Last updated: July 27, 2025

Introduction

Varenicline tartrate, commercially known as Chantix (or Champix outside the United States), is a prescription medication developed for smoking cessation. Since its approval by the FDA in 2006, it has emerged as a prominent pharmacologic option among anti-smoking therapies. Analyzing its market dynamics and financial trajectory requires understanding the evolving landscape of tobacco addiction management, regulatory actions, competitive forces, and broader healthcare trends shaping its commercial prospects.

Market Landscape and Demand Drivers

Global Smoking Cessation Market

The global market for smoking cessation aids was valued at approximately USD 2.2 billion in 2021, with a compound annual growth rate (CAGR) of around 8% projected through 2030 [1]. The increasing prevalence of tobacco addiction—particularly in low and middle-income countries—and heightened awareness of smoking-related morbidities continue to boost demand for effective cessation therapies, including varenicline.

Consumer and Healthcare Provider Adoption

Physician prescribing patterns and patient preferences significantly influence varenicline's market share. Its efficacy in increasing quitting success rates has positioned it as a preferred pharmacotherapy, especially among patients who have previously failed nicotine replacement therapy (NRT). However, safety concerns—including neuropsychiatric side effects—had initially tempered its adoption, prompting cautious prescribing practices.

Regulatory and Safety Influences

In 2009, the FDA issued a boxed warning regarding potential neuropsychiatric adverse events, which temporarily constrained prescription volumes. Subsequent post-market surveillance and regulatory reviews led to the removal of the boxed warning in 2016, restoring confidence and facilitating increased utilization [2]. This regulatory shift directly impacted varenicline’s financial trajectory by expanding its accessible patient population.

Competitive Environment

Varenicline faces competition from other pharmacological options, notably NRTs, bupropion, and emerging digital and behavioral therapies. Generic versions of varenicline have entered several markets, intensifying price competition and margins. Nonetheless, its superior efficacy compared to NRTs sustains its market relevance.

Pharmaceutical Company Strategies and Financial Trajectory

Market Penetration and Expansion

Pfizer initially marketed Chantix, capturing majority share in the United States and Europe. As patent exclusivity neared expiration in key jurisdictions, generic manufacturers entered, leading to a sharp decline in branded sales. Pfizer reported revenues of over USD 1 billion annually at its peak, primarily attributable to Chantix [3]. Post-generic entry, revenue diminished significantly, reflecting commoditization.

Pipeline and Product Diversification

Pfizer and other developers have invested in developing new formulations—such as extended-release patches or combination therapies—and in digital health integrations to bolster engagement and adherence. Although these innovations aim to sustain economic value, their impact remains incremental relative to the core product.

Pricing and Reimbursement Trends

Pricing strategies have adapted to competition, with some markets implementing stricter reimbursement policies. Insurance coverage and government health programs significantly influence patient access and, consequently, revenue streams. In the U.S., insurance plans have tended to favor generic offerings or alternative therapies to control costs.

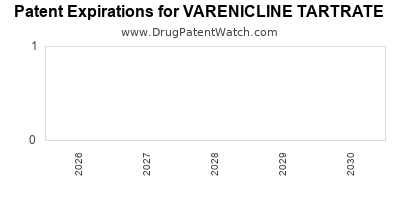

Market Entrants and Patent Challenges

The expiration of Pfizer's patents and subsequent patent litigations and settlements have facilitated generic competition, eroding profitability. Conversely, some companies explore licensing and regional exclusivity deals to prolong profitability windows.

Future Market and Financial Outlook

Growth Opportunities

Despite generic erosion, opportunities persist in niche markets—such as specialized populations, developing regions, and digital health integration—that could sustain revenue streams. The rising prevalence of tobacco use in countries like India and China presents substantial growth potential, provided access barriers are addressed.

Regulatory and Legal Risks

Further safety concerns, class-action lawsuits, or regulatory modifications could influence market stability. The confirmation or refutation of previous safety signals will remain pivotal for future sales performance.

Impact of Digital Health and Alternative Therapies

Innovative behavioral interventions and digital therapeutics may complement or substitute pharmacologic options, potentially limiting varenicline’s long-term growth. Nonetheless, these advances could also enable targeted, personalized cessation programs, indirectly benefiting pharmacotherapies by increasing overall quit rates.

Financial Trajectory Summary

Initially experiencing rapid sales growth, the market for varenicline faced decline due to patent expiry and generic competition. While branded revenues have diminished, the medication remains relevant, especially in regions with limited access to alternatives. Its long-term financial trajectory hinges on market penetration strategies, regulatory developments, and emergence of complementary or alternative cessation methods.

Regulatory and Policy Considerations

Global health initiatives increasingly advocate for comprehensive tobacco control strategies, including pharmacotherapy. Organizations such as WHO promote access to evidence-based cessation aids, potentially expanding markets. Conversely, regulatory vigilance around safety surveillance continues to shape prescribing practices and reimbursement policies, influencing financial outcomes.

Concluding Perspectives

The market dynamics for varenicline tartrate display a classic lifecycle trajectory constrained by patent expiration and competitive pressures. While current revenues are modest compared to peak periods, opportunities in emerging markets, regulatory changes, and digital health integrations offer avenues for resurgence or niche monetization. Robust surveillance, strategic diversification, and alignment with public health priorities will dictate its financial trajectory in the evolving landscape of tobacco cessation therapies.

Key Takeaways

- Market evolution: Varenicline’s initial rapid growth was driven by superior efficacy but faced setbacks due to safety concerns and patent expiry.

- Revenue decline: Branded sales have declined post-generic entry, yet global demand persists, especially in developing regions.

- Regulatory influence: Regulatory rescissions and safety perceptions materially impact prescribing behaviors and sales volumes.

- Competitive pressures: The rise of generics and alternative therapies constrains profitability but also broadens access and usage.

- Future outlook: Opportunities exist in digital health partnerships, emerging markets, and tailored behavioral programs, though long-term growth faces headwinds from competition and safety concerns.

FAQs

1. What is the current global market size for varenicline tartrate?

The global smoking cessation market, in which varenicline is a key player, was valued at approximately USD 2.2 billion in 2021, with varenicline representing a significant niche due to its efficacy and prescription requirements [1].

2. How have safety concerns affected varenicline's market performance?

Safety concerns initially led to FDA boxed warnings and subdued prescribing. Removal of these warnings in 2016 improved clinician confidence and increased utilization, positively influencing sales patterns temporarily [2].

3. What are the main competitors to varenicline?

NRTs (patches, gums), bupropion (Zyban), and emerging digital/behavioral therapies constitute the primary competitors, alongside pricing and reimbursement strategies affecting market share.

4. How does patent expiration influence the financial prospects of varenicline?

Patent expiry facilitates generic entry, significantly reducing revenues for branded manufacturers and intensifying price competition, impacting long-term profitability.

5. Are there ongoing innovations that could revive varenicline’s market relevance?

Potential innovations include combination therapies, improved formulations, and digital health integrations aimed at enhancing adherence and expanding access, especially in underserved markets.

References

[1] Grand View Research. Smoking Cessation Market Size & Share Insights (2022).

[2] U.S. Food and Drug Administration. Finalized Safety Labeling Changes for Varenicline. (2016).

[3] Pfizer Annual Reports. Revenue data for Chantix/Champix (2006–2021).