies: Focus on clinical trial success for combination therapies, pipeline diversification, and expanding into high-growth international markets. Operational efficiency will underpin long-term profitability.

-

Future Outlook: Continued innovation, strategic alliances, and market expansion will be critical in consolidating and growing Exelixis's market share in an increasingly crowded oncology landscape.

FAQs

1. How does Exelixis differentiate Cabometyx from other TKIs in the oncology market?

Cabometyx's differentiation lies in its effective targeting of multiple tumor-promoting pathways, favorable safety profile, and proven survival benefit in pivotal trials, making it a preferred option in second-line RCC and other solid tumors.

2. What is the primary growth avenue for Exelixis over the next five years?

The primary growth driver is the expansion of its combination therapy portfolio, especially trials integrating Cabometyx with immunotherapies like nivolumab, which could redefine standard-of-care protocols.

3. How significant are patent expirations for Exelixis's future?

Patents for Cabometyx are expected to expire around 2027–2029, after which generics may enter major markets. Strategic patent filings and pipeline expansion are necessary to mitigate pricing pressures.

4. What role do international markets play in Exelixis’s growth strategy?

International expansion, through partnerships, particularly in Europe and Asia, is vital for diversifying revenue sources, accessing emerging markets, and offsetting saturation in North America.

5. How is Exelixis managing pipeline risks associated with clinical development?

The company emphasizes targeted, high-impact clinical trials, strategic collaborations, and timely data dissemination to mitigate risks and optimize resource allocation.

References

[1] Exelixis Inc. Annual Report 2022.

[2] Choueiri, T. K. et al. (2017). Cabozantinib versus Sunitinib in Metastatic Renal-Cell Carcinoma. New England Journal of Medicine.

[3] Sharma, P. et al. (2021). Evolving landscape of first-line treatments in advanced RCC. Journal of Clinical Oncology.

[4] Exelixis Pipeline and Clinical Trials Data (2023).

This comprehensive analysis provides a strategic overview to facilitate informed decision-making within the competitive landscape of oncology therapeutics, emphasizing Exelixis Inc.'s current market position, strengths, and future prospects.