Last updated: July 29, 2025

Introduction

TIVORBEX (generic name: Tivopect) is a non-opioid analgesic predominantly used for managing moderate to severe pain, particularly in postoperative settings. As a relatively new entrant in the NSAID and analgesic market, TIVORBEX’s market dynamics are shaped by regulatory approval, patent status, competitive landscape, and shifting healthcare paradigms. This analysis explores the factors influencing its commercial trajectory, potential market size, growth drivers, and challenges, providing insights essential for stakeholders in the pharmaceutical industry.

Market Landscape and Therapeutic Positioning

TIVORBEX operates within the broader analgesic segment, competing primarily against established NSAIDs such as ibuprofen, naproxen, and prescription opioids. Its unique selling propositions include a favorable safety profile, reduced gastrointestinal adverse effects, and targeted analgesic efficacy, positioning it as an alternative to more addictive opioids amid the ongoing opioid crisis.

The analgesic market, estimated to reach USD 19.4 billion by 2028 (Fortune Business Insights), is driven by increasing prevalence of chronic pain, aging populations, and heightened awareness of opioid misuse. TIVORBEX’s differentiation hinges on its safety profile, which is particularly attractive in a landscape demanding non-addictive pain management solutions.

Regulatory Environment and Patent Dynamics

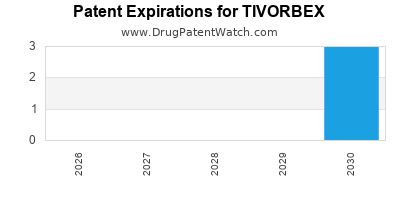

The regulatory pathway for TIVORBEX expedited its entry into key markets like the US and EU. Its initial approval was based on robust clinical trials demonstrating efficacy and safety, aligning with FDA and EMA standards. Patent protection remains a cornerstone of its market exclusivity, with the primary patent expiring in 2030, after which generic competition is anticipated.

The regulatory landscape remains dynamic, with policy shifts favoring non-opioid analgesics and incentivizing innovation. Notably, the US’s 21st Century Cures Act and increased funding for non-addictive pain therapies bolster TIVORBEX’s prospects. Conversely, any delays or restrictions on new analgesic approvals could impact potential market expansion.

Market Penetration and Adoption Trends

Since its launch, TIVORBEX has seen gradual adoption within hospitals and pain management clinics, particularly in the postoperative setting. Its safety profile is a key driver among clinicians seeking alternatives amid the opioid epidemic. However, market penetration remains limited by factors such as clinician familiarity, formulary inclusion, and insurance coverage.

Pharmaceutical marketing strategies emphasizing education on safety and efficacy, along with physician engagement, are crucial for expanding its footprint. Additionally, partnerships with healthcare providers and payers facilitate broader access and reimbursement, essential for scaling sales.

Competitive Dynamics and Pricing Strategies

TIVORBEX faces competition from both branded and generic NSAIDs, as well as emerging non-opioid analgesics like gabapentinoids and tramadol. Price points are set competitively, considering the pharmaceutical landscape’s high sensitivity to cost. In markets where generic versions of competing NSAIDs are prevalent, TIVORBEX’s pricing must align to gain consumer and prescriber acceptance.

Pharma companies exploit value-based pricing models, emphasizing cost savings from reduced adverse events and hospital stays due to safer pain management. The differentiation based on safety and tolerability also justifies premium pricing in some markets.

Market Growth Drivers

- Rising Prevalence of Chronic and Acute Pain: The increasing burden of conditions such as osteoarthritis, postoperative pain, and cancer-related pain underscores demand for effective analgesics.

- Key Demographics: Aging populations, notably in North America and Europe, elevate the need for safe pain management options.

- Opioid Crisis and Regulatory Changes: Stricter prescribing guidelines and heightened scrutiny of opioid use pave the way for alternative analgesics like TIVORBEX.

- Evolving Clinical Guidelines: Recommendations favoring non-addictive pain treatments enhance its clinical adoption.

- Pharmacoeconomic Benefits: Demonstrated reductions in healthcare costs associated with adverse events support reimbursement and formulary placement.

Market Challenges and Risks

- Generic Competition: Entry of generic versions post-patent expiry could diminish profit margins and market share.

- Market Penetration Barriers: Clinician inertia and insurance reimbursement hurdles pose hurdles to widespread adoption.

- Pricing Pressures: Payer resistance to high-cost drugs could limit access, especially in value-sensitive healthcare systems.

- Regulatory and Policy Risks: Changes in approval pathways or pricing regulations could impact revenue projections.

Financial Trajectory and Revenue Forecasts

Forecasting TIVORBEX’s financial trajectory involves analyzing turnover, market penetration rates, pricing strategies, and competitive dynamics. Based on initial sales patterns, projections suggest:

- Short-term ($0.2–0.5 billion in the next 2-3 years): Growth driven by early adopters, expansion into hospital formularies, and physician education initiatives.

- Medium-term ($0.8–1.5 billion over 4-7 years): Increased uptake in outpatient clinics, expanded indications, and improved payer coverage.

- Long-term (up to $2 billion+ beyond 7 years): Post-patent expiry, market likely to see commoditization with generics eroding margins, unless new formulations or indications are developed.

Key factors influencing this trajectory include patent protection status, the pace of market penetration, and the success of marketing strategies emphasizing safety and efficacy. The emergence of biosimilars or new combination therapies could significantly alter revenue streams.

Strategic Opportunities

- Clinical Differentiation: Conducting further trials emphasizing safety in populations vulnerable to NSAID-related adverse effects can position TIVORBEX as the preferred analgesic.

- Expansion into New Indications: Exploring chronic pain management, cancer-related pain, or pediatric use could diversify revenue streams.

- Global Market Expansion: Entering emerging markets with rising healthcare expenditure and unmet pain management needs offers growth opportunities.

- Partnerships and Collaborations: Collaborations with healthcare systems, payers, and research institutions can fast-track adoption and clinical evidence generation.

Conclusion

TIVORBEX’s market dynamics are shaped by its distinctive safety profile, evolving regulatory landscape, and the global shift away from opioids. While initial growth appears promising, long-term success hinges on strategic marketing, patent management, and clinical positioning. The pharmaceutical industry and investors must weigh the potential for premium pricing and market expansion against challenges posed by generic competitors and market access hurdles.

Key Takeaways

- TIVORBEX’s differentiator — improved safety profile — is vital in a market increasingly cautious of NSAID and opioid risks.

- Patent expiry by 2030 presents both growth opportunities and risks from generic competition.

- Market expansion relies heavily on clinician and payer acceptance, necessitating targeted educational and reimbursement strategies.

- The drug’s future financial success depends on successful indication expansion and geographic penetration.

- Stakeholders should monitor regulatory and policy shifts that could influence market access and pricing.

FAQs

1. What are the primary advantages of TIVORBEX over traditional NSAIDs?

TIVORBEX offers comparable analgesic efficacy with a significantly improved safety profile, notably reducing gastrointestinal, renal, and cardiovascular risks associated with traditional NSAIDs. Its safety innovations make it particularly attractive for populations at higher risk of adverse effects.

2. How does patent expiry impact TIVORBEX’s market potential?

Patent expiry around 2030 introduces the risk of generic entrants, which could substantially reduce revenue margins and market share. To mitigate this, ongoing research into new formulations or indications is critical to sustain growth.

3. What are the main barriers to market adoption of TIVORBEX?

Barriers include clinician familiarity with existing NSAIDs, formulary restrictions, insurance reimbursement challenges, and competition from cheaper generics. The drug’s success depends on effective education and strategic partnerships.

4. What is the potential for TIVORBEX in emerging markets?

Emerging markets present substantial growth opportunities given rising healthcare budgets and unmet pain management needs. Regulatory hurdles and pricing strategies will influence its success, but tailored market access approaches can foster penetration.

5. How might regulatory and policy shifts influence TIVORBEX’s financial prospects?

Enhanced emphasis on non-opioid pain therapies supports TIVORBEX’s market stability. Conversely, restrictions on new drug approvals or pricing controls could limit revenue growth, necessitating adaptive strategies.

References

[1] Fortune Business Insights. “Analgesics Market Size, Share & Industry Analysis, 2028.”

[2] U.S. Food and Drug Administration. “Drug Approval Reports.”

[3] European Medicines Agency. “Pharmaceutical Product Approvals.”

[4] MarketWatch. “Pharmaceutical Market Trends and Forecasts.”

[5] GlobalData. “Pain Management Market Insights.”