ADEMPAS Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Adempas, and what generic alternatives are available?

Adempas is a drug marketed by Bayer Hlthcare and is included in one NDA. There are three patents protecting this drug and one Paragraph IV challenge.

This drug has sixty-nine patent family members in forty-three countries.

The generic ingredient in ADEMPAS is riociguat. There are two drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the riociguat profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Adempas

A generic version of ADEMPAS was approved as riociguat by MSN on September 1st, 2022.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ADEMPAS?

- What are the global sales for ADEMPAS?

- What is Average Wholesale Price for ADEMPAS?

Summary for ADEMPAS

| International Patents: | 69 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 18 |

| Patent Applications: | 1,058 |

| Drug Prices: | Drug price information for ADEMPAS |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ADEMPAS |

| What excipients (inactive ingredients) are in ADEMPAS? | ADEMPAS excipients list |

| DailyMed Link: | ADEMPAS at DailyMed |

Recent Clinical Trials for ADEMPAS

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Sheffield | Phase 4 |

| University of Cambridge | Phase 4 |

| University of Newcastle Upon-Tyne | Phase 4 |

Pharmacology for ADEMPAS

| Drug Class | Soluble Guanylate Cyclase Stimulator |

| Mechanism of Action | Guanylate Cyclase Stimulators |

US Patents and Regulatory Information for ADEMPAS

ADEMPAS is protected by five US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-001 | Oct 8, 2013 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-004 | Oct 8, 2013 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-004 | Oct 8, 2013 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-002 | Oct 8, 2013 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-004 | Oct 8, 2013 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-005 | Oct 8, 2013 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-005 | Oct 8, 2013 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ADEMPAS

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-001 | Oct 8, 2013 | ⤷ Get Started Free | ⤷ Get Started Free |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-004 | Oct 8, 2013 | ⤷ Get Started Free | ⤷ Get Started Free |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-005 | Oct 8, 2013 | ⤷ Get Started Free | ⤷ Get Started Free |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-003 | Oct 8, 2013 | ⤷ Get Started Free | ⤷ Get Started Free |

| Bayer Hlthcare | ADEMPAS | riociguat | TABLET;ORAL | 204819-002 | Oct 8, 2013 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for ADEMPAS

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Bayer AG | Adempas | riociguat | EMEA/H/C/002737Chronic thromboembolic pulmonary hypertension (CTEPH)Adempas is indicated for the treatment of adult patients with WHO Functional Class (FC) II to III withinoperable CTEPH,persistent or recurrent CTEPH after surgical treatment,to improve exercise capacity.Pulmonary arterial hypertension (PAH)AdultsAdempas, as monotherapy or in combination with endothelin receptor antagonists, is indicated for the treatment of adult patients with pulmonary arterial hypertension (PAH) with WHO Functional Class (FC) II to III to improve exercise capacity.Efficacy has been shown in a PAH population including aetiologies of idiopathic or heritable PAH or PAH associated with connective tissue disease.PaediatricsAdempas is indicated for the treatment of PAH in paediatric patients aged less than 18 years of age and body weight ≥ 50 kg with WHO Functional Class (FC) II to III in combination with endothelin receptor antagonists. | Authorised | no | no | no | 2014-03-27 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ADEMPAS

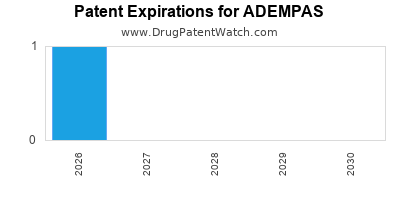

When does loss-of-exclusivity occur for ADEMPAS?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 14220801

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015019571

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 07859

Estimated Expiration: ⤷ Get Started Free

Patent: 01636

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 15002304

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5102457

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 150422

Patent: FORMAS DE METILO {4,6-DIAMINO-2-[1- (2-FLUOROBENCIL) -1H-PIRAZOLO [3,4-B] PIRIDINO -3-IL] PIRIMIDINO-5-IL} CARBAMATO DE METILO

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 150092

Patent: FORMAS DEL METIL {4,6-DIAMINO-2-[1-(2-FLUOROBENCIL)-1H-PIRAZOLO [3,4-B] PIRIDINO-3-IL] PIRIMIDINO-5-IL} METIL CARBAMATO

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 015000199

Patent: FORMAS DEL METIL {4,6-DIAMINO-2- [1-(2-FLUOROBENCIL)-1H-PIRAZOLO [3,4-B] PIRIDINO-3-IL] PIRIMIDINO-5-IL} METIL CARBAMATO

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1500852

Patent: ФОРМЫ МЕТИЛ {4,6-ДИАМИНО-2-[1-(2-ФТОРБЕНЗИЛ)-1Н-ПИРАЗОЛО[3,4-В]ПИРИДИНО-3-ИЛ]ПИРИМИДИНО-5-ИЛ}МЕТИЛ КАРБАМАТА

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 58914

Patent: FORMES DU {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDIN-3-YL]PYRIMIDIN-5-YL}MÉTHYLCARBAMATE DE MÉTHYLE (FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE)

Estimated Expiration: ⤷ Get Started Free

Patent: 60629

Patent: FORMES DU {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDIN-3-YL]PYRIMIDIN-5-YL}MÉTHYLCARBAMATE DE MÉTHYLE (FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 17488

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 86478

Estimated Expiration: ⤷ Get Started Free

Patent: 16509039

Patent: メチル{4,6−ジアミノ−2−[1−(2−フルオロベンジル)−1H−ピラゾロ[3,4−B]ピリジノ−3−イル]ピリミジノ−5−イル}メチルカルバメートの形態

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 15010725

Patent: FORMAS DE METIL {4,6-DIAMINO-2-[1-(2-FLUOROBENCIL)-1H-PIRAZOLO [3,4-B] PIRIDINO-3-IL] PIRIMIDINO-5-IL} METIL CARBAMATO. (FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3, 4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 350

Patent: Formes du {4,6-diamino-2-[1-(2-fluorobenzyl)-1h-pyrazolo[3,4-b]pyridin-3-yl]pyrimidin-5-yl}méthylcarbamate de méthyle

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1500110

Patent: FORMAS DEL METIL {4,6-DIAMINO-2-[1-(2-FLUOROBENCIL)-1h-PIRAZOLO [4,3-B] PIRIDINO-3-IL]PIRIMIDINO-5-IL} METIL CARBAMATO

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 151590

Patent: FORMAS DEL METIL {4,6-DIAMINO-2- [1-(2-FLUOROBENCIL)-1H-PIRAZOLO [3,4-B] PIRIDINO-3-IL] PIRIMIDINO-5-IL} METIL CARBAMATO

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 015501839

Patent: FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201506211R

Patent: FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 150119871

Patent: 메틸 {4,6-디아미노-2-[1-(2-플루오로벤질)-1H-피라졸로[3,4-b]피리디노-3-일]피리미디노-5-일}메틸 카르바메이트의 형태 (FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE)

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 15000361

Patent: FORMS OF METHYL {4,6-DIAMINO-2-[1-(2-FLUOROBENZYL)-1H-PYRAZOLO[3,4-B]PYRIDINO-3-YL]PYRIMIDINO-5-YL}METHYL CARBAMATE

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ADEMPAS around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Canada | 2485143 | PYRAZOLOPYRIDINES A SUBSTITUTION CARBAMATE (CARBAMATE-SUBSTITUTED PYRAZOLOPYRIDINES) | ⤷ Get Started Free |

| Croatia | P20041166 | CARBAMATE-SUBSTITUTED PYRAZOLOPYRIDINES | ⤷ Get Started Free |

| Argentina | 016736 | DERIVADOS SUSTITUIDOS DE PIRAZOL, PROCEDIMIENTO PARA SU PREPARACION, SU USO EN LA MANUFACTURA DE UN MEDICAMENTO, MEDICAMENTOS QUE LOS CONTIENEN,PROCEDIMIENTO PARA PREPARAR DICHOS MEDICAMENTOS | ⤷ Get Started Free |

| Argentina | 039789 | PIRAZOLOPIRIDINAS SUSTITUIDAS CON CARBAMATO | ⤷ Get Started Free |

| Spain | 2268363 | ⤷ Get Started Free | |

| Spain | 2255288 | ⤷ Get Started Free | |

| Guatemala | 200300101 | PIRAZOLOPIRIDINAS SUBSTITUIDAS CON CARBAMATO | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ADEMPAS

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1506193 | S1400019 | Hungary | ⤷ Get Started Free | PRODUCT NAME: RIOCIGUAT; REG. NO/DATE: EU/1/13/97 20140327 |

| 1506193 | C300659 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: RIOCIGUAT, DESGEW ENST IN DE; REGISTRATION NO/DATE: EU/1/13/907 20140327 |

| 1506193 | 132014902270282 | Italy | ⤷ Get Started Free | PRODUCT NAME: RIOCIGUAT(ADEMPAS); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/13/907, 20140327 |

| 1506193 | 92419 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: RIOCIGUAT ET SES DERIVES PHARMACEUTIQUEMENT ACCEPTABLES(ADEMPAS) |

| 1506193 | 300659 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: RIOCIGUAT, DESGEWENST IN DE VORM VAN EEN FARMACEUTISCH AANVAARDBAAR ZOUT OF HYDRAAT; REGISTRATION NO/DATE: EU/1/13/907 20140331 |

| 1506193 | 14C0032 | France | ⤷ Get Started Free | PRODUCT NAME: RIOCIGUAT,SES SELS,SES ISOMERES ET SES HYDRATES.; REGISTRATION NO/DATE: EU/1/13/907/001-015 20140327 |

| 1506193 | PA2014018 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: ; REGISTRATION NO/DATE: EU/1/13/907/001 - EU/1/13/907/015 20140327 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for ADEMPAS

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.