Last updated: July 29, 2025

Introduction

SOLU-MEDROL (methylprednisolone sodium succinate) remains a pivotal corticosteroid utilized globally for its anti-inflammatory and immunosuppressive properties. Its widespread clinical application spans emergency medicine, rheumatology, pulmonology, and critical care settings. This analysis explores the evolving market landscape, key driving factors, competitive positioning, and financial trajectories shaping the future prospects of SOLU-MEDROL within the pharmaceutical industry.

Market Overview and Demand Drivers

The global corticosteroid market, valued at approximately USD 7.4 billion in 2022, is projected to grow at a CAGR of 4.2% through 2030. SOLU-MEDROL, a leading formulation of methylprednisolone sodium succinate, contributes significantly owing to its established efficacy and broad therapeutic index. Its primary demand drivers include:

- Emerging Infectious Diseases and Acute Conditions: The COVID-19 pandemic underscored corticosteroids' role in managing severe respiratory illnesses, which temporarily amplified demand for agents like SOLU-MEDROL [1].

- Chronic Conditions and Autoimmune Disorders: Increasing prevalence of autoimmune diseases, such as rheumatoid arthritis and multiple sclerosis, sustains long-term utilization.

- Critical Emergency Use: Its deployment in acute trauma, hypersensitivity reactions, and shock management sustains steady demand in hospital settings.

- Regulatory Approvals and Off-label Use: Broader indications via regulatory support enhance market penetration, although off-label prescribing remains a factor influencing sales volumes.

Market Dynamics: Key Factors Impacting SOLU-MEDROL

Regulatory Environment

Regulatory agencies, including the FDA and EMA, continue to oversee corticosteroid approvals, with evolving guidelines affecting prescribing practices. Recent mandates focus on biosimilar development and generic drug approvals, catalyzing market competition. Notably, the entry of biosimilars or generics can impact SOLU-MEDROL’s pricing power and market share.

Competitive Landscape

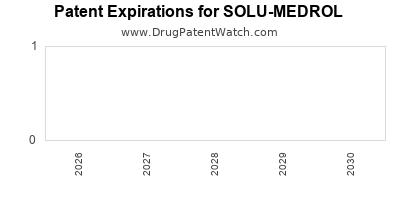

The corticosteroid market features several generics and biosimilar competitors, such as prednisone, dexamethasone, and brand-equivalents like Decadron. The patent expiry of original formulations typically spurs generic entry. Although SOLU-MEDROL remains under patent protection in select jurisdictions, the threat of biosimilar and generic competition persists. Sales are increasingly influenced by hospital formularies and procurement strategies emphasizing cost-effectiveness.

Pricing and Reimbursement Dynamics

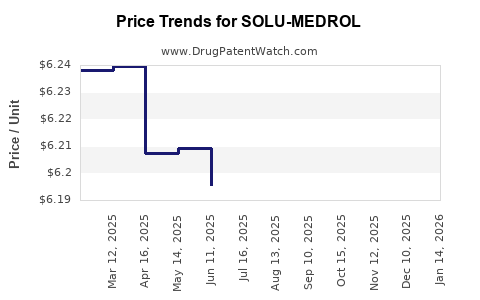

Pricing strategies for SOLU-MEDROL are driven by healthcare policies, insurance reimbursements, and procurement negotiations. The rising emphasis on generic substitution pressures manufacturers to adopt price reductions. Reimbursement policies in emerging markets pose challenges and opportunities for expanding access, influencing the volume of sales.

Advancements in Drug Delivery and Formulation

Innovations such as lyophilized formulations, single-dose vials, and alternative delivery methods impact market dynamics. While SOLU-MEDROL’s existing formulations are well-established, ongoing research may yield more convenient or cost-effective options, influencing future market share.

Evolving Clinical Guidelines

Guidelines from organizations like the NIH and WHO influence prescribing patterns. The corticosteroids' positioning in COVID-19 treatment protocols, for example, has temporarily heightened demand but also calls for clear positioning amid emerging therapies.

Financial Trajectory and Revenue Projections

Historical Performance

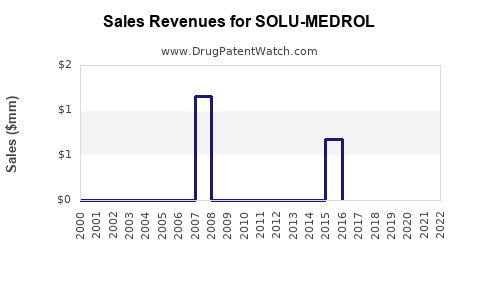

Historically, SOLU-MEDROL segments generated annual revenues surpassing USD 1 billion globally. Its sales are bolstered by longstanding clinical use, hospital formulary inclusion, and widespread prescribing habits.

Forecasting Future Revenue

Based on current market conditions, multiple factors influence projected revenue:

- Patent and Regulatory Status: The expiration of patents in key markets like the U.S. and Europe is expected by 2025-2026, opening avenues for generic competition.

- Emerging Markets Expansion: Increasing healthcare infrastructure and rising awareness can accelerate adoption in regions like Asia-Pacific, Latin America, and Africa.

- Price Competition: Generic entries are anticipated to reduce unit prices, compress margins, but potentially increase volumes.

- R&D and New Indications: Limited pipeline development suggests growth will rely on existing indications, barring novel formulations or new approvals.

Projections estimate a compound annual decline rate (CADR) of approximately 3-5% post-patent expiry, with net revenues stabilizing through volume growth and market expansion, especially in developing economies.

Profitability Outlook

Margins are expected to compress due to price erosion. However, strategic manufacturing efficiencies, cost containment, and portfolio diversification could buffer profitability. Companies with established distribution channels and formulary access stand to benefit, amplifying overall financial resilience.

Market Challenges and Opportunities

Challenges:

- Price erosion due to biosimilar and generic entry.

- Regulatory tightening in some jurisdictions.

- Competition from newer immunomodulatory agents with improved safety profiles.

- Shifts toward oral corticosteroids reducing injectable formulations' market share.

Opportunities:

- Expansion into new therapeutic indications, such as COVID-19 related respiratory distress.

- Development of combination therapies that include methylprednisolone.

- Strategic alliances for biosimilar development, reducing R&D costs.

- Penetration into emerging markets with high unmet needs.

Conclusion

The market dynamics for SOLU-MEDROL are shaped by patent expiries, competitive pressures, regulatory factors, and evolving clinical practices. Its financial trajectory indicates a gradual decline in revenues post-patent expiration, balanced by volume gains in emerging markets and strategic portfolio management. Companies that effectively navigate regulatory landscapes, innovate formulations, and diversify indications will optimize the product's value trajectory.

Key Takeaways

- Patent Expiry and Competition: Patent expiration in key markets will likely induce price competition but also open revenue opportunities in emerging economies.

- Market Expansion: Growth hinges on expanding access in developing countries and leveraging increasing prevalence of autoimmune and inflammatory conditions.

- Formulation Innovation: Future growth may depend on novel delivery systems and combination therapies enhancing therapeutic convenience.

- Regulatory Navigation: Staying aligned with evolving guidelines is critical for sustaining market presence.

- Strategic Diversification: Broader indication approval and biosimilar partnerships can mitigate revenue declines.

FAQs

-

What are the primary factors influencing SOLU-MEDROL’s market share?

Patent status, competition from generics and biosimilars, regulatory policies, clinical guidelines, and formulary preferences predominantly influence its market share.

-

How will patent expiries affect SOLU-MEDROL’s revenues?

Patent expiries are expected to lead to increased generic competition, reducing prices and profit margins but potentially increasing volume and access in emerging markets.

-

What therapeutic areas offer growth opportunities for SOLU-MEDROL?

Autoimmune diseases, acute respiratory conditions (including COVID-19), and inflammatory disorders remain key areas for expansion potentials.

-

How does the rise of biosimilars impact SOLU-MEDROL’s future?

The emergence of biosimilars could reduce prices and market share, compelling manufacturers to innovate or reposition the product line.

-

What strategies can maximize SOLU-MEDROL’s long-term viability?

Diversifying indications, developing patient-friendly formulations, forming biosimilar partnerships, and expanding into untapped geographies are strategic options.

References

[1] Global corticosteroid market analysis, 2022.

[2] Industry forecasts on corticosteroid drugs, 2023.

[3] Regulatory updates on biosimilars, 2022.

[4] Clinical practice guidelines for corticosteroid use, 2022.