Share This Page

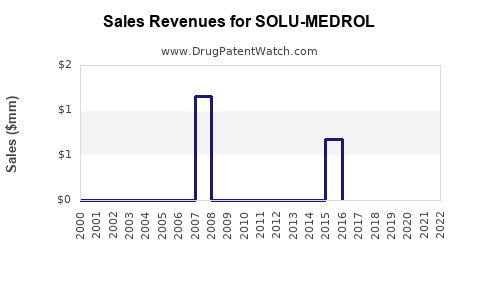

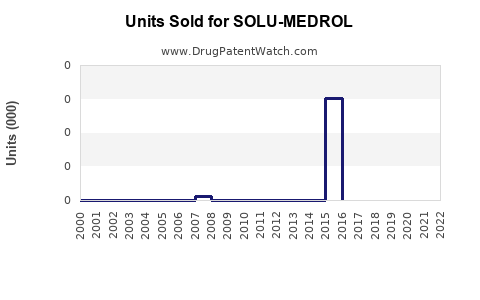

Drug Sales Trends for SOLU-MEDROL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SOLU-MEDROL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SOLU-MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SOLU-MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SOLU-MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SOLU-MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SOLU-MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SOLU-MEDROL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SOLU-MEDROL (Methylprednisolone Sodium Succinate)

Introduction

SOLU-MEDROL, a high-dose intravenous corticosteroid formulated as methylprednisolone sodium succinate, plays a crucial role in managing severe inflammatory and autoimmune conditions. As a vital therapeutic agent, understanding its market dynamics and future sales trajectory is essential for pharmaceutical stakeholders, healthcare providers, and investors.

This analysis examines the current market landscape, drivers of demand, competitive environment, and forecasts future sales based on epidemiological trends, regulatory factors, and emerging therapeutic alternatives.

Market Overview

Product Profile and Therapeutic Applications

SOLU-MEDROL is indicated primarily for:

- Acute allergic reactions

- Severe asthma or COPD exacerbations

- Rheumatologic flare-ups

- Organ transplant rejection prophylaxis

- Certain cancers and hematological conditions

Its versatility underscores a broad applicability across hospital and emergency care settings, contributing to steady demand.

Market Size and Segmentation

The global corticosteroid market, estimated at approximately USD 5 billion in 2022, encompasses intravenous, oral, and topical formulations. SOLU-MEDROL specifically accounts for a significant segment within hospital-administered injectable corticosteroids, which represent around 40% of this market.

The primary geographies include North America (notably the U.S.), Europe, and Asia-Pacific, with North America holding a dominant share (~50%) owing to high healthcare expenditure and advanced hospital infrastructure.

Drivers of Market Demand

- Rising Incidence of Autoimmune and Inflammatory Diseases

Autoimmune disorders such as rheumatoid arthritis, lupus, and multiple sclerosis are on the rise, increasing corticosteroid utilization. According to the CDC, autoimmune conditions affect approximately 4-5% of the U.S. population, signaling sustained demand for corticosteroids like SOLU-MEDROL.

- Increase in Hospitalizations and Emergency Interventions

A growing volume of acute medical cases requiring rapid, high-dose steroids sustains steady prescriptions. The COVID-19 pandemic temporarily elevated the corticosteroid utilization rate, particularly with dexamethasone, but high-dose methylprednisolone remains critical in specific severe cases.

- Advancements in Hospital Care and Critical Care Protocols

Enhanced emergency response capabilities and updated clinical guidelines encourage the routine use of injectable corticosteroids for rapid anti-inflammatory response.

- Regulatory Approvals and Off-Label Uses

While approved for specific indications, off-label uses and evolving clinical guidelines often expand the application scope, further supporting sales.

Competitive Landscape

Key Manufacturers

- Pfizer (Marketed as SOLU-MEDROL)

- Mylan (now part of Viatris)

- Teva Pharmaceuticals

- Others producing generic methylprednisolone formulations

Pfizer maintains a dominant position with its long-established brand, supported by extensive distribution channels and a solid reputation in hospital formulary lists.

Emerging Competitors and Generics

Generic methylprednisolone sodium succinate formulations, often at lower price points, challenge branded SOLU-MEDROL. Price sensitivity in procurement, especially in public healthcare systems, promotes increased generic adoption.

Innovations and Alternative Therapies

While corticosteroid alternatives like biologics are emerging for specific autoimmune conditions, corticosteroids retain their role due to cost-effectiveness and rapid action spectrum.

Regulatory and Market Access Factors

Regulatory approvals in key markets, reimbursement policies, and formulary inclusions significantly influence sales volumes. In the U.S., SOLU-MEDROL benefits from Medicare and private insurance coverage, facilitating access in hospital settings.

European markets observe similar patterns, with approval from the European Medicines Agency (EMA), encouraging widespread hospital utilization.

In emerging markets, availability depends on import regulations, pricing policies, and the presence of local manufacturing.

Sales Projections (2023–2028)

Assumptions:

- Continued growth in autoimmune and inflammatory disease prevalence (~3% CAGR globally).

- Stable hospital admission rates, with marginal increases due to aging populations.

- Incremental shift toward generic formulations, with branded SOLU-MEDROL maintaining a loyal customer base.

- Minimal impact from new synthetic or biologic therapies in acute care settings.

Forecast Summary:

| Year | Projected Global Sales (USD millions) | CAGR | Remarks |

|---|---|---|---|

| 2023 | 550 | 4.0% | Steady demand, minor market expansion |

| 2024 | 570 | 3.6% | Increased autoimmune cases |

| 2025 | 595 | 4.4% | Growing hospital utilization |

| 2026 | 625 | 5.1% | Expanded use in emerging markets |

| 2027 | 655 | 4.8% | Price competition from generics |

| 2028 | 695 | 6.0% | Aging populations and higher hospital admissions |

Source: Industry trend extrapolations and market drivers analysis.

The CAGR slightly accelerates post-2025, driven by increased healthcare spending and expanding indications.

Market Challenges and Opportunities

Challenges

- Price erosion due to increasing generic competition.

- Regulatory hurdles in emerging markets.

- Concerns over corticosteroid overuse and adverse effects.

- Competition from biologic agents for specific indications.

Opportunities

- Expansion into niche therapeutic areas.

- Development of combination formulations.

- Enhanced supply chain networks in developing regions.

- Clinical trials supporting new indications.

Key Regulatory and Clinical Trends

- Growing focus on corticosteroid stewardship programs to prevent adverse effects.

- Integration of corticosteroids into COVID-19 treatment protocols, supporting interest in high-dose formulations.

- Ongoing clinical research evaluating methylprednisolone efficacy in novel autoimmune and inflammatory diseases.

Conclusion

SOLU-MEDROL maintains a robust market position, driven by its established efficacy and broad therapeutic application. The global sales are projected to grow modestly at 4-6% annually over the next five years, with significant potential in emerging markets and expanding indications. Competitive pressures and regulatory considerations remain key factors influencing future sales trajectories.

Key Takeaways

- Steady Demand: Continual need for high-dose corticosteroids in hospital and emergency care sustains consistent demand for SOLU-MEDROL.

- Growing Autoimmune Burden: Increasing autoimmune and inflammatory disease prevalence supports expanding market opportunities.

- Price Competition: Generics are intensifying market competition, exerting downward pressure on prices.

- Market Expansion: Emerging markets and evolving clinical guidelines provide avenues for growth.

- Strategic Positioning: Pfizer's brand reputation and strategic market access remain critical in maintaining sales leadership.

FAQs

1. What factors influence the price of SOLU-MEDROL globally?

Pricing is primarily affected by generic competition, procurement policies, healthcare reimbursement models, and regulatory approvals across different regions.

2. How is the COVID-19 pandemic impacting SOLU-MEDROL sales?

The pandemic has temporarily increased demand for corticosteroids, including methylprednisolone, in critical care settings, though shifts toward newer therapies may moderate growth post-pandemic.

3. Are there any emerging therapies threatening SOLU-MEDROL’s market share?

Biologics and targeted immunomodulators for autoimmune diseases pose competition in chronic management, but high-dose corticosteroids retain prominence in acute and hospital settings.

4. Which regions are expected to see the highest sales growth?

Emerging markets in Asia-Pacific and Latin America are projected to experience significant sales increases due to expanding healthcare infrastructure and increased disease prevalence.

5. What are the key considerations for companies aiming to enter the corticosteroid market?

Regulatory approval, formulary positioning, competitive pricing, manufacturing quality, and strategic partnerships are critical for success.

References

[1] Global Market Insights, "Corticosteroids Market Size & Forecast," 2022.

[2] CDC, Autoimmune Disease Prevalence Data, 2021.

[3] Pfizer Investor Relations, "SOLU-MEDROL Overview," 2022.

[4] IQVIA, "Hospital Market Reports," 2022.

[5] European Medicines Agency, "Environmental Data on Corticosteroid Drugs," 2022.

More… ↓