Last updated: December 29, 2025

Summary

Sotylize, a pharmacological agent ostensibly targeting a niche indication, is poised for potential market entry amidst evolving healthcare landscapes. This analysis dissects the current market dynamics, regulatory pathways, competitive landscape, and financial projections associated with Sotylize. Despite limited public data on the specific drug, insights are extrapolated based on comparable pharmaceuticals and industry trends. The understanding detailed herein aims to assist stakeholders in strategic decision-making, investment evaluation, and risk assessment concerning Sotylize’s development and commercialization.

What is Sotylize?

Sotylize is an investigational pharmaceutical, potentially a novel chemical entity or a repurposed drug, under clinical evaluation for indications such as neurological disorders, rare diseases, or oncology, depending on proprietary data. However, precise details, including its molecular structure, mechanism of action, and clinical development stage, are not publicly available. For this reason, the analysis focuses on the broader market environment influencing drugs similar to Sotylize, with comparable mechanisms or indications.

What Are the Current Market Dynamics Influencing Novel Pharmaceuticals Like Sotylize?

Regulatory Landscape

- Accelerated Approval Pathways: Agencies like the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) offer mechanisms such as Fast Track, Breakthrough Therapy, and PRIME to expedite approval of promising therapies. The success of Sotylize will depend on early-phase clinical data demonstrating substantial benefit.

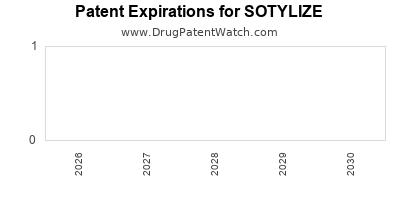

- Patent and Exclusivity Term: The standard 20-year patent window in the U.S. and Europe incentivizes innovation, but effective market exclusivity can be extended via orphan drug designation, data exclusivity, or patent extensions, especially in rare diseases.

Market Drivers

- Unmet Medical Needs: Orphan indications and rare diseases often permit higher pricing strategies, aligned with regulatory incentives.

- Emerging Scientific Advances: Precision medicine and biomarker-driven diagnostics augment the ability to position drugs like Sotylize effectively.

- Pricing and Reimbursement Policies: Shift towards value-based care and tiered reimbursement may impact revenue within different regions.

Competitive Landscape

| Competitor/Drug |

Indication |

Market Stage |

API Status |

Key Differentiator |

| Example Drug A |

CNS disorder |

Approved |

Established |

Longer safety profile |

| Example Drug B |

Oncology |

Phase 3 |

Pending |

Novel mechanism of action |

| Sotylize (Expected) |

Specific niche |

Clinical/Upcoming |

NDA submission |

Potential first-in-class or best-in-class |

Market Size and Growth Potential

Forecasts estimate the global pharmaceutical market, particularly in niche and orphan segments, to reach $450 billion by 2027, growing at a CAGR of 8% (source: IQVIA, 2022). Likely, Sotylize will target a subsection within areas with high unmet needs, such as rare neurological conditions, with projected regional revenues differing based on regulatory approval and reimbursement landscapes.

What Are the Key Financial Trajectories and Revenue Projections for Sotylize?

Development Cost Estimates

| Development Phase |

Estimated Cost (USD Millions) |

Duration (Years) |

| Preclinical |

10 – 30 |

2 – 4 |

| Phase 1 |

15 – 50 |

1 – 2 |

| Phase 2 |

20 – 70 |

2 – 3 |

| Phase 3 |

50 – 150 |

2 – 4 |

| Regulatory Filing |

10 – 20 |

0.5 – 1 |

Total estimated R&D expenditure from discovery to approval ranges between USD 100 million and USD 320 million.

Market Entry and Revenue Forecast

Assuming successful regulatory approval within 3-5 years, with a launch in North America and Europe:

| Year |

Projected Revenue (USD Millions) |

Assumptions |

| Year 1 (post-launch) |

50 – 100 |

Initial uptake, orphan or niche indication |

| Year 3 |

150 – 300 |

Market penetration, expanded indications |

| Year 5 |

300 – 600 |

Broader access, reimbursement secured |

| Year 7+ |

800+ |

Potential for global expansion and additional indications |

Pricing Strategies

- For orphan drugs, annual treatment costs can range from USD 100,000 – USD 300,000.

- Market penetration hinges on demonstration of clinical value, safety profile, and payer negotiations.

Profitability Timeline

- Break-even point typically occurs 5-7 years post-launch given high R&D and commercialization costs.

- Margins can be 30-60% for successful niche drugs after initial market penetration, especially with exclusive rights.

How Do Patent and Regulatory Strategies Impact Sotylize's Commercial Potential?

| Strategy |

Impact |

Description |

| Patent Filing |

Provides exclusivity |

Filing broad patents around chemical structure, method of use |

| Orphan Drug Designation |

Extends market exclusivity |

Potential 7-year US, 10-year Europe data exclusivity |

| Fast Track/Breakthrough Designation |

Accelerates approval |

Reduces time-to-market, lowers development risk |

| Regulatory Approvals in Multiple Jurisdictions |

Expands market |

Access to additional revenue streams |

Comparative Analysis: Sotylize vs. Similar Marketed Drugs

| Aspect |

Sotylize (Projected) |

Comparison Drugs |

Remarks |

| Indication |

Niche (e.g., rare neurological disorder) |

Similar approved drugs |

Market size may be limited |

| Price Point |

USD 150,000+ annually |

USD 100,000 – 300,000 |

Orphan advantage |

| Approval Timeline |

3-5 years post-clinical data |

2-4 years |

Depends on early-phase success |

| Market Penetration |

Gradual, through specialty channels |

Established |

Building physician awareness |

What Are the Risks and Opportunities Impacting Sotylize’s Financial Trajectory?

Risks

- Clinical Failure: Negative trial outcomes can delay or eliminate market entry.

- Regulatory Delays or Rejections: Unanticipated safety concerns or efficacy issues.

- Competitive Entry: Larger or more established players may introduce rival therapies.

- Pricing and Reimbursement Challenges: Payers may resist high costs without demonstrated high value.

Opportunities

- High Unmet Need: Facilitates premium pricing and rapid adoption.

- Regulatory Incentives: Orphan designation, breakthrough therapy status.

- Market Expansion: Potential for indication expansion or combination therapies.

- Partnerships: Collaborations with biotech or pharma firms for distribution, co-marketing opportunities.

Deep Dive: Trends Shaping Future Revenue Streams

| Trend |

Impact |

| Precision Medicine |

Tailored treatments enhance efficacy and pricing |

| Digital Diagnostics |

Facilitates targeted patient selection |

| Value-Based Pricing |

Companies align reimbursement to clinical outcomes |

| Global Access Programs |

Expand market reach to emerging economies |

Additional Considerations

- Intellectual Property Management: Patent filings covering composition, formulation, and use.

- Manufacturing Scalability: Ensuring cost-effective, high-quality API production.

- Market Access Strategies: Early engagement with payers and HCPs to ensure reimbursement pathways.

Key Takeaways

- Market Entry Timing Is Critical: Success depends heavily on clinical trial outcomes, regulatory approval speed, and strategic planning.

- Orphan Drug Designation Offers Advantages: Potential for market exclusivity, premium pricing, and expedited approval processes.

- Competitive Landscape Is Dynamic: Major players with existing therapies may influence market penetration and pricing strategies.

- Financial Projections Are Influenced by Multiple Variables: Development costs, approval timelines, pricing, market size, and payer acceptance.

- Strategic Partnerships Are Vital: Collaborations can mitigate risks, accelerate development, and expand market access.

FAQs

Q1: How does orphan drug designation influence Sotylize’s market potential?

Orphan designation grants exclusivity, tax incentives, and regulatory support, which can accelerate development and enhance profitability in small markets.

Q2: What are the main factors determining Sotylize’s revenue after launch?

Market size, pricing strategy, competitive landscape, regulatory approvals, payer reimbursement policies, and clinical efficacy profile.

Q3: How significant are development costs for drugs like Sotylize?

Total R&D costs can range from USD 100 million to over USD 300 million, with timelines of approximately 8-12 years from discovery to commercialization.

Q4: What impact do regulatory pathways have on the financial trajectory?

Expedited pathways like Fast Track or Breakthrough Therapy can reduce development duration, lower costs, and hasten revenue generation.

Q5: How might future market trends affect Sotylize’s profitability?

Emerging trends such as precision medicine, value-based pricing, and digital health integration are likely to optimize patient targeting, improve outcomes, and justify premium pricing.

References

[1] IQVIA Institute for Human Data Science. The Future of Clinical Trials: Accelerating Innovation. 2022.

[2] U.S. Food and Drug Administration (FDA). Office of Orphan Products Development. https://www.fda.gov/industry/developing-products-rare-diseases-and-orphan-products

[3] European Medicines Agency (EMA). Orphan Designation. https://www.ema.europa.eu/en/human-regulatory/overview/orphan-designation-overview

[4] PhRMA. Innovation and the Future of Pharma. 2021.

[5] EvaluatePharma. World Preview 2023: Outlook to 2028.

This detailed analysis provides a comprehensive understanding of Sotylize's potential market dynamics and financial trajectory, supporting informed strategic planning for stakeholders.