COVIS Company Profile

✉ Email this page to a colleague

What is the competitive landscape for COVIS, and what generic alternatives to COVIS drugs are available?

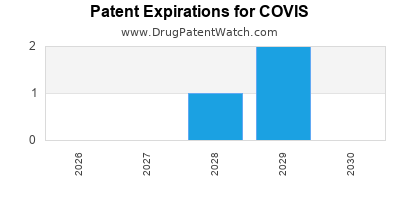

COVIS has eleven approved drugs.

There are five US patents protecting COVIS drugs.

There are one hundred and forty-four patent family members on COVIS drugs in forty-six countries and twenty-seven supplementary protection certificates in fourteen countries.

Drugs and US Patents for COVIS

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Covis | DUAKLIR PRESSAIR | aclidinium bromide; formoterol fumarate | POWDER, METERED;INHALATION | 210595-001 | Mar 29, 2019 | RX | Yes | Yes | 11,000,517 | ⤷ Sign Up | Y | ⤷ Sign Up | |||

| Covis | DUAKLIR PRESSAIR | aclidinium bromide; formoterol fumarate | POWDER, METERED;INHALATION | 210595-001 | Mar 29, 2019 | RX | Yes | Yes | 8,051,851 | ⤷ Sign Up | Y | ⤷ Sign Up | |||

| Covis | OMNARIS | ciclesonide | SPRAY, METERED;NASAL | 022004-001 | Oct 20, 2006 | RX | Yes | Yes | 8,371,292 | ⤷ Sign Up | ⤷ Sign Up | ||||

| Covis | SULAR | nisoldipine | TABLET, EXTENDED RELEASE;ORAL | 020356-001 | Feb 2, 1995 | DISCN | Yes | No | ⤷ Sign Up | ⤷ Sign Up | |||||

| Covis | SULAR | nisoldipine | TABLET, EXTENDED RELEASE;ORAL | 020356-007 | Jan 2, 2008 | AB | RX | Yes | Yes | ⤷ Sign Up | ⤷ Sign Up | ||||

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | RX | Yes | Yes | 10,085,974 | ⤷ Sign Up | Y | ⤷ Sign Up | |||

| Covis | DUAKLIR PRESSAIR | aclidinium bromide; formoterol fumarate | POWDER, METERED;INHALATION | 210595-001 | Mar 29, 2019 | RX | Yes | Yes | RE46417 | ⤷ Sign Up | Y | Y | ⤷ Sign Up | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for COVIS

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Covis | PRILOSEC | omeprazole magnesium | FOR SUSPENSION, DELAYED RELEASE;ORAL | 022056-001 | Mar 20, 2008 | 5,690,960 | ⤷ Sign Up |

| Covis | TUDORZA PRESSAIR | aclidinium bromide | POWDER, METERED;INHALATION | 202450-001 | Jul 23, 2012 | 5,840,279 | ⤷ Sign Up |

| Covis | SULAR | nisoldipine | TABLET, EXTENDED RELEASE;ORAL | 020356-005 | Jan 2, 2008 | 5,626,874 | ⤷ Sign Up |

| Covis | SULAR | nisoldipine | TABLET, EXTENDED RELEASE;ORAL | 020356-002 | Feb 2, 1995 | 4,703,038 | ⤷ Sign Up |

| Covis | PRILOSEC | omeprazole magnesium | FOR SUSPENSION, DELAYED RELEASE;ORAL | 022056-001 | Mar 20, 2008 | 5,900,424 | ⤷ Sign Up |

| Covis | RILUTEK | riluzole | TABLET;ORAL | 020599-001 | Dec 12, 1995 | 5,527,814 | ⤷ Sign Up |

| Covis | ALVESCO | ciclesonide | AEROSOL, METERED;INHALATION | 021658-002 | Jan 10, 2008 | 6,006,745 | ⤷ Sign Up |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

Paragraph IV (Patent) Challenges for COVIS drugs

| Drugname | Dosage | Strength | Tradename | Submissiondate |

|---|---|---|---|---|

| ➤ Subscribe | Injection | 30 mg/mL, 17 mL single-use vials | ➤ Subscribe | 2015-12-04 |

| ➤ Subscribe | Extended-release Tablets | 20 mg and 30 mg | ➤ Subscribe | 2007-11-07 |

| ➤ Subscribe | Extended-release Tablets | 40 mg | ➤ Subscribe | 2007-06-11 |

| ➤ Subscribe | Nasal Spray | 250 mcg | ➤ Subscribe | 2012-02-13 |

| ➤ Subscribe | Extended-release Tablets | 25.5 mg and 34 mg | ➤ Subscribe | 2008-11-28 |

| ➤ Subscribe | Extended-release Tablets | 8.5 mg and 17 mg | ➤ Subscribe | 2009-03-02 |

International Patents for COVIS Drugs

Supplementary Protection Certificates for COVIS Drugs

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1200431 | 421 | Finland | ⤷ Sign Up | |

| 1200431 | C01200431/01 | Switzerland | ⤷ Sign Up | PRODUCT NAME: ACLIDINIUM; REGISTRATION NO/DATE: SWISSMEDIC 62590 25.04.2013 |

| 1411900 | SPC/GB11/015 | United Kingdom | ⤷ Sign Up | PRODUCT NAME: NAPROXEN AND ESOMEPRAZOLE; REGISTERED: UK PL 17901/0263-0001 20101105 |

| 1200431 | SPC/GB13/006 | United Kingdom | ⤷ Sign Up | PRODUCT NAME: ACLIDINIUM SALT WITH PHARMACEUTICALLY ACCEPTABLE ANION OF A MONO OR POLYVALENT ACID ESPECIALLY AS ACLIDINIUM BROMIDE; REGISTERED: UK EU/1/12/778/001 20120720; UK EU/1/12/778/002 20120720; UK EU/1/12/778/003 20120720; UK EU/1/12/781/001 20120720; UK EU/1/12/781/002 20120720; UK EU/1/12/781/003 20120720 |

| 1169062 | 2012C/052 | Belgium | ⤷ Sign Up | PRODUCT NAME: FERUMOXYTOL; AUTHORISATION NUMBER AND DATE: EU/1/12/774/001 20120620 |

| 1169062 | C300558 | Netherlands | ⤷ Sign Up | PRODUCT NAME: FERUMOXYTOL IN IEDERE DOOR HET BASISOCTROOI BESCHERMDE VORM; REGISTRATION NO/DATE: EU/1/12/774/001-002 20120615 |

| 1200431 | PA2013001,C1200431 | Lithuania | ⤷ Sign Up | PRODUCT NAME: ACLIDINII BROMIDUM; REGISTRATION NO/DATE: EU/1/12/778/001 - EU/1/12/778/003, 2012 07 20 EU/1/12/781/001 - EU/1/12/781/003 20120720 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |