Last updated: July 27, 2025

Introduction

SYNTHROID (levothyroxine sodium) remains a cornerstone in the management of hypothyroidism, a condition affecting approximately 4.6% of the U.S. population, impacting millions globally. As a synthetic form of thyroxine (T4), SYNTHROID plays a vital role in restoring normal metabolic activities disrupted by thyroid hormone deficiencies. Understanding the drug’s market dynamics and financial course involves examining its therapeutic importance, manufacturing landscape, regulatory environment, competitive positioning, and emerging trends.

Therapeutic Significance and Market Drivers

The primary demand for SYNTHROID stems from hypothyroidism’s high prevalence and the chronic nature of treatment. The typical lifelong dependency on levothyroxine translates into a stable, recurring market. Its efficacy, safety profile, and longstanding clinical trust have solidified its position as the gold standard therapy.

Key drivers include:

- Aging Population: Increased incidence of thyroid disorders among older adults fuels sustained demand, especially in developed markets.

- Chronic Disease Management: As hypothyroidism requires continuous therapy, sales are less sensitive to cyclical market fluctuations.

- Global Awareness and Diagnosis: Improved screening practices and awareness campaigns contribute to higher diagnosed cases, expanding the patient base for SYNTHROID.

Market Dynamics and Competitive Landscape

1. Market Share and Leading Manufacturers

AbbVie, through its subsidiary AbbVie (formerly owned by Merck until 2019), holds a dominant position in the SYNTHROID market, accounting for a significant share of prescriptions in the United States. The drug’s entrenched status, coupled with limited product alternatives, grants Abbott a resilient market presence despite emerging competition.

2. Generic Competition and Formulation Variability

While synthetic levothyroxine has been on patent expiry, the market is characterized by a proliferation of generic versions produced by multiple manufacturers worldwide. Despite this, branded SYNTHROID differentiates itself through quality assurance, batch consistency, and trust established over decades.

However, formulation variability among generics—particularly in bioequivalence—remains a concern for clinicians, creating opportunities for branded versions that guarantee stability and potency. This fosters a semi-oligopolistic market where trust and quality control influence prescribing behavior.

3. Regulatory Environment

The U.S. Food and Drug Administration (FDA) regulates levothyroxine products strictly, requiring bioequivalence and rigorous manufacturing standards. Recent regulatory changes have incentivized manufacturers to improve product consistency, which can limit market fragmentation but complicate generic entry.

Internationally, regulatory differences impact market access, especially in emerging economies where regulatory pathways are less standardized but growing demand creates expansion opportunities.

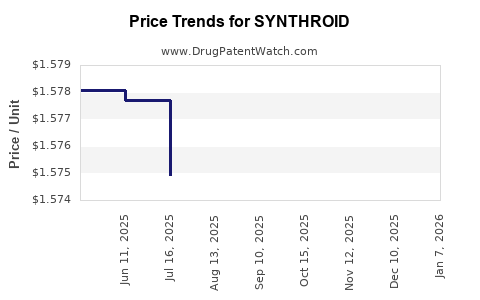

4. Pricing and Reimbursement

In mature markets like the U.S., SYNTHROID benefits from favorable reimbursement policies. Price elasticity remains low due to the chronic necessity, allowing manufacturers to maintain stable pricing. Nonetheless, pressures for cost containment may influence reimbursement rates and formulary placements.

5. Innovation and Future Therapies

The market landscape anticipates gradual shifts with the development of novel formulations—like liquid levothyroxine or implantable devices—aimed at improving absorption or compliance. While these innovations may threaten traditional tablets, SYNTHROID’s entrenched supply chain and clinician familiarity provide a substantial competitive buffer in the near term.

Financial Trajectory

Historical Perspective

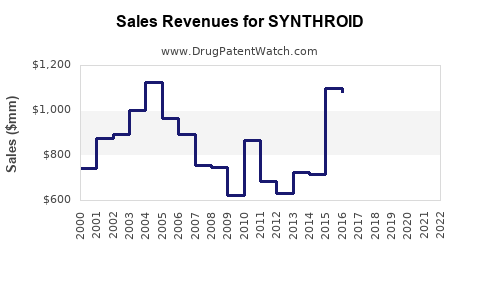

SYNTHROID has demonstrated resilient revenue streams over the past decade, buoyed by steady demand. According to IQVIA data, in the U.S., the annual sales volume surpasses several hundred million dollars, with stable year-over-year growth rates averaging approximately 2-3%. Pricing strategies and generic proliferation influence total revenue but do not significantly diminish market dominance.

Forecasting Future Revenue

Looking forward, several factors influence SYNTHROID’s financial trajectory:

- Stable or Moderate Growth: As hypothyroidism prevalence remains steady, sales are expected to maintain consistent levels, subject to demographic shifts.

- Price Optimization and Cost Management: Manufacturers investing in manufacturing efficiencies and quality control can sustain margins amidst pricing pressures.

- Regulatory and Policy Impacts: Emerging regulations around drug quality and bioequivalence may impact generic availability and pricing strategies.

Impact of Emerging Therapies

The advent of desiccated thyroid extract and compounded levothyroxine formulations pose marginal competition but have not significantly dented SYNTHROID’s market share due to better efficacy and consistency of synthetic options. However, any breakthrough in treatment—such as combination therapies—may alter the financial outlook over the next decade.

Global Market Expansion

Emerging markets represent significant growth prospects. Rising healthcare infrastructure development, increased screening programs, and rising hypothyroidism prevalence support market expansion, promising increased revenue streams over the long term. Strategic partnerships and licensing in these regions could further enhance financial performance.

Market Challenges

Despite its resilience, SYNTHROID faces specific challenges:

- Formulation Variability and Bioequivalence Concerns: These issues have prompted regulatory scrutiny, impacting generic substitution policies in some markets.

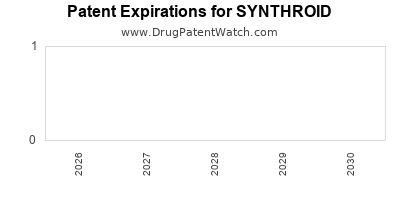

- Patent and Trademark Strategies: While the original patent expired, proprietary formulations or delivery systems could influence exclusivity periods.

- Pricing Pressures: Payer-driven cost containment initiatives may restrict pricing flexibility and impact profit margins.

Emerging Trends and Opportunities

- Precision Medicine: Personalized dosing and new delivery formats could optimize treatment outcomes, unlocking upselling and premium-priced segments.

- Digital Therapeutics: Integration with digital health monitoring tools offers avenues for enhanced patient adherence and market differentiation.

- Global Expansion: Focused efforts on developing markets with increasing hypothyroidism incidence can fuel future sales growth.

Key Takeaways

- SYNTHROID's longstanding clinical trust and stable demand underpin its resilient market position.

- The product faces limited but significant competition mainly from generics, with quality and consistency being decisive factors.

- Demographic trends and increased awareness are expected to sustain steady growth, especially in emerging markets.

- Regulatory developments around formulation standards and bioequivalence may influence market dynamics and pricing strategies.

- Innovation in drug delivery and personalized therapies present future growth avenues but may also introduce competitive challenges.

Conclusion

The market dynamics for SYNTHROID are characterized by stability underpinned by high therapeutic necessity and entrenched clinical reliance. Its financial trajectory remains positive, supported by demographic trends and global expansion opportunities, despite pressures from regulatory standards and generic competition. Manufacturers and investors should monitor evolving regulatory landscapes, technological innovations, and demographic shifts to adapt their strategies effectively.

FAQs

-

What factors contribute to SYNTHROID’s market dominance in hypothyroidism treatment?

Its proven efficacy, safety profile, long-term clinician trust, and the chronic nature of hypothyroidism drive sustained demand, reinforced by regulatory standards that favor quality and consistency.

-

How does generic competition affect SYNTHROID’s market position?

While generics have lowered prices and increased accessibility, branded SYNTHROID maintains market share through quality assurance, consistent formulation, and physician confidence, creating a semi-oligopolistic environment.

-

What are the key opportunities for growth in the SYNTHROID market?

Expansion into emerging markets, development of innovative formulations, and integration into digital health platforms are significant growth vectors.

-

What regulatory challenges could impact SYNTHROID’s future sales?

Stringent bioequivalence standards and formulation quality regulations may restrict generic market entry or alter formulation practices, potentially affecting pricing and availability.

-

What emerging therapies could threaten SYNTHROID’s market share?

Novel delivery systems, combination therapies, or genetic treatments might reduce reliance on traditional levothyroxine, but such shifts are likely at least a decade away.

Sources

[1] IQVIA, "U.S. Prescription Trends in Thyroid Medication," 2022.

[2] FDA, "Guidance on Bioequivalence and Generic Drug Approval," 2021.

[3] MarketWatch, "Global Levothyroxine Market Outlook," 2023.

[4] American Thyroid Association, "Hypothyroidism Incidence and Treatment," 2022.

[5] Pharma Intelligence, "Emerging Markets Growth in Endocrinology Pharmaceuticals," 2023.