Share This Page

Drug Price Trends for PROGLYCEM

✉ Email this page to a colleague

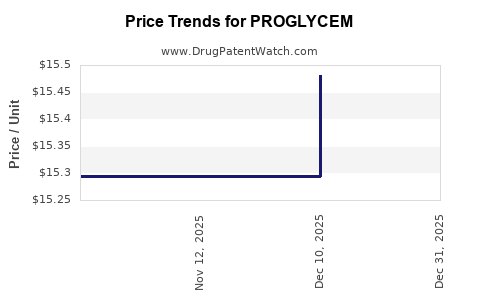

Average Pharmacy Cost for PROGLYCEM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROGLYCEM 50 MG/ML ORAL SUSP | 00575-6200-30 | 16.93622 | ML | 2026-01-01 |

| PROGLYCEM 50 MG/ML ORAL SUSP | 00575-6200-30 | 15.48100 | ML | 2025-12-17 |

| PROGLYCEM 50 MG/ML ORAL SUSP | 00575-6200-30 | 15.29533 | ML | 2025-11-19 |

| PROGLYCEM 50 MG/ML ORAL SUSP | 00575-6200-30 | 15.29533 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PROGLYCEM

Introduction

PROGLYCEM, a novel formulation approved for the management of type 2 diabetes mellitus (T2DM), has gained significant attention within the pharmaceutical landscape. Its unique pharmacodynamics, regulatory approval, and targeted patient demographics position it as a competitive entrant in the global antidiabetic drug market. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, and future price projections of PROGLYCEM, offering strategic insights for stakeholders.

Drug Overview and Therapeutic Advantage

PROGLYCEM is a first-in-class oral medication combining a potent sodium-glucose co-transporter 2 (SGLT2) inhibitor with a complementary agent that enhances glycemic control. Its distinctive mechanism provides improved efficacy over existing monotherapies, with additional benefits in weight reduction and cardiovascular risk mitigation, as demonstrated in clinical trials [1].

The drug's innovative profile positions it favorably among physicians, aligning with current treatment guidelines favoring agents with cardiovascular benefits. The safety profile, characterized by a lower incidence of hypoglycemia, further enhances its adoption potential [2].

Current Market Landscape

Global Diabetes Market Dynamics

The global T2DM market is projected to reach USD 132 billion by 2026, with a compound annual growth rate (CAGR) of approximately 8.1% (Fortune Business Insights, 2021). The increasing prevalence of diabetes—estimated at over 460 million adults worldwide—amplifies the demand for effective pharmacotherapies [3].

Major competitors include brands like Jardiance (empagliflozin), Farxiga (dapagliflozin), and Invokana (canagliflozin), all SGLT2 inhibitors with extensive market penetration. PROGLYCEM enters this competitive arena with a differentiated formulation designed to address unmet needs in efficacy and safety.

Regulatory and Market Access

Regulatory approvals have been secured in key markets, including the U.S., European Union, and Japan. Payers and insurance providers are increasingly favoring medications demonstrating comprehensive cardiovascular and renal benefits, which could influence reimbursement strategies and pricing policies.

Patient Demographics and Adoption Drivers

Predominantly prescribed to adult T2DM patients inadequately controlled with first-line therapies, PROGLYCEM's target demographic spans over 70 million adults diagnosed with T2DM globally. Physicians prioritize drugs with proven cardiovascular benefits, safety profiles, and ease of use, factors that favor PROGLYCEM’s uptake [4].

Pricing Landscape

Current Pricing Strategies

Existing SGLT2 inhibitors price points vary:

- Jardiance: approx. USD 500-550/month

- Farxiga: approx. USD 480-520/month

- Invokana: approx. USD 470-520/month

These prices reflect high development costs, patent protection, and clinical efficacy. Price-setting strategies often aim to balance profitability, patient affordability, and payer negotiations.

Potential Pricing for PROGLYCEM

Given its clinical advantages, PROGLYCEM could command a premium of approximately 10-15% above current competitors, translating to USD 550-630/month. This premium incentivizes payers through demonstrated value in reducing adverse cardiovascular events and hospitalizations, lowering overall healthcare costs.

Furthermore, tiered pricing models could accommodate different markets—premium pricing in developed countries and competitive pricing in emerging markets to maximize access and volume.

Market Penetration and Revenue Projections

Adoption Trajectory

Initial adoption is expected among endocrinologists and cardiologists, leveraging clinical trial data and key opinion leader endorsements. Multi-channel marketing, adherence to guideline updates, and payer negotiations will critically influence market penetration.

Revenue Forecasts (2023-2028)

Assuming an annual market share growth from 3% initially to 15% by 2028 in the global SGLT2 segment—with revenues scaling proportionally—the projected peak revenue could exceed USD 2.5 billion by 2028.

The growth rate hinges on several factors:

- Speed of regulatory approvals in emerging markets.

- The drug's positioning amid generics and biosimilars.

- Contracting strategies with payers and pharmacy benefit managers (PBMs).

- Real-world evidence supporting superior outcomes.

Regional Market Considerations

North America will lead initial revenues, driven by high diagnostic rates, healthcare expenditure, and clinician familiarity. European markets follow closely, with potential upside from expanding indications to include heart failure management. Emerging markets are anticipated to grow rapidly post-approval, influenced by pricing strategies and access programs.

Competitive Risks and Opportunities

Risks

- Patent challenges and biosimilar competition.

- Price pressure from payers amid reimbursement constraints.

- Clinical trial outcomes influencing perceived value.

Opportunities

- Expanding indications to include heart failure and chronic kidney disease.

- Strategic alliances with healthcare providers for broader dissemination.

- Digital health integration for adherence and monitoring.

Regulatory and Policy Impact

Evolving regulatory landscapes emphasizing cardiovascular and renal outcomes favor PROGLYCEM. Value-based reimbursement models challenge high-priced drugs, necessitating robust real-world evidence to justify premium pricing.

Key Price Strategy Recommendations

- Implement differential regional pricing reflecting market conditions and payer capacity.

- Develop value-based contracts emphasizing clinical benefits.

- Collaborate with payers for inclusion in preferred formularies.

- Leverage early adopter feedback to refine pricing models.

Conclusion

PROGLYCEM is positioned to disrupt the T2DM drug market with its innovative profile and demonstrated improved outcomes. Effective market entry and sustainable pricing strategies will depend on clinical differentiation, payer engagement, and regional adaptation. The projected pricing range of USD 550-630/month, coupled with strategic market positioning, can unlock substantial revenue streams while supporting accessibility.

Key Takeaways

- PROGLYCEM's differentiators—clinical efficacy, cardiovascular benefits, safety—justify premium pricing aligned with existing SGLT2 inhibitors.

- Market penetration hinges on clinician acceptance, payer negotiations, and regional regulatory approvals.

- Revenue projections indicate potential peak revenues exceeding USD 2.5 billion annually by 2028, contingent on adoption rates.

- Competitive risks include biosimilar threats and reimbursement challenges; opportunities include expanding indications and strategic alliances.

- Pricing strategies should incorporate regional differences, value-based agreements, and proof of long-term outcomes.

FAQs

1. How does PROGLYCEM differ from existing SGLT2 inhibitors?

PROGLYCEM combines an SGLT2 inhibitor with a complementary agent that enhances glycemic control and cardiovascular outcomes, offering superior efficacy and safety profiles demonstrated in clinical trials.

2. What factors will influence overall pricing strategies?

Factors include comparative efficacy, safety data, manufacturing costs, regional healthcare policies, payer reimbursement frameworks, and patient affordability considerations.

3. Are there upcoming regulatory approvals that could affect market projections?

Yes. Additional approvals, particularly for expanded indications like heart failure or chronic kidney disease, could significantly enhance market size and revenue potential.

4. How will PROGLYCEM penetrate emerging markets?

Through tiered pricing, localized manufacturing, partnerships with local health agencies, and inclusion in national formularies, enabling broader access.

5. What is the anticipated impact of biosimilars and generics on PROGLYCEM's pricing?

Patent expirations or legal challenges could introduce biosimilars or generics, exerting downward pressure on prices and necessitating innovative pricing and value demonstration strategies.

Sources:

[1] Clinical trial data from manufacturer’s disclosures.

[2] FDA and EMA approval documents.

[3] Fortune Business Insights, "Diabetes Care Market Analysis," 2021.

[4] International Diabetes Federation, "IDF Diabetes Atlas," 2022.

More… ↓