Last updated: July 27, 2025

Introduction

Alnylam Pharmaceuticals Inc. stands at the forefront of RNA interference (RNAi) therapeutics, a revolutionary modality in genetic medicine. As the industry shifts towards precision medicine, Alnylam's innovative pipeline, strategic collaborations, and robust market position make it a critical entity in the biotech and pharmaceutical landscape. This analysis explores Alnylam's current market stance, core strengths, competitive advantages, and strategic pathways to sustain growth amid intensifying industry competition.

Market Position and Industry Context

Alnylam’s strategic focus on RNAi-based therapeutics places it in a niche yet rapidly expanding segment of high-value genetic medicines. The RNAi platform enables targeted gene silencing, addressing previously intractable diseases with high unmet medical needs, including rare genetic disorders and those with devastating morbidity. As of 2023, Alnylam boasts the market authorization and commercialization privileges for several leading products, including Onpattro (patisiran) and Oxluma (lumasiran).

The company’s geographic footprint spans North America, Europe, and select Asia-Pacific markets, reinforced by a robust commercialization infrastructure. The global RNAi therapeutics market, valued at approximately $2 billion in 2022, is projected to grow at a CAGR exceeding 20% through 2030, driven by technological advancements and increasing pipeline approvals—placing Alnylam in a strategic position to capitalize on this growth.

Core Strengths

1. Technological Superiority and Proprietary Platforms

Alnylam’s foundational strength resides in its proprietary RNAi platform, which enables efficient, targeted gene silencing with a high degree of specificity. Its innovative delivery mechanisms, particularly lipid nanoparticle (LNP) technology, have demonstrated safety and efficacy in clinical settings. The company’s investment in platform diversification—such as GalNAc conjugates—enhances tissue-specific targeting, particularly hepatocytes, reducing side effects and improving therapeutic indices.

2. Diversified and Advanced Pipeline

Alnylam maintains a diversified pipeline spanning rare genetic diseases, cardiovascular, hepatic, and infectious diseases. Notably, its approved therapies like Onpattro address hereditary transthyretin-mediated amyloidosis (hATTR amyloidosis), showcasing clinical efficacy and robust commercial uptake. Its pipeline includes late-stage candidates like ALN-AGT, targeting hypertension and cardiovascular risk, promising significant market penetration upon approval.

3. Strategic Collaborations and Licensing Agreements

Alnylam’s collaborations with industry giants such as Novartis and Regeneron bolster its R&D capabilities and extend its market reach. Partnerships facilitate shared expertise, co-development, and commercialization, enabling rapid pipeline advancement and risk mitigation.

4. Focus on Rare and Orphan Diseases

A strategic emphasis on orphan indications offers exclusivity benefits, high unmet needs, and premium pricing potential. This focus reduces competitive pressures from blockbuster-centric strategies prevalent in traditional pharma markets, enabling stable revenue streams even with limited patient populations.

5. Strong Financial Position and Commercial Infrastructure

Alnylam has demonstrated consistent revenue growth since its IPO, driven by product sales and licensing revenues. The company maintains healthy cash reserves and significant R&D investment, positioning it competitively for pipeline expansion and technological innovation.

Competitive Position and Challenges

Market Competition

Alnylam operates amidst a competitive landscape populated by biotech firms and dominant pharma players investing heavily in genetic medicines. Companies such as BioNTech and Moderna are expanding into nucleic acid therapies, entering the RNAi space with innovative delivery platforms. Other competitors include Arrowhead Pharmaceuticals, Dicerna Pharmaceuticals (acquired by Novo Nordisk), and larger incumbents like Pfizer and Novartis, which are developing gene silencing or editing therapies.

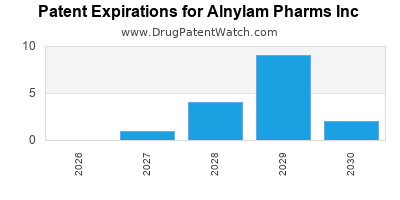

Patent Expiry and Biosimilar Threats

While Alnylam’s current product portfolio enjoys significant patent protections, the eventual expiration of key patents poses long-term revenue risks. The company’s ability to innovate and expand indications is vital to counter biosimilar penetration and maintain profitability.

Regulatory and Development Risks

Advancements in gene therapies are associated with inherent regulatory challenges, including safety concerns related to off-target effects and delivery mechanisms. Moreover, the high development costs and attrition rate in early-stage RNAi candidates necessitate strategic risk management.

Manufacturing and Supply Chain Complexities

As a biotech-centric manufacturer, Alnylam faces complexities related to scaling production for global markets, ensuring consistent quality, and managing supply chain disruptions, which could impede commercialization efforts.

Strategic Insights

1. Pipeline Expansion and Diversification

Alnylam should prioritize expanding its pipeline into more prevalent diseases, leveraging its established platform to develop therapies for common conditions such as cardiovascular, metabolic, and infectious diseases. Diversification reduces dependence on a few key products and opens broader market opportunities.

2. Enhancing Delivery Technologies

Investment in next-generation delivery platforms that enable tissue targeting beyond the liver will be crucial. Success in delivering RNAi therapeutics to muscles, lungs, or central nervous system tissues will unlock pathways for more diverse indications.

3. Strategic Mergers and Acquisitions

Selective acquisitions or partnerships could acquire novel delivery technologies, diversify the pipeline, or expand into adjacent areas like gene editing or mRNA therapeutics, which could synchronize with Alnylam's expertise in nucleic acid delivery.

4. Regulatory Engagement and Life Cycle Management

Proactive engagement with regulators towards flexible approval pathways and post-marketing surveillance will streamline commercialization. Long-term follow-up data and real-world evidence can bolster confidence in delivering safety and efficacy assurances.

5. Market Expansion and Commercial Scaling

Expanding into emerging markets with tailored pricing strategies will augment revenue. Strengthening partnerships with local distributors and investing in education can facilitate adoption in less penetrated regions.

Conclusion

Alnylam Pharmaceuticals holds a compelling position within the RNAi therapeutic market, driven by its proprietary platform, diversified pipeline, and strategic collaborations. Its focus on orphan and rare disease segments provides a competitive moat, although long-term sustainability will depend on pipeline innovation, delivery technology advancements, and global commercialization strategies. As the genetic medicine landscape evolves, Alnylam is well-positioned to capitalize on early-mover advantages, provided it navigates regulatory, patent, and manufacturing challenges effectively.

Key Takeaways

- Leadership in RNAi therapeutics affords Alnylam a unique competitive edge, with several approved products and a promising pipeline targeting diverse diseases.

- Technological innovation, especially in delivery platforms, is critical for expanding indications and tissue targeting beyond hepatocytes.

- Diversification into common diseases is vital for scaling revenue and reducing reliance on niche markets.

- Strategic collaborations with large pharma firms amplify R&D capabilities and market access.

- Proactive pipeline and innovation management will determine Alnylam’s ability to sustain long-term growth amid increasing industry competition.

FAQs

1. How does Alnylam differentiate itself in the RNAi therapeutic market?

Alnylam’s proprietary delivery platforms, notably GalNAc conjugates, enable highly targeted gene silencing with proven safety and efficacy. Its focus on rare diseases provides exclusivity benefits and high unmet needs, setting it apart from broader molecular therapy competitors.

2. What are the primary risks facing Alnylam's growth?

Patent expiries, regulatory challenges, manufacturing complexities, and increased competition from emerging nucleic acid technologies pose ongoing risks. Additionally, high R&D costs and clinical trial failures remain intrinsic to biotech innovation.

3. Which markets offer the most growth opportunities for Alnylam?

While North America and Europe remain primary markets, Asia-Pacific presents emerging opportunities given healthcare infrastructure growth and increasing adoption of genetic medicines. Expansion into these regions is strategic for long-term growth.

4. How is Alnylam positioned against competitors like Arrowhead or Dicerna?

Alnylam’s early market entry, established pipeline, and collaborations provide it with an advantage. However, competitors advancing novel delivery methods or targeting broader indications could challenge its position, emphasizing the need for continuous innovation.

5. What strategic initiatives should Alnylam pursue to sustain its market leadership?

Investing in advanced delivery technologies, pipeline diversification into prevalent diseases, expanding geographic reach, and strategic acquisitions will be critical to maintain competitive momentum and unlock new growth avenues.

Sources:

[1] Alnylam Pharmaceuticals Inc. Annual Reports, 2022.

[2] MarketResearch.com, RNAi Therapeutics Market, 2022.

[3] IQVIA, Global Healthcare Data, 2023.