Last updated: October 15, 2025

Introduction

Bayer Healthcare is a global pharmaceutical and life sciences company, renowned for its diversified portfolio spanning prescription medicines, consumer health products, and agricultural solutions. As the healthcare industry faces rapid innovation, increasing regulatory scrutiny, and evolving market demands, Bayer’s strategic positioning becomes crucial for stakeholders aiming to understand competitive dynamics. This analysis delineates Bayer Healthcare's current market position, core strengths, challenges, and strategic considerations within the competitive pharmaceutical landscape.

Market Position of Bayer Healthcare

Global Footprint & Revenue Streams

Bayer Healthcare maintains a robust global presence with a substantial footprint across North America, Europe, and emerging markets. Its pharmaceutical division historically contributed significantly to Bayer’s overall revenue, with key therapeutic areas including cardiology, oncology, ophthalmology, and rare diseases. As of FY2022, Bayer reported approximately €20.5 billion in sales from pharmaceuticals, underscoring its substantial market footprint (Bayer Annual Report, 2022).

Key Therapeutic Strengths

- Cardiology & Hematology: Rich portfolio with drugs like Xarelto (rivaroxaban) for anticoagulation, which is a market leader with over €3 billion in annual sales.

- Oncology: Growth driven by Nubeqa (darolutamide) for prostate cancer and strategic acquisitions like BlueRock Therapeutics, aiming to strengthen cell and gene therapy pipelines.

- Ophthalmology: Dominance via Eylea (aflibercept), a top-selling drug for retinal diseases with worldwide sales exceeding €3.4 billion.

R&D & Innovation Pipeline

Bayer invests around €3 billion annually in R&D, focusing on precision medicine, rare diseases, and innovative biologics. Its strategic partnerships and acquisitions aim to bolster its pipeline, addressing unmet medical needs and expanding into personalized therapeutics. Notably, its focus on gene therapy exemplifies this long-term outlook.

Competitive Standing

Positioned as a major player, Bayer faces stiff competition from Novo Nordisk, Johnson & Johnson, Pfizer, and Roche, especially in cardiovascular and oncology segments. While Bayer commands leadership in specific niches—like anticoagulants and ophthalmology—it lags behind in the broader oncology space dominated by Roche and Merck.

Strengths of Bayer Healthcare

1. Diversified Portfolio & Market Leadership in Niche Segments

Bayer’s diversified portfolio mitigates sector-specific risks and offers cross-segment synergies. Its leadership in anticoagulation (Xarelto) and ophthalmology (Eylea) establishes stable revenue streams with high margins, critical during market uncertainties.

2. Robust R&D Investment & Innovation Drive

Continuous investment in R&D underpins Bayer’s future prospects. The company's focus on precision medicine, cell and gene therapy, and digital health positions it to capitalize on emerging trends. Strategic acquisitions, notably BlueRock Therapeutics, exemplify this forward-looking approach.

3. Global Distribution Network & Market Penetration

A wide geographical footprint ensures access to mature and emerging markets. Bayer’s manufacturing and distribution capabilities allow it to rapidly scale innovative products, maintain supply chain resilience, and respond to global health crises effectively.

4. Strong Brand Recognition & Intellectual Property Portfolio

Brands like Xarelto and Eylea enjoy high physician trust, supported by extensive clinical data and patents extending into the next decade. This status fortifies Bayer's competitive barriers and revenue stability.

5. Commitment to Sustainability & Digital Transformation

Bayer’s ESG initiatives and digital health investments enhance stakeholder confidence and operational efficiency. Digital tools enable improved R&D productivity, supply chain transparency, and patient engagement.

Strategic Challenges & Risks

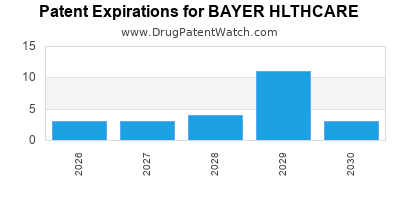

1. Patent Expirations & Generic Competition

Key products like Xarelto face impending patent expirations (expected around 2024–2026), risking revenue erosion from generic entrants. Patent cliffs necessitate diversification and robust pipeline development.

2. Competition & Market Consolidation

Major competitors continue aggressive M&A, such as Johnson & Johnson’s acquisitions in ophthalmology and Roche's oncology portfolio expansion. Bayer must innovate rapidly to maintain its market share.

3. Regulatory & reimbursement pressures

Stringent regulatory environments and cost-containment measures in key markets impact pricing and market access, particularly in the U.S. and Europe.

4. Pipeline Uncertainty & R&D Risks

Despite high R&D investment, translating experimental therapies into commercial success remains uncertain. High attrition rates in drug development pose risks to pipeline robustness.

5. Integration & Strategic Alignment Post-Acquisitions

Successful integration of acquired assets like BlueRock is essential but challenging, necessitating disciplined management to realize synergies.

Strategic Insights & Recommendations

Focus on Personalized Medicine & Rare Diseases

Bayer should accelerate personalized therapeutics through biomarker-driven clinical trials, addressing high unmet medical needs and premium pricing opportunities. Investments in rare diseases align with its current expertise and market trends.

Enhance Digital & Data-Driven Innovation

Leveraging digital health platforms, AI-enabled drug discovery, and real-world evidence analytics can improve R&D efficiency, expedite regulatory approvals, and facilitate remote patient monitoring.

Pipeline Diversification & Accelerated Commercialization

Diversification into biologics, gene therapies, and novel modalities such as antibody-drug conjugates (ADCs) can buffer patent expiries. Strategic licensing and collaborations will augment internal R&D.

Strengthen Market Access & Pricing Strategies

Proactive engagement with payers, comprehensive health economics data, and value-based pricing approaches will optimize reimbursements amid increasing cost pressures.

Global Expansion & Local Partnerships

Expanding presence in Asia-Pacific and Latin America through local partnerships can enhance access to emerging markets and diversify revenue streams. Tailored offerings and patient-centric strategies will improve market penetration.

Conclusion

Bayer Healthcare remains a formidable contender in the global pharmaceutical arena, supported by diversified products, significant R&D investments, and strategic market positioning. However, shifting competitive dynamics and patent landscapes require its sustained innovation efforts, pipeline expansion, and agility in market adaptation. By harnessing technological advancements and focusing on high-growth therapeutic areas, Bayer can reinforce its market leadership and unlock new value creation opportunities.

Key Takeaways

- Bayer Healthcare maintains strong positions in cardiology, ophthalmology, and oncology, driven by flagship products like Xarelto and Eylea.

- Investment in innovative therapies such as gene and cell therapies is critical to offset patent expiries and global competition.

- Strategic acquisitions and digital transformation are essential to accelerate R&D and market access initiatives.

- Managing patent expiries, regulatory risks, and market dynamics requires continuous agility and diversification.

- Global expansion into emerging markets offers significant growth potential, contingent upon local partnerships and tailored strategies.

FAQs

1. How does Bayer Healthcare compare with its main competitors?

Bayer holds leadership in specific niches like anticoagulation and ophthalmology but trails in broader oncology and biologics markets, competing with J&J, Roche, and Novartis, which have larger oncology and biologics pipelines.

2. What are Bayer’s primary growth drivers going forward?

Key drivers include expanding its pipeline in precision medicine, investing in cell and gene therapies, and capturing emerging markets through local partnerships.

3. How vulnerable is Bayer to patent cliffs?

Key revenue-generating products face patent expirations within the next few years, risking generic competition; diversification into biologics and innovative therapies is vital for mitigation.

4. What role does digital innovation play in Bayer’s strategy?

Digital tools enhance R&D productivity, streamline clinical trials, improve supply chain resilience, and facilitate telemedicine and remote patient management.

5. What strategic moves can Bayer undertake to sustain long-term growth?

Accelerating pipeline diversification, expanding in emerging markets, strengthening partnerships, and integrating digital health platforms are critical pathways to sustained growth.

Sources:

[1] Bayer Annual Report 2022

[2] Industry Reports on Pharmaceutical Market Dynamics 2022

[3] Strategic analyses published by IQVIA and Evaluate Pharma