Share This Page

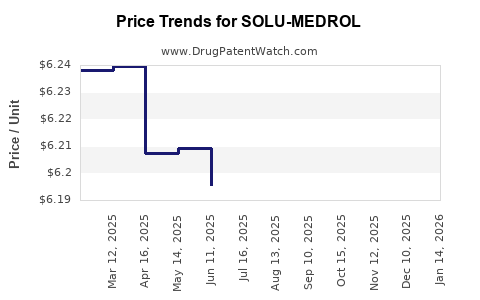

Drug Price Trends for SOLU-MEDROL

✉ Email this page to a colleague

Average Pharmacy Cost for SOLU-MEDROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SOLU-MEDROL 40 MG VIAL | 00009-0039-32 | 6.25309 | EACH | 2025-12-17 |

| SOLU-MEDROL 40 MG VIAL | 00009-0039-06 | 6.25309 | EACH | 2025-12-17 |

| SOLU-MEDROL 40 MG VIAL | 00009-0039-28 | 6.25309 | EACH | 2025-12-17 |

| SOLU-MEDROL 125 MG VIAL | 00009-0047-22 | 10.09458 | EACH | 2025-12-17 |

| SOLU-MEDROL 125 MG VIAL | 00009-0047-22 | 10.14925 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SOLU-MEDROL

Introduction

SOLU-MEDROL (methylprednisolone sodium succinate) is a potent corticosteroid widely used in various clinical settings, including emergency medicine, rheumatology, and critical care. Its broad therapeutic applications and established efficacy make it a significant drug in the corticosteroid segment. As the pharmaceutical landscape evolves with increased emphasis on specialty drugs and biosimilars, understanding SOLU-MEDROL's market positioning, competitive dynamics, and price trajectories is essential for stakeholders ranging from manufacturers to healthcare providers.

Market Overview

Global Market Size and Trends

The global corticosteroid market, valued at approximately USD 4.95 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of about 4.3% through 2030 [1]. SOLU-MEDROL, as a leading injectable corticosteroid, accounts for a substantial portion of this segment, especially within hospital and emergency settings.

Factors driving growth include:

- Increasing prevalence of autoimmune and inflammatory diseases: Conditions such as rheumatoid arthritis, asthma, and multiple sclerosis are on the rise, amplifying demand for corticosteroids.

- Expanding use in critical care: The COVID-19 pandemic has accentuated corticosteroid use, notably dexamethasone, but methylprednisolone remains integral in various treatment protocols.

- Regulatory approvals and expanded indications: Ongoing clinical trials and expanded approvals bolster market opportunities.

Market Segments and Key Players

The corticosteroid market primarily segments into oral, injectable, and topical formulations. SOLU-MEDROL principally resides in the injectable segment, which is projected to expand at a CAGR of 4.8%, driven by hospitalizations and emergency treatments.

Leading competitors include Pfizer (the original manufacturer), Teva Pharmaceuticals, Sandoz, and Mylan. The entry of biosimilars and generics increases market competitiveness, compelling price adjustments.

Regulatory and Competitive Dynamics

Patent and Patent Expirations

Pfizer's patent protection for SOLU-MEDROL expired in key markets such as the U.S. in early 2010, leading to scope for generic and biosimilar entrants [2]. The proliferation of generic methylprednisolone formulations has introduced price competition, putting downward pressure on brand-name prices.

Biosimilar and Generic Competition

While the term "biosimilar" typically pertains to biologics, methylprednisolone's small-molecule status invites generic competition. Several generics are marketed globally, often at significantly lower prices. Nonetheless, Pfizer maintains a presence through differentiated formulation and quality standards.

Pricing Analysis

Historical Pricing Trends

Historically, SOLU-MEDROL's price has seen a gradual decline consonant with generic market entry. In the U.S., the average wholesale price (AWP) for a 40 mg vial was approximately USD 25–30 in 2010, stabilizing at lower levels as generics proliferated, approximate to USD 10–15 by 2020 [3].

Current Pricing Landscape

Current pricing varies significantly across geographies:

- United States: Retail prices for a 40 mg vial range from USD 8-12, with institutional discounts often reducing procurement costs further.

- Europe: Prices tend to be lower, with some countries negotiating around EUR 5-8 per vial.

- Emerging Markets: Prices are often subsidized or discounted, ranging from USD 3-7 per vial.

The price reduction trend is influenced by:

- Increased generic availability.

- Purchaser negotiations, especially under hospital formularies.

- Regulatory policies aimed at lowering drug costs.

Price Projections

Looking forward, several factors are poised to influence price dynamics:

- Continued generic penetration: Further erosion of brand premiums is expected to sustain downward pressure, likely stabilizing the price at or below current levels.

- Market consolidation and negotiating power: Larger hospital systems and government purchasers may negotiate prices downward by leveraging bulk procurement.

- Regulatory interventions: Policies aimed at drug affordability could enforce price caps or incentivize biosimilar and generic competition.

- Potential new formulations or indications: Any approved biosimilar or alternative delivery systems could alter competitive and pricing landscapes.

Projected Price Range (2023–2030):

- Institutional setting: USD 5–10 per vial (USD 5–7 in the U.S. likely).

- Average retail price: Remains stable or slightly declines, trending toward USD 4–8 per vial by 2030.

Market and Price Drivers

- Healthcare expenditure expansion: Rising global healthcare budgets augment demand for cost-effective corticosteroid therapies.

- Policy shifts favoring generics: Governments and payers prioritize lower-cost alternatives, fostering competitive pricing.

- Clinical demand stability: Chronic and acute indications ensure a steady need, mitigating drastic price fluctuations.

- Innovation in formulations: Long-acting or combination formulations, if developed, could reposition pricing dynamics.

Challenges and Opportunities

Challenges

- Biosimilar and generic competition reducing profitability for original manufacturers.

- Price regulations in certain markets restricting pricing flexibility.

- Market saturation in mature markets, limiting growth prospects.

Opportunities

- Expanding indications, including dermatology and neurology.

- Emerging markets presenting growth potential due to increased healthcare spending.

- Development of superior formulations offering improved delivery or stability, commanding premium pricing.

Key Takeaways

- The global SOLU-MEDROL market is mature, with significant generic penetration exerting downward pressure on prices.

- Price projections indicate stabilization at or below current levels, especially in high-volume institutional settings.

- Competitor dynamics, regulatory policies, and innovation trajectories will shape future pricing strategies.

- Cost-effective use within hospitals and healthcare systems remains the central market driver.

- Stakeholders must closely monitor regulatory changes and market entries to optimize procurement and pricing strategies.

FAQs

1. How does the expiration of Pfizer's patent impact SOLU-MEDROL pricing?

Patent expiration in major markets opened the door for generic manufacturers, leading to increased competition and reduced prices. This trend has persisted, with generics often offering comparable efficacy at lower costs, contributing to a price decline for the drug.

2. Are biosimilars relevant to SOLU-MEDROL?

No, because methylprednisolone is a small-molecule corticosteroid. The term "biosimilar" applies primarily to biologic drugs. However, multiple generic versions act as therapeutically equivalent alternatives.

3. What factors could cause SOLU-MEDROL prices to increase?

Price increases could occur if new, patent-protected formulations or delivery systems emerge, or if regulatory policies restrict generic competition. Also, shortages or manufacturing issues might temporarily elevate prices.

4. How do regional pricing differences impact global access to SOLU-MEDROL?

Price disparities influence affordability, with lower prices in emerging markets enhancing access. Conversely, high prices in certain markets may limit utilization, especially where healthcare budgets are constrained.

5. Will the growing use of corticosteroids like dexamethasone overshadow SOLU-MEDROL?

While dexamethasone has gained prominence, especially during COVID-19, SOLU-MEDROL remains valuable for specific indications requiring methylprednisolone's potency and pharmacokinetic profile, sustaining its market relevance.

References

[1] Mordor Intelligence. "Global Corticosteroids Market – Growth, Trends, COVID-19 Impact, and Forecasts (2022-2030)."

[2] U.S. Patent and Trademark Office. "Patent Expiry and Market Entry Data."

[3] Red Book. "U.S. Retail Prices and Wholesale Acquisition Costs (WAC) for Methylprednisolone."

More… ↓