Last updated: July 27, 2025

Introduction

Rizatriptan benzoate, a selective serotonin receptor agonist, remains a pivotal medication in the treatment of acute migraine attacks. Since its FDA approval in 1998, it has garnered significant market share and continues to demonstrate therapeutic relevance amid evolving competitive landscapes. Analyzing its market dynamics and financial trajectory offers crucial insights for pharmaceutical companies, investors, and healthcare stakeholders aiming to navigate the complexities of migraine therapeutics.

Overview of Rizatriptan Benzoate

Rizatriptan benzoate operates by stimulating 5-HT1B/1D receptors, constricting cranial blood vessels and inhibiting pro-inflammatory neuropeptide release. Its fast action and oral formulation have established it as a preferred option over some predecessors, such as sumatriptan. Despite the rise of newer drugs, including gepants and ditans, rizatriptan maintains a significant position owing to its efficacy, safety profile, and established prescribing patterns.

Market Size and Growth Drivers

Global Market Valuation

The migraine therapeutics market, within which rizatriptan competitors reside, was valued at approximately USD 4.6 billion in 2022, with projections reaching USD 7 billion by 2030 [[1]]. Rizatriptan contributes a notable segment owing to its widespread utilization, particularly in North America and Europe, where migraine prevalence is high.

Increasing Prevalence of Migraine

An estimated 1 billion people globally suffer from migraines, with 12% of the population affected [[2]]. The growing burden of migraine translates into consistent demand for effective acute treatments. Rising awareness and diagnosis rates fuel pharmaceutical sales, benefitting drugs like rizatriptan.

Advancements and Competition

While rizatriptan remains efficacious, the advent of new classes such as gepants (ubrogepant, rimegepant) and ditans (-lasmiditan) has intensified competition. These newer agents appeal due to fewer contraindications, fewer drug interactions, and better tolerability profiles, leading to a potential market share shift [[3], [4]].

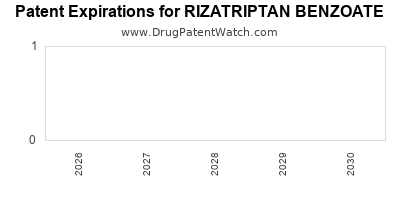

Patent Expiry and Generics

Rizatriptan benzoate's patent expiry occurred approximately in late 2000s, prompting generic entry. Generics typically reduce prices by 20-80%, impacting brand sales but expanding access. The proliferation of generics introduces price competition but maintains volume-driven revenues, especially in cost-sensitive markets.

Market Dynamics Shaping Rizatriptan’s Trajectory

Prescribing Trends and Physician Preferences

Physicians often favor older, well-established medications due to familiarity and insurance formulary considerations. Despite newer options, rizatriptan’s proven efficacy sustains its prescribing rate, especially in acute settings. Nevertheless, the medical community's cautious stance toward drugs with central nervous system contraindications influences utilization patterns.

Regulatory Environment

Regulatory approvals for newer agents, along with updated safety guidelines, impact rizatriptan’s market access. For instance, the contraindication of triptans in patients with cardiovascular risk factors continues to limit use in certain populations, slightly constraining market potential [[5]].

Reimbursement Policies

Insurance coverage significantly influences patient access. In countries with comprehensive coverage, utilization remains high; where reimbursement is limited or requires prior authorization, utilization declines. Generic availability helps maintain affordability, supporting ongoing prescriptions.

Competitive Landscape

The emergence of newer drugs with novel mechanisms offers alternative treatments. Gepants and ditans, marketed as having fewer cardiovascular restrictions, attract patients previously unsuitable for triptans. Companies actively market these as first-line treatments, possibly cannibalizing rizatriptan’s market share.

Price Trends and Market Penetration

Post-generic entry, price erosion has been notable, stimulating increased volume but compressing profit margins for manufacturers. Strategic positioning, including co-marketing and combination therapies, can offset revenue declines and sustain financial health.

Financial Trajectory and Revenue Outlook

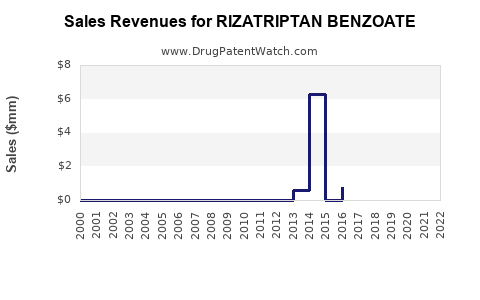

Historical Revenue Performance

In its prime, rizatriptan generated annual sales of several hundred million USD globally. For example, a report indicated peak sales exceeding USD 300 million in the early to mid-2000s [[6]]. Generic proliferation subsequently reduced this figure considerably, with current revenues estimated to be significantly lower.

Forecasting Future Revenue

Considering current market trends, the pharmaceutical revenue from rizatriptan is expected to decline gradually due to:

- Increasing adoption of newer therapeutic options.

- Price competition from generic formulations.

- Prescriber and patient preferences shifting towards drugs with improved tolerability.

However, in emerging markets where generics are less penetrated and migraine prevalence remains high, sales may sustain or slightly grow.

Impact of Novel Therapy Integration

The integration of CGRP antagonists (e.g., erenumab as a preventive agent) also impacts acute medication demand. While these are preventive treatments, their use influences overall migraine management strategies, potentially reducing reliance on acute therapies like rizatriptan over time.

Opportunity for Lifecycle Extension

Patent strategies, formulation innovations (e.g., nasal spray), and combination therapies can potentially extend rizatriptan’s market life. Additionally, developing pediatric formulations might open new revenue streams, depending on regulatory approvals.

Strategic Considerations for Stakeholders

- Pharmaceutical companies should optimize pricing strategies and expand access in underserved markets.

- Investors must evaluate the sustainability of revenues considering patent cliffs and competitive threats.

- Healthcare providers should weigh efficacy, safety, and patient preferences when prescribing, influencing market dynamics.

Key Takeaways

- Rizatriptan benzoate remains a significant acute migraine therapeutic, but its market share is under pressure from newer agents with favorable safety profiles.

- The global migraine market offers growth opportunities, especially in regions with high prevalence and limited access to advanced treatments.

- Generic entry has driven price reductions, transforming revenue prospects—necessitating strategic adjustments to sustain profitability.

- Evolving prescribing practices, regulatory updates, and competitive innovation significantly influence rizatriptan’s financial trajectory.

- Lifecycle management strategies, including formulation enhancements and expanding indications, are critical for maintaining relevance and revenue streams.

Conclusion

Rizatriptan benzoate’s market dynamics are shaped by a complex interplay of clinical, regulatory, and competitive factors. While facing challenges from newer therapies and generics, it maintains a substantial presence driven by proven efficacy and physician familiarity. Stakeholders keen on maximizing value should monitor evolving trends, embrace lifecycle strategies, and innovate within the acute migraine treatment landscape.

FAQs

1. How does the patent expiration of rizatriptan affect its market?

Patent expiration facilitates generic entry, leading to significant price reductions and increased accessibility. While it diminishes brand revenues, it sustains overall utilization due to affordability, especially in cost-sensitive markets.

2. Are there emerging competitors that threaten rizatriptan’s market share?

Yes. The advent of gepants (like ubrogepant) and ditans (such as lasmiditan) presents attractive alternatives with fewer contraindications, potentially reducing rizatriptan’s share in the acute migraine segment.

3. What factors influence physicians’ prescribing choices for migraine drugs?

Physicians prioritize efficacy, safety profile, contraindications (particularly cardiovascular), patient comorbidities, and formulary restrictions. Familiarity and insurance coverage also play roles.

4. How does the availability of generic versions impact the financial trajectory of rizatriptan?

Generics lower prices, reducing profit margins but increasing prescription volume. This shift often results in a decline in revenue but can stabilize overall market sales due to volume-based growth.

5. What strategic moves can sustain rizatriptan’s market relevance?

Innovating formulations, expanding indications, exploring combination therapies, and entering emerging markets with tailored pricing strategies are effective approaches to extend lifecycle and revenue.

References

[1] Fortune Business Insights. "Migraine Drugs Market Size, Share & Industry Analysis." 2022.

[2] World Health Organization. "Migraine Fact Sheet." 2019.

[3] Goadsby PJ et al. "Gepants and Ditans: New Migraine Therapeutics." Lancet Neurol. 2021.

[4] Lipton RB et al. "Efficacy and Safety of Gepants and Ditans." JAMA. 2022.

[5] FDA Guidance for Triptan Use. 2019.

[6] MarketWatch. "Rizatriptan Revenue Trends." 2015.