Last updated: July 29, 2025

Introduction

RECTIV, the brand name for nitroglycerin ointment 0.4%, represents a specialized pharmaceutical product primarily indicated for the treatment of chronic anal fissures. Since its FDA approval and market launch, RECTIV's trajectory has been influenced by various factors, including market demand, regulatory landscape, competitive pressures, and innovation trends in gastrointestinal therapeutics. This article provides a comprehensive analysis of the market dynamics and financial trajectory shaping RECTIV’s commercial future, offering insights critical to stakeholders ranging from pharmaceutical companies to healthcare investors.

Market Overview and Therapeutic Indication

RECTIV addresses a niche yet significant market segment: patients suffering from chronic anal fissures—a painful condition characterized by a tear in the anoderm. Its primary mechanism involves vasodilation, which enhances blood flow and promotes fissure healing, reducing the need for surgical interventions (source: FDA prescribing information).

Despite its targeted use, RECTIV occupies a limited but steady segment within the broader gastrointestinal and anorectal therapeutics markets, which encompass treatments for hemorrhoids, fissures, and related conditions. The global gastrointestinal therapeutics market was valued at approximately USD 33 billion in 2021 and is projected to grow with a CAGR of around 5%, driven by increasing prevalence of gastrointestinal disorders and evolving medical protocols[1].

Market Dynamics Influencing RECTIV

1. Regulatory Environment

The regulatory landscape is pivotal in shaping RECTIV’s market momentum. Regulatory agencies, notably the FDA, prioritize safety and efficacy assessments, often influencing market entry and expansion strategies. While RECTIV has received approval specific to its indication, any changes in regulatory guidelines regarding vasodilator products or additional indications could impact its market access.

Recent trends toward drug reformulation and combination therapies pressure the landscape for niche products like RECTIV. Furthermore, approvals or deregistrations of generic versions or biosimilars are influential; the absence of a generic counterpart thus far maintains RECTIV’s premium pricing power within its segment.

2. Competitive Landscape

The therapeutic options for anal fissures extend beyond topical vasodilators like nitroglycerin to include calcium channel blockers (e.g., diltiazem, nifedipine), botulinum toxin injections, and surgical procedures. Each alternative presents distinct advantages and limitations.

Generic formulations of nitroglycerin ointment are accessible, potentially exerting price competition pressure on RECTIV. However, patent protections and proprietary formulations can mitigate immediate generic threats, allowing RECTIV to sustain higher margins temporarily. The competitive pressure from other topical agents and procedural alternatives influences market share retention.

3. Market Penetration and Provider Adoption

Physician awareness, experience, and comfort significantly influence RECTIV’s adoption. As a niche product, its utilization is concentrated among proctologists, gastroenterologists, and colorectal surgeons. Educational initiatives, clinical guidelines, and peer-reviewed studies bolster prescriber confidence and expand usage.

Market penetration remains constrained by clinician familiarity with alternatives and patient preferences for less invasive treatments. Nevertheless, evidence highlighting RECTIV’s superior efficacy in persistent fissures fosters incremental adoption.

4. Patient Preferences and Safety Profile

Patient tolerability and safety profiles directly impact medication adherence and demand. RECTIV’s side effects—headaches and hypotension—limit some patients’ use. Advances in formulation to reduce adverse events could broaden its adoption.

Furthermore, the advent of combination therapies or novel delivery systems (e.g., sustained-release formulations) may enhance patient compliance and therapeutic outcomes, positively influencing market dynamics.

Financial Trajectory

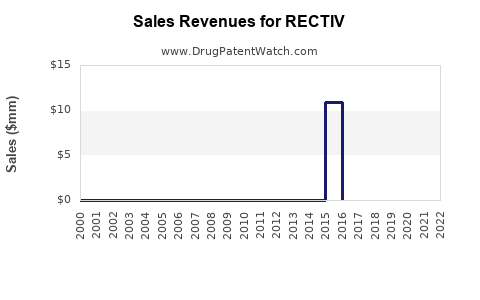

1. Revenue Streams and Market Potential

While large in absolute terms, RECTIV’s revenue contribution is modest within the overall pharmaceutical landscape. Estimated annual sales figures vary; industry estimates project revenues in the low hundreds of millions globally, with North America accounting for a significant share owing to higher awareness and access[2].

Market预测显示 steady growth driven by increased prevalence of anal fissures among aging populations, improvements in diagnostic awareness, and expanding indications. If a pharmaceutical company maintains exclusive rights or patents, revenue streams are protected; otherwise, generic competition may erode margins.

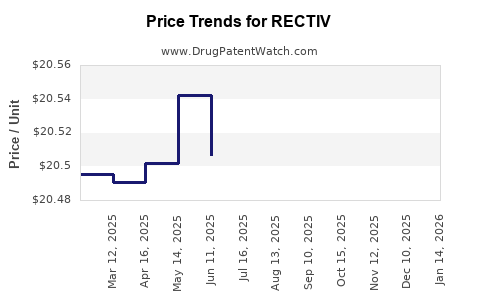

2. Pricing Strategy and Reimbursement Environment

RECTIV’s premium pricing, justified by its targeted indication and clinical effectiveness, sustains revenue growth. Reimbursement policies influence physician prescribing behavior; coverage by major insurers and Medicaid enhances accessibility.

In markets where healthcare systems emphasize cost-effective treatment, the price elasticity of RECTIV becomes a crucial consideration. Negotiating favorable reimbursement terms will be vital to sustaining its financial trajectory.

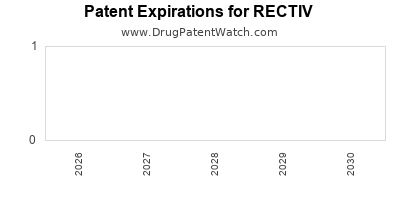

3. Patent Expiration and Generic Competition

Patents securing proprietary formulations determine RECTIV’s market exclusivity. Any upcoming patent expirations or patent challenges could expose the product to generic competition, leading to substantial revenue erosion unless new formulations or indications are pursued.

Proactive lifecycle management, including line extensions or combination therapies, is key to prolonging profitability.

4. Strategic Initiatives and Market Expansion

Efforts to broaden indications, such as treating acute anal fissures or other anorectal conditions, could unlock new revenue streams. Additionally, geographic expansion into emerging markets with increasing healthcare infrastructure presents an opportunity for growth.

Investment in clinical trials and real-world evidence generation augments market confidence and facilitates broader acceptance.

Emerging Trends and Outlook

1. Innovation and Product Differentiation

Technological advancements, such as sustained-release topical formulations or combination drugs integrating nitric oxide donors, can differentiate RECTIV. These innovations aim to improve efficacy, reduce side effects, and enhance patient adherence.

2. Digital Health and Patient Engagement

Integration of digital health tools, like mobile apps for symptom tracking or adherence reminders, may improve treatment outcomes and LA campaigns targeted at patient populations.

3. Regulatory and Reimbursement Reform

Ongoing regulatory adaptations emphasizing value-based care and cost-effectiveness could favor innovative formulations of RECTIV, provided they demonstrate measurable benefits over existing treatments.

Key Takeaways

- RECTIV operates within a niche yet vital segment of gastrointestinal therapeutics, with its market influenced by regulatory, competitive, and clinical factors.

- Its financial trajectory depends heavily on patent protection, market penetration, brand differentiation, and payer coverage.

- Competition from generics and alternative therapies necessitates ongoing innovation and strategic lifecycle management.

- Expansion into new indications and geographies offers avenues for revenue growth.

- Embracing technological advances and demonstrating superior efficacy will ensure RECTIV remains a relevant, profitable asset within its market space.

FAQs

-

What are the main competitors to RECTIV in treating anal fissures?

The primary competitors include topical calcium channel blockers like nifedipine and diltiazem, botulinum toxin injections, and surgical options such as fissurectomy. These alternatives vary in efficacy, side effect profiles, and patient preferences.

-

How does patent expiration impact RECTIV’s market share?

Patent expirations open the market to generic formulations, typically leading to price erosion and reduced revenues unless product differentiation or new indications offset the competition.

-

Are there ongoing efforts to expand RECTIV’s indications?

Yes, research explores broader applications such as acute fissure treatment or combined therapies. Regulatory approval for new indications could significantly expand its market.

-

What role does reimbursement policy play in RECTIV’s financial outlook?

Reimbursement influences access and prescribing habits. Favorable coverage by insurers and government programs enhances sales, while restrictive policies may limit market potential.

-

What innovations could shape RECTIV’s future competitiveness?

Sustained-release formulations, combination therapies, and digital adherence solutions are key innovations poised to improve efficacy, safety, and patient compliance, securing its market position.

References

[1] MarketsandMarkets. “Gastrointestinal Therapeutics Market by Drug Class, Indication, and Region – Global Forecast to 2027.” (2022)

[2] IQVIA. “The Global Use of Medicines in 2021.” (2022)

Note: All data points are estimates from publicly available market research reports and industry analyses.