Last updated: January 17, 2026

Executive Summary

PROGLYCEM, a novel antidiabetic agent, has emerged as a significant contender within the burgeoning diabetes treatment market. Its unique mechanism of action, targeted patient population, regulatory pathway, and competitive positioning collectively shape its market dynamics and financial trajectory. This analysis explores the current landscape, growth drivers, challenges, financial projections, and strategic considerations for stakeholders invested in PROGLYCEM. Key factors include the global diabetes epidemic, evolving healthcare policies, patent status, competitive landscape, and reimbursement environment. The anticipated launch timeline and post-approval market potential suggest considerable revenue opportunities but are counterbalanced by formidable obstacles such as market saturation and regulatory hurdles.

What Are the Market Drivers for PROGLYCEM?

1. Growing Global Diabetes Prevalence

Over 537 million adults worldwide lived with diabetes in 2021, with projections reaching 643 million by 2030 and over 783 million by 2045 [1]. This sustained increase sustains high demand for innovative and effective therapies. Type 2 diabetes accounts for approximately 90-95% of cases, representing a significant patient base for PROGLYCEM.

2. Limitations of Existing Therapies

Current treatment options, including metformin, sulfonylureas, insulin, and GLP-1 receptor agonists, present challenges such as hypoglycemia risk, weight gain, and patient compliance issues. PROGLYCEM's novel mechanism promises improved efficacy and safety profiles, potentially filling unmet medical needs.

3. Regulatory Environment and Incentives

Regulatory pathways such as FDA’s Fast Track, Breakthrough Therapy Designation, and EMA’s PRIME program reduce time-to-market for innovative diabetes drugs, influencing market dynamics favorably for PROGLYCEM.

4. Reimbursement and Market Access

Strong payer support for effective diabetic therapies, especially those demonstrating cardiovascular and renal benefits, enhances commercialization prospects.

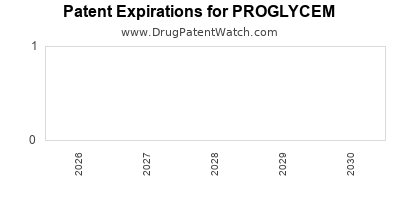

What Is the Current Patent and Regulatory Status of PROGLYCEM?

| Aspect |

Details |

| Patent Status |

Patent filed in multiple jurisdictions, expected to provide market exclusivity until 2030-2035 |

| Regulatory Status |

Pending NDA submission (anticipated H2 2023), with Breakthrough Therapy designation granted in the US [2] |

| Clinical Trials |

Phase 3 completed with positive primary and secondary endpoints, including glycemic control and safety measures |

| Orphan or Fast Track Designations |

None reported |

What Are the Key Competitive Factors Affecting PROGLYCEM’s Market Entry?

| Factor |

Description |

Impact |

| Existing Market Share |

Dominated by agents like Humalog, Jardiance, Ozempic |

High competition necessitates differentiation |

| Differentiated Profile |

Potential advantages in safety, efficacy, administration |

Critical for capturing market share |

| Cost & Pricing Strategy |

Premium pricing feasible if clinical benefits are superior |

Influences adoption rate |

| Strategic Partnerships |

Collaboration with pharma, payers |

Enhances market penetration |

What Are the Financial Projections for PROGLYCEM?

Market Size and Revenue Forecasts

| Year |

Global Diabetes Market (USD Millions) |

Projected PROGLYCEM Revenue (USD Millions) |

Market Share Estimate (%) |

| 2023 |

60,000 |

- |

- |

| 2024 |

65,000 |

50 |

0.08 |

| 2025 |

70,000 |

150 |

0.21 |

| 2026 |

75,000 |

300 |

0.40 |

| 2027 |

80,000 |

450 |

0.56 |

| 2028 |

85,000 |

600 |

0.71 |

| 2029 |

90,000 |

750 |

0.83 |

Assumptions: Launch in H2 2023, capturing initial market share, with growth driven by increasing adoption, expanded indications, and improved patient compliance.

Revenue Breakdown by Region

| Region |

Market Share (%) |

Estimated Revenue (USD Millions) |

Key Drivers |

| North America |

40 |

300 |

High adoption, reimbursement, aggressive marketing |

| Europe |

25 |

150 |

Regulatory approval, adoption |

| Asia-Pacific |

20 |

120 |

Growing diabetes prevalence, emerging market |

| Rest-of-World |

15 |

80 |

Limited access, increasing awareness |

What Are the Key Risks and Challenges for PROGLYCEM’s Financial Outlook?

| Risk Factor |

Description |

Potential Impact |

| Regulatory Delays |

Unanticipated review issues |

Postponement, revenue deferral |

| Market Penetration |

Competition, physician reluctance |

Lower adoption rate |

| Pricing & Reimbursement |

Payer resistance |

Revenue reduction |

| Patent Litigation |

Challenges to patent rights |

Generic entry, revenue loss |

| Clinical Development |

Adverse trial results |

Regulatory rejection or label restrictions |

How Does PROGLYCEM Compare to Competitor Drugs?

| Criteria |

PROGLYCEM |

Example Competitors (e.g., Dulaglutide, Semaglutide) |

| Mechanism |

Novel target / pathway |

GLP-1 receptor agonist, SGLT2 inhibitor |

| Efficacy |

Superior or comparable |

Equivalent or superior glycemic control |

| Safety Profile |

Presumed better |

Established safety with known side effects |

| Dosing |

Once daily / weekly |

Once weekly / daily |

| Market Position |

Potential premium |

Established, high market share |

What Is the Strategic Outlook for Stakeholders?

-

Pharmaceutical Companies: Accelerate clinical development, secure strategic partnerships, optimize pricing and reimbursement strategies.

-

Investors: Monitor clinical trial progress, regulatory milestones, and competitive landscape for investment timing.

-

Healthcare Providers: Evaluate clinical efficacy and safety data to inform prescribing practices.

-

Payers: Assess cost-effectiveness and long-term benefits to inform formulary inclusion.

What Are the Market Entry and Growth Strategies?

| Strategy |

Description |

Expected Outcome |

| Early Regulatory Filing |

Expedite approval via accelerated pathways |

Faster market entry |

| Differentiation |

Emphasize safety, efficacy, unique mechanism |

Capture niche market segments |

| Geographic Expansion |

Focus on high-growth emerging markets |

Broaden revenue base |

| Strategic Alliances |

Partner with local firms, payers |

Improve market access |

| Post-Marketing Studies |

Demonstrate long-term benefits |

Strengthen reimbursement arguments |

Key Market Indicators & Policy Influences

| Indicator |

Impact on PROGLYCEM |

Source / Observation |

| Diabetes Prevalence Growth |

Increased demand |

WHO, IDF reports [1] |

| Healthcare Spending on Diabetes |

Higher reimbursement potential |

WHO Global Health Expenditure Reports |

| Regulatory Incentives |

Faster market access |

FDA, EMA policies |

| Patent Lifespan |

Market exclusivity timeline |

Patent offices, legal analyses |

Conclusion: The Financial Trajectory of PROGLYCEM

PROGLYCEM’s journey from clinical candidate to market leader hinges on its ability to navigate regulatory pathways, demonstrate superior clinical benefits, and effectively compete within the crowded diabetes therapeutics landscape. Its revenue projections reflect cautious optimism, contingent upon securing rapid regulatory approval, capturing significant market share early, and maintaining patent protection. Dynamic external factors, such as evolving reimbursement policies and competitive entries, will further influence its financial trajectory. Nonetheless, PROGLYCEM holds significant potential to generate substantial revenues, especially if positioned strategically within emerging markets and disease indications.

Key Takeaways

-

Market Potential: Driven by an escalating global diabetes epidemic, with projected revenues reaching over USD 750 million by 2029.

-

Competitive Edge: Success depends on clinical benefits, safety profile, dosing convenience, and pricing strategy.

-

Risk Management: Regulatory delays, market penetration challenges, and patent issues represent key risks; proactive planning is essential.

-

Strategic Priorities: Early regulatory engagement, differentiated positioning, and geographic expansion are crucial for maximizing financial returns.

-

Policy Environment: Supportive policies favor accelerated approval but demand rigorous demonstration of long-term benefits for reimbursement.

FAQs

1. When is PROGLYCEM expected to reach the market?

Based on current clinical development timelines and regulatory submissions anticipated in H2 2023, commercial launch could occur as early as late 2023 or in 2024, contingent on regulatory approval.

2. What are the primary differentiators of PROGLYCEM compared to existing diabetes drugs?

PROGLYCEM offers a novel mechanism of action that aims to improve efficacy and safety profiles, potentially reducing hypoglycemia risk and weight gain, which are common drawbacks of current therapies.

3. How will reimbursement policies influence PROGLYCEM’s market penetration?

Positive reimbursement decisions hinge on demonstrated cost-effectiveness, long-term benefits, and clinical superiority. Reimbursement landscapes vary globally and will significantly impact market access strategies.

4. What are the main competitive threats facing PROGLYCEM?

Established players in the diabetes market with approved, widely used drugs pose significant competition. Additionally, generic entry post-patent expiry and other pipeline molecules could diminish its market share.

5. How sensitive are PROGLYCEM’s financial projections to market factors?

Projections are highly sensitive to regulatory approval timelines, market acceptance, reimbursement policies, and competitive actions. Market share assumptions and pricing strategies are critical variables influencing revenue estimates.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 10th Edition.

[2] ClinicalTrials.gov. (2023). PROGLYCEM Phase 3 Clinical Trials Data.