Last updated: July 28, 2025

Introduction

Polyethylene glycol 3350 (PEG 3350) stands as a globally recognized osmotic laxative primarily employed in the treatment of occasional constipation. Over the past decade, the compound’s market dynamics have been shaped by rising prevalence of gastrointestinal disorders, advancements in pharmaceutical formulations, and escalating demand for over-the-counter (OTC) laxatives. This article meticulously analyzes PEG 3350's market environment, competitive landscape, growth drivers, challenges, and its projected financial trajectory to inform stakeholders and decision-makers.

Market Overview and Composition

PEG 3350’s market predominantly comprises OTC segments, with pharmaceuticals like MiraLAX (generics) serving as flagship brands. Uptake extends across North America, Europe, and Asia-Pacific, aligned with increasing health awareness and aging populations. The global laxatives market was valued at approximately USD 4.7 billion in 2022 [1], with PEG-based products constituting a significant share. The consistent demand for safe, non-invasive constipation remedies positions PEG 3350 as a market leader, especially given its efficacy, minimal adverse effects, and ease of use.

Market Drivers

1. Rising Prevalence of Gastrointestinal Disorders

Increasing incidences of chronic constipation, irritable bowel syndrome, and other GI disturbances propel demand for effective laxatives like PEG 3350. Aging populations, particularly in North America and Europe, further amplify this trend, as gastrointestinal motility issues are common among seniors [2].

2. Expanding OTC Accessibility

Regulatory frameworks in many regions endorse OTC sales of PEG 3350 formulations, empowering consumers to self-medicate. This ease of access fosters consistent demand, with manufacturers capitalizing on the convenience and minimal prescription barriers [3].

3. Advancements in Formulation and Delivery

Innovations such as low-dose, flavor-enhanced, or combined therapy formulations improve patient compliance and broaden applications, including prophylactic use. This enhances market penetration and encourages new product development.

4. Expanding Pharmacovigilance and Safety Profile

PEG 3350 is recognized for its favorable safety profile, with limited systemic absorption and low incidence of adverse reactions [4]. This safety advantage sustains its popularity amidst burgeoning focus on drug safety.

5. Growing Global Healthcare Expenditure

Increased healthcare spending and awareness campaigns boost diagnostics, treatment options, and over-the-counter supplement utilization, fostering market growth.

Market Challenges

1. Competition from Alternative Laxatives

The market also witnesses fierce competition from stimulant laxatives, stool softeners, fiber-based supplements, and novel agents like prucalopride or lubiprostone. These alternatives may target specific patient segments or offer differing safety profiles.

2. Regulatory and Prescription Trends

While PEG 3350 remains OTC in many markets, stricter regulatory scrutiny concerning safety, labeling, and quality standards could influence its marketability. Any safety concerns or adverse event reports may prompt tighter controls [5].

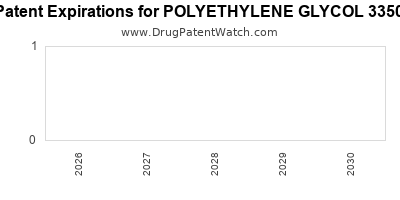

3. Limited Innovation and Patent Lifespan

As a well-established generic compound, PEG 3350 faces limited scope for innovation or patent protection, leading to commoditization and pricing pressures among manufacturers.

4. Environmental and Manufacturing Concerns

Production processes and environmental sustainability considerations might impact supply chain costs and regulatory compliance, indirectly affecting profitability.

Competitive Landscape

Major players include Baxter International (MiraLAX), Sandoz, and numerous generics manufacturers globally. Market strategies revolve around product differentiation, pricing competitiveness, and expanding distribution channels. Custom formulations and co-branding efforts enhance market presence.

Emerging entrants, particularly in Asian markets, leverage low-cost manufacturing and local distribution networks, intensifying price competition.

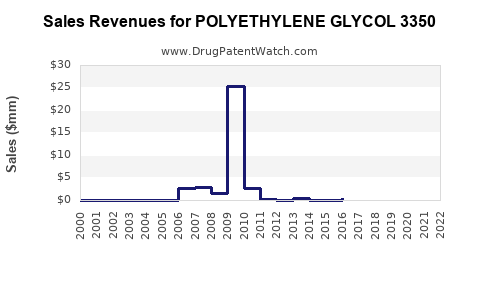

Financial Trajectory and Future Outlook

Short-Term (2023–2026)

The PEG 3350 market is expected to retain steady growth at a CAGR of approximately 4%, driven by aging demographics and increasing consumer health awareness. Industry reports project revenues in the OTC laxatives segment to approach USD 6.2 billion by 2026 [1].

Manufacturers will likely focus on consolidating supply chains, expanding distribution channels, and marketing campaigns emphasizing safety and efficacy. Product launches incorporating flavor enhancements or combined therapies could stimulate incremental growth.

Medium to Long-Term (2026 and beyond)

Market growth may moderate as saturation in mature regions occurs; however, emerging markets such as China and India present substantial upside, driven by rising disposable incomes and shifting healthcare paradigms. These markets could witness CAGR rates of 6-8% over the next five years.

Innovations in delivery systems, personalized medicine approaches, and integration with gut microbiome research may sustain long-term growth prospects. Additionally, regulatory approvals for novel PEG formulations or combination products might unlock new revenue streams.

Intellectual Property and Market Consolidation

Given the generic nature of PEG 3350, profit margins remain under pressure. Nonetheless, companies investing in manufacturing efficiency, quality assurance, and expanding geographic footprints are positioned for resilient financial performance.

Regulatory Environment Impact

The United States Food and Drug Administration (FDA) classifies PEG 3350 as generally recognized as safe (GRAS) when used as directed, supporting OTC sales growth [4]. Similarly, regulatory bodies across Europe and Asia continue endorsing PEG-based laxatives, provided safety standards are met. Nonetheless, ongoing pharmacovigilance and transparency are crucial to maintaining favorable regulatory status.

Key Opportunities and Risks

Opportunities:

- Expansion into emerging markets with concerted marketing efforts.

- Development of value-added formulations (e.g., flavor enhancements, combined therapies).

- Strategic collaborations between pharma companies to accelerate product innovation.

- Digital marketing campaigns to educate consumers and physicians on safety and efficacy.

Risks:

- Potential regulatory restrictions due to safety concerns.

- Market commoditization leading to declining margins.

- Competitive pressures from newer agents targeting specific patient needs.

- Supply chain disruptions affecting production costs.

Conclusion

Polyethylene glycol 3350 maintains a robust market position driven by its safety profile, OTC availability, and global prevalence of gastrointestinal disorders. While growth may slow in saturated regions, expanding markets and innovations in product formulations offer significant future opportunities. Pharmaceutical stakeholders must navigate regulatory landscapes carefully, focus on supply chain efficiencies, and innovate within the constraints of its patent lifecycle to sustain profitable trajectories.

Key Takeaways

- The PEG 3350 market is characterized by steady growth, with a focus on expanding into emerging markets.

- Safety, OTC accessibility, and convenience underpin its competitive advantage.

- Market growth is challenged by competition, regulatory scrutiny, and commoditization.

- Innovations in formulations and strategic collaborations represent opportunities for revenue enhancement.

- Long-term success hinges on navigating regulatory environments, optimizing manufacturing, and capitalizing on emerging market trends.

FAQs

1. What factors have contributed to PEG 3350’s dominance in the laxatives market?

Its proven safety profile, efficacy, minimal side effects, and OTC availability make PEG 3350 the preferred choice for occasional constipation, especially among older populations.

2. How do regulatory policies impact the future growth of PEG 3350?

Regulations emphasizing safety and quality control can hinder or facilitate market access. Stringent safety monitoring may impose additional compliance costs but ensures sustained consumer trust.

3. What emerging markets show the most promise for PEG 3350 expansion?

China, India, and Southeast Asian countries offer substantial growth potential owing to rising healthcare awareness, increasing disposable income, and expanding pharmaceutical distribution networks.

4. How does competition influence pricing strategies for PEG 3350?

The generic nature leads to price competition, pressuring margins. Companies focus on differentiation through formulations, branding, and distribution to maintain profitability.

5. What long-term trends could impact the PEG 3350 market?

Advances in gut microbiome research, personalized medicine, and alternative therapies may influence demand patterns, along with regulatory changes and environmental considerations affecting manufacturing.

References

[1] Market Research Future. (2022). Global Laxatives Market Report.

[2] World Health Organization. (2021). Aging and Gastrointestinal Health.

[3] U.S. Food and Drug Administration. (2022). OTC Laxatives Regulatory Overview.

[4] Center for Drug Evaluation and Research. (2020). PEG 3350 Safety Profile.

[5] European Medicines Agency. (2021). Pharmaceuticals Safety Updates.