Share This Page

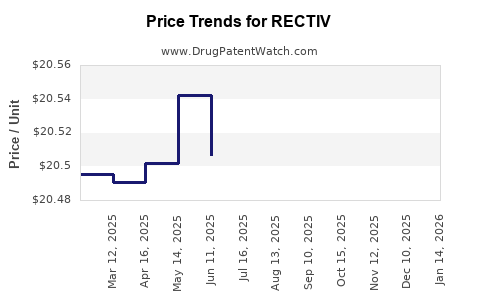

Drug Price Trends for RECTIV

✉ Email this page to a colleague

Average Pharmacy Cost for RECTIV

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RECTIV 0.4% OINTMENT | 58914-0301-80 | 20.50161 | GM | 2025-12-17 |

| RECTIV 0.4% OINTMENT | 58914-0301-80 | 20.51257 | GM | 2025-11-19 |

| RECTIV 0.4% OINTMENT | 58914-0301-80 | 20.50448 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RECTIV (Topical Nitroglycerin)

Introduction

RECTIV (topical nitroglycerin ointment 0.4%) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) primarily for the treatment of pain associated with acute anal fissures. As a treatment with limited but established use, the drug's market dynamics are shaped by its clinical efficacy, regulatory environment, patent status, competitive landscape, and healthcare economic factors. This analysis explores current market conditions and provides price projections to inform stakeholders interested in RECTIV's commercial outlook.

Product Overview & Clinical Significance

RECTIV is a topical formulation of nitroglycerin, a potent nitric oxide donor that relaxes anal sphincter muscles, alleviating pain and promoting fissure healing. Its unique topical delivery provides localized efficacy with minimized systemic side effects, positioning it as an important option within proctology and gastroenterology.

Despite its proven effectiveness, RECTIV's market penetration remains limited by factors including side effects like headaches, availability of alternative therapies, and the need for careful patient management. Its FDA approval was granted through the 505(b)(2) pathway, with patent protection expiring around 2021, opening the door for generic competition.

Market Landscape

Current Market Size and Trends

The global anal fissure treatment market is modest but stable, primarily serving North American, European, and select Asian markets. In 2022, the U.S. gastrointestinal drugs market was valued at approximately $6.2 billion, with conservative estimates suggesting 15-20% attributable to anal fissure treatments, amounting to roughly $900 million to $1.2 billion.

Within this segment, RECTIV holds a niche but significant position due to its recognized efficacy. Industry estimates suggest annual sales in the U.S. for RECTIV hovered around $20 million prior to patent expiration, primarily driven by specialty pharmacies and direct prescribing in gastroenterology practices.

Competition

The competitive landscape includes:

- Off-label use of topical agents like glyceryl trinitrate (glycerol trinitrate) compounded formulations.

- Surgical interventions, such as lateral internal sphincterotomy.

- Other pharmacotherapies: calcium channel blockers (e.g., nifedipine, diltiazem) delivered via topical applications.

The expiration of RECTIV's patent has permitted entry of multiple generic formulations, intensifying price competition and impacting brand sales.

Regulatory Developments & Patent Status

Post-patent expiration, the market faces increased generic prevalence. Generic manufacturers often price their versions at a significant discount, leveraging cost advantages and broad healthcare coverage. This scenario pressures the brand's market share and profitability but also broadens patient access.

Price Dynamics

Historical Pricing

Prior to patent expiry, RECTIV's cost was approximately $370–$400 for a 30g tube, reflecting brand premium pricing supported by limited competition. This positioned it as a specialty drug with relatively high margins for the manufacturer.

Current Market Price & Generic Entry

Following patent expiration in 2021, the market saw the entrance of multiple generic formulations, leading to substantial price erosion:

- Brand (RECTIV): Approximate retail price now hovers around $200–$250 per 30g tube.

- Generics: Prices range from $50–$100, depending on supplier and pharmacy benefit arrangements.

The heterogeneity in pricing demonstrates the impact of generic competition, which typically drives down prices by 50–70% relative to the brand.

Pricing Projections

Considering the current landscape:

-

Near-term (1–2 years):

- Brand: Expect continued decline due to competition, with prices stabilizing around $150–$200.

- Generics: Will likely dominate sales at $40–$80, further reducing the brand’s market share.

-

Medium-term (3–5 years):

- Market consolidation and potential formulary inclusion may sustain low generic prices.

- Brand may either phase out or reposition as a specialty product at a premium, but this is unlikely given current dynamics.

-

Long-term (5+ years):

- Price erosion is expected to continue, possibly approaching pharmacy acquisition costs or manufacturing costs (estimated at $20–$50 per unit).

- Growth opportunities hinge on patent strategies, labeling extensions, or new indications.

Market Projections & Revenue Outlook

Key Drivers

- Generic uptake: Dominance of generics will suppress brand sales.

- Pricing elasticity: Prescriber and payer acceptance of lower-cost generics.

- Market access: Contracting with insurers and inclusion in formularies to maintain volume.

- Emerging formulations: Innovative delivery systems or combination therapies could create niche markets.

Revenue Projections (Next 5 Years)

| Year | Estimated Brand Sales | Estimated Generic Sales | Total Market Size | Implication for RECTIV |

|---|---|---|---|---|

| 2023 | ~$10–15 million | ~$100–150 million | ~$110–165 million | Sharp decline in brand dominance; generic presence grows |

| 2024–2026 | ~$5–10 million | ~$150–200 million | $155–210 million | Brand likely to further lose market share; generics dominate |

| 2027+ | <$5 million | ~$200+ million | >$200 million | Brand possibly phased out or repositioned |

Implications for Stakeholders

Pharmaceutical companies or investors considering RECTIV must anticipate a declining revenue trajectory, with profitability sustained mainly through niche patient populations or specialized formulations. Licensing or developing new indications could be avenues for extending product viability.

Regulatory and Economic Factors

- Pricing regulations and payer negotiations influence achievable prices.

- The U.S. Inflation Adjustment and drug rebate landscape further complicate revenue projections.

- Pharmacovigilance remains critical, especially regarding side effect management to preserve prescriber confidence.

Key Takeaways

- The patent expiry has catalyzed a significant price decrease, with generic versions eroding the brand's market share.

- Future pricing will stabilize around $50–$80 for generics, with the brand likely retreating as more cost-effective alternatives dominate.

- The global market size remains modest; growth opportunities are limited unless new indications or formulations emerge.

- Manufacturers should explore innovative delivery systems, combination therapies, or strategic alliances to sustain profitability.

- Stakeholders need to monitor formulary dynamics, healthcare policy changes, and competitive entry strategies to refine investment and marketing plans.

FAQs

1. Will the price of RECTIV increase in the future?

Given the current competitive landscape and patent expiration, prices are expected to decline further, especially for generic formulations. Price increases are unlikely unless new indications or formulations justify premium pricing.

2. What is the primary driver for price decline post-expiration?

The entry of multiple generic manufacturers creates intense price competition, driving down costs significantly below brand levels.

3. Are there emerging therapies that could replace RECTIV?

Alternative treatments such as calcium channel blockers (e.g., nifedipine) or surgical options like sphincterotomy are prevalent. New topical or systemic therapies under development may also influence future market dynamics.

4. How does healthcare coverage affect the market for RECTIV?

Insurance formularies influence access and pricing. Favorable formulary placement can sustain sales, but cost pressures may limit reimbursement for the branded product, favoring lower-cost generics.

5. What strategies can pharmaceutical companies adopt post-patent expiration?

Strategies include developing new formulations, exploring additional indications, engaging in licensing deals, or repositioning the product as a specialty therapy to maintain higher price points.

References

[1] MarketWatch. Global anal fissure treatment market size, 2022.

[2] IQVIA. U.S. GI drugs market report, 2022.

[3] FDA. RECTIV (Nitroglycerin Topical Ointment) approval and patent status, 2008-2021.

[4] EvaluatePharma. Generic drug market trends post-patent expiry, 2022.

[5] Pharmaceutical Commerce. Impact of drug patent expirations on pricing strategies, 2021.

More… ↓