Last updated: July 28, 2025

Introduction

Biogen Idec, now operating under the simplified brand name Biogen, stands as a major contender within the global biotechnology and pharmaceutical sectors, chiefly focusing on neurodegenerative, hematologic, and autoimmune disorders. Established in 1978, the company has evolved through strategic acquisitions, innovative R&D, and a robust pipeline, solidifying its position among leading biopharmaceutical entities. This analysis dissects Biogen’s market positioning, core strengths, competitive landscape, and strategic outlook to assist stakeholders in informed decision-making.

Market Position and Revenue Dynamics

Biogen is predominantly recognized for its pioneering work in multiple sclerosis (MS), notably with its blockbuster drug, Tecfidera (dimethyl fumarate), which contributes a significant proportion of its revenue. As of 2022, Biogen generated approximately $11.3 billion in annual revenue, with MS therapies accounting for over 60% of sales. The company’s portfolio also includes therapies for spinal muscular atrophy (SMA), Alzheimer’s disease (AD), and comorbid neurodegenerative conditions.

The company's global footprint extends across North America, Europe, and Asia-Pacific, with a focus on expanding access and regulatory approvals in emerging markets. The evolving landscape of biotech innovation, competitive pressures, and regulatory shifts continually shape its market standing.

Core Strengths

1. Robust Portfolio of Neural and Autoimmune Therapies

Biogen’s core strengths reside in its extensive portfolio targeting neurodegenerative diseases. Its flagship MS products, including Tysabri (natalizumab), Plegridy (peginterferon beta-1a), and Avonex (interferon beta-1a), have cemented its leadership in MS treatment. The early entry and sustained innovation in neurobiology have established Biogen as a trusted brand among neurologists.

2. Pioneering R&D and Strategic Innovation

Biogen’s commitment to R&D, with investments exceeding $2 billion annually, fuels a pipeline of over 50 therapies under development. Its strategic acquisitions—such as Swedish biotech company ReNeuron (gene therapy expertise) and Blackthorn Therapeutics (neuropsychiatric disorders)—enhance its innovation capabilities. Notably, Biogen is pioneering AD therapy development, with recent approvals like Leqembi (lecanemab) in 2023, marking its entrance into the competitive Alzheimer’s space.

3. Strategic Collaborations and Licensing Agreements

Collaborations with other pharma entities bolster Biogen’s pipeline and market reach. Partnering with Eisai on lecanemab provides leverage in Alzheimer's therapeutics. These alliances enable shared risk and access to novel technologies.

4. Focused Niche Market Leadership

Biogen’s specialization in neurodegenerative and rare genetic diseases positions it uniquely within highly specialized markets with high entry barriers. Its early market penetration affords sustained revenue streams and customer loyalty.

Competitive Landscape

Biogen operates within a highly competitive environment. Key competitors include:

- Roche/Genentech: A dominant player with a broad portfolio for MS, oncology, and neuroscience.

- Novartis: Competing mainly via its MS drug Gilenya (fingolimod) and gene therapy advancements.

- Eli Lilly: Entering neurodegenerative space with anti-amyloid drugs similar to Leqembi.

- Eisai: Partnered with Biogen on AD therapeutics and actively developing its own pipeline.

- Sanofi: Focusing on autoimmune and neurological diseases, with newer biologic therapies.

Other noteworthy competitors include Regeneron, Roche, and emerging biotech firms. The landscape emphasizes rapid innovation, patent protection, and personalized medicine strategies.

Strengths and Strategic Insights

Market Differentiation

Biogen’s long-standing expertise and focus on neurological disorders differentiate it from more diversified pharma giants. Its early development of key MS treatments established brand loyalty and sustained revenue. The company’s targeted approach reduces operational complexity and aligns R&D efforts toward high-growth, high-need areas.

Pipeline Robustness and Innovation Pipeline

The upcoming launch of Leqembi signals Biogen’s successful pivot toward Alzheimer’s disease—a historically challenging market. Its investments in gene therapies, such as zuricapsen (for spinal muscular atrophy), and neurodegeneration biomarkers, position the company ahead in personalized medicine.

Regulatory and Market Risks

Despite strengths, regulatory hurdles pose risks. Recent scrutiny of amyloid-targeting drugs by the FDA has introduced uncertainty around approval pathways and reimbursement. Biogen must navigate these challenges to maintain its innovative edge.

Global Expansion and Emerging Markets

While strong in established markets, Biogen has growth potential in Asia-Pacific and Latin America. Tailoring regulatory strategies and expanding access will be key to capturing these markets’ growth.

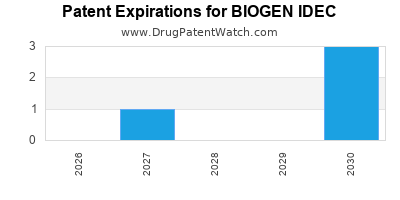

Focus on Diversification and Acquisition Strategy

To mitigate dependence on MS revenues, Biogen’s acquisitions and licensing agreements aim to diversify its portfolio into cell and gene therapies, broadening revenue streams and reducing vulnerability to patent expiration.

Strategic Recommendations

- Accelerate pipeline development, especially in neurodegenerative and rare disease treatments, leveraging biomarkers and personalized medicine.

- Strengthen partnerships with biotech innovators and academic institutions to access cutting-edge technology and accelerate clinical development.

- Prioritize market access and reimbursement strategies, particularly amidst COVID-19’s impact on healthcare budgets.

- Expand geographical footprint through tailored regulatory strategies and local partnerships to penetrate emerging markets effectively.

- Invest in digital health and real-world evidence collection to demonstrate value and optimize patient outcomes.

Conclusion

Biogen’s strategic focus on neuroscience and autoimmune disorders, combined with a strong R&D pipeline and targeted market approach, sustains its position among leading biotech firms. Navigating regulatory challenges, diversifying its portfolio, and expanding into emerging markets will be crucial to maintaining competitive advantage. Stakeholders should monitor its pipeline developments, regulatory landscape, and strategic alliances to capitalize on growth opportunities.

Key Takeaways

- Biogen maintains a dominant position in MS and neurodegenerative therapeutics but faces intensifying competition.

- Its substantial R&D investments and strategic acquisitions underpin a promising pipeline, particularly in Alzheimer’s and gene therapies.

- Regulatory scrutiny and market access barriers remain risks; proactive engagement and innovation are vital.

- Geographical expansion into emerging markets offers significant growth potential.

- Diversification beyond core neurology treatments is essential for sustained long-term growth.

FAQs

1. What are Biogen’s flagship products, and what markets do they serve?

Biogen’s flagship products include Tecfidera, Tysabri, Avonex, and Plegridy, primarily serving multiple sclerosis patients. The company also develops therapies for SMA, Alzheimer’s, and other neurodegenerative diseases.

2. How is Biogen diversifying its pipeline to reduce dependence on MS treatments?

Biogen is investing heavily in Alzheimer’s disease therapies, gene therapies for rare diseases like SMA, and neuropsychiatric conditions, through organic R&D and strategic acquisitions, to diversify revenue streams.

3. What are the primary competitive challenges faced by Biogen?

Key challenges include regulatory hurdles, patent expirations, competition from Roche, Novartis, and Lilly, and the high costs of clinical trials.

4. How does Biogen’s strategic partnership model enhance its market position?

Partnerships, such as with Eisai for lecanemab, allow risk-sharing, accelerate pipeline development, and provide access to complementary technologies, strengthening its competitive edge.

5. What growth opportunities exist for Biogen in emerging markets?

Expanding regulatory approvals, building local manufacturing and distribution capabilities, and establishing partnerships can facilitate market penetration in Asia-Pacific, Latin America, and Africa.

Sources:

[1] Biogen Annual Report 2022

[2] Company Website and Press Releases

[3] MarketWatch, 2023 Reports on Biotech Industry Trends