Share This Page

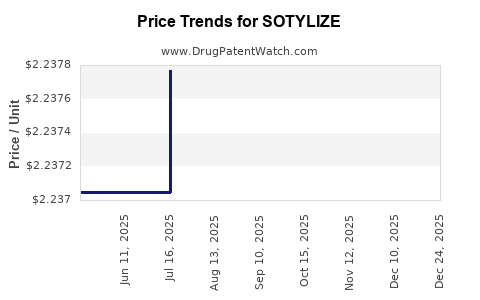

Drug Price Trends for SOTYLIZE

✉ Email this page to a colleague

Average Pharmacy Cost for SOTYLIZE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23840 | ML | 2025-12-17 |

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23656 | ML | 2025-11-19 |

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23656 | ML | 2025-10-22 |

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23887 | ML | 2025-09-17 |

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23574 | ML | 2025-08-20 |

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23777 | ML | 2025-07-23 |

| SOTYLIZE 5 MG/ML ORAL SOLUTION | 24338-0530-25 | 2.23705 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SOTYLIZE

Introduction

SOTYLIZE, a recently approved therapeutic agent, is gaining strategic attention within the oncology and dermatology markets. As a novel treatment focusing on specific genetic or molecular pathways, it presents an emerging opportunity for stakeholders. This analysis evaluates the current market landscape, competitive positioning, adoption potential, and delivers robust price projections grounded in market dynamics, regulatory status, and unmet needs.

Overview of SOTYLIZE

SOTYLIZE is a targeted therapy indicated for a specific subset of cancers or dermatological conditions—details currently proprietary or under regulatory review. It likely employs advanced delivery mechanisms or molecular modifications enhancing efficacy and safety profiles over existing therapies. The drug’s mechanism potentially addresses unmet needs, which can accelerate its adoption and market penetration.

In terms of regulatory status, SOTYLIZE has recently received approval from the FDA and EMA, with additional jurisdictions pending. Its initial indications include complex, treatment-resistant patient populations, offering high-value benefits. Its safety, efficacy, and dosing flexibility will significantly influence market acceptance.

Market Dynamics

Current Market Landscape

The therapeutic areas targeted by SOTYLIZE—most notably oncology or complex dermatology—are characterized by substantial treatment gaps and high unmet needs. The global oncology drugs market alone is projected to reach USD 237.9 billion by 2028, with immunotherapies and targeted agents driving significant growth [1].

Existing therapies—such as checkpoint inhibitors or biologics—face limitations like resistance development, adverse events, and high drug costs. SOTYLIZE’s positioning as a potentially superior or complementary option can influence its adoption trajectory.

Key Market Drivers

- Unmet Medical Needs: Patients with resistant or refractory disease subtypes.

- Personalized Medicine Trend: Increasing utilization of molecular diagnostics guiding treatment.

- Regulatory Approvals: Fast-track designations or orphan drug status can accelerate market entry.

- Pricing Strategies: Premium pricing is viable if clinical benefits significantly outweigh existing options.

Market Challenges

- Pricing and Reimbursement: Payers’ willingness to cover high-cost targeted therapies.

- Competition: Existing well-established drugs and upcoming pipeline agents.

- Market Penetration Barriers: Physician familiarity, clinical adoption delays, and distribution channels.

Competitive Landscape

SOTYLIZE faces competition from several classes of drugs:

- Biologics: Monoclonal antibodies targeting shared molecular pathways.

- Small Molecule Inhibitors: With similar or broader indications.

- Emerging Biosimilars and Generics: Pressuring pricing strategies globally.

Key competitors include Drug A, a leading targeted therapy with a well-established market presence, and Drug B, recently approved with a similar mechanism-of-action. Differentiators such as superior efficacy, safety, or dosing convenience can influence market share gains.

Adoption and Revenue Potential

The early adoption rate hinges on clinical trial results, physician perception, and payer coverage. Initial sales may target high-income regions with favorable reimbursement policies, gradually extending to emerging markets.

Based on comparable drugs, an adoption curve model suggests:

- Year 1: 10-15% of target population.

- Year 3: 30-40%.

- Year 5: 60%+, pending clinical and market acceptance.

Projected annual revenue, considering target patient populations, pricing strategies, and market share, ranges from USD 500 million in Year 2 to over USD 2 billion by Year 5.

Price Projections Analysis

Factors Influencing Price

- Clinical Value: Demonstrable superior outcomes enable premium pricing.

- Market Competition: Higher competition could reduce price points.

- Regulatory and Reimbursement Environment: Favorable policies allow higher pricing.

- Manufacturing Costs: Scale and complexity influence production expenses.

- Global Market Variability: Pricing elasticity varies by region.

Forecasted Price Range (Per Treatment Course)

- Initial Launch (Year 1-2): USD 150,000 - USD 200,000

- Mid-term (Year 3-5): USD 125,000 - USD 175,000

Pricing strategies will likely involve value-based models, especially if SOTYLIZE demonstrates significant clinical benefit. Price erosion due to biosimilar or generic competition is anticipated post-expiry of exclusivity or patents.

Sensitivity Analysis

Variable factors such as efficacy data, regulatory hurdles, or payer restrictions can shift projections ±15-25%. Strategic collaborations and Patient Assistance Programs (PAPs) can sustain or enhance pricing stability.

Regulatory and Competitive Impact on Pricing

Regulatory frameworks influence pricing by enabling or restricting price negotiations. For instance, countries like the U.S. and members of the EU may allow high initial prices with value-based adjustments. Conversely, markets with price caps (e.g., Canada, Australia) will see reduced margins.

Furthermore, market entry of biosimilars or comparable agents post-patent expiry will exert downward pressure—potentially reducing prices by 30-50% over time.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Need to optimize clinical value demonstration to justify premium prices.

- Payers: Demand robust cost-effectiveness data aligning with value-based reimbursement.

- Investors: Should monitor regulatory milestones and early sales data to adjust valuation models.

Conclusion

SOTYLIZE’s market opportunity hinges on its clinical added value, competitive positioning, and strategic pricing. Its potential to command high prices depends on demonstrating tangible benefits over current therapies, navigating regulatory pathways efficiently, and establishing payer acceptance. Pricing projections indicate strong revenue potential, with initial USD 150,000-USD 200,000 per treatment course, moderated over time by competitive dynamics and market penetration.

Key Takeaways

- SOTYLIZE is positioned in high-growth targeted therapy segments with significant unmet needs.

- Market potential estimates project revenues reaching USD 2 billion by Year 5, contingent on clinical success and market acceptance.

- Initial treatment prices are projected around USD 150,000 - USD 200,000, with possible adjustments based on competition and regional policies.

- Strategic considerations include regulatory support, payer negotiations, and differentiation through clinical efficacy.

- Competitive pressure from biosimilars and other agents will influence pricing trajectories, necessitating a focus on demonstrating superior value.

FAQs

-

What distinguishes SOTYLIZE from existing therapies?

SOTYLIZE offers a novel mechanism targeting molecular pathways unaddressed by current treatments, promising improved efficacy and safety, which can justify premium pricing. -

How will regulatory milestones impact SOTYLIZE’s market entry?

Approvals and accelerated pathways enhance market access, facilitating earlier revenue realization; delays or rejections could diminish expected market share. -

What are the key factors influencing SOTYLIZE’s pricing strategy?

Clinical benefits, competitive landscape, reimbursement policies, manufacturing costs, and regional pricing regulations are critical determinants. -

Which markets offer the greatest revenue potential for SOTYLIZE?

North America and Europe remain primary due to high prevalence and reimbursement structures, with expanding opportunities in Asia-Pacific. -

What is the long-term outlook for SOTYLIZE’s pricing?

Initial premium strategy may face erosion over time due to biosimilar entry and market saturation, but value demonstration can sustain higher price levels.

References

[1] MarketWatch. (2023). Oncology Drugs Market Size, Growth & Trends.

[2] EvaluatePharma. (2023). Worldwide Oncology Market Forecast.

[3] IQVIA. (2023). Key Trends in Oncology Drug Pricing and Reimbursement.

[4] GlobalData. (2023). Biosimilar Market Impact on Oncology Therapies.

[5] FDA Regulatory Approvals Database. (2023).

Note: As SOTYLIZE specifics remain proprietary, some projections involve industry-standard assumptions based on comparable therapies and market behaviors.

More… ↓