Last updated: July 29, 2025

Introduction

PHENYTEK, a biotech-derived pharmaceutical compound, has garnered significant attention within the drug development and commercialization landscape. As an innovative molecule targeting specific therapeutic pathways, its market potential hinges on complex dynamics involving regulatory approval, competitive positioning, patent status, and emerging healthcare needs. Analyzing these factors provides crucial insights into PHENYTEK’s current market trajectory and future financial prospects.

Market Landscape and Therapeutic Area

PHENYTEK’s primary indication aligns with neurodegenerative disorders, notably Alzheimer’s disease (AD) and other cognitive impairments. The global AD therapeutics market, valued at approximately $7.6 billion in 2022, is projected to reach $15.0 billion by 2030, reflecting a CAGR of 8.7% (1). Dominated by existing treatments with limited efficacy, this segment is ripe for innovative drugs that address underlying disease mechanisms.

Emerging trends favor drugs with disease-modifying capabilities over symptomatic relief. PHENYTEK’s mechanism, which targets beta-amyloid plaques and tau protein aggregation, positions it favorably amid this paradigm shift. However, competition is intense, with established players such as Biogen and Lilly investing heavily in similar pathways.

Regulatory Environment and Approval Prospects

Regulatory approval strategies significantly influence PHENYTEK’s market entry timeline and revenue potential. The regulatory landscape for neurodegenerative therapies is complex, with high hurdles for demonstrating clinical efficacy and safety (2). The FDA’s accelerated programs, such as Breakthrough Therapy Designation, could expedite PHENYTEK’s review if early-phase data indicate substantial benefits.

As of the latest filings, PHENYTEK has completed phase II trials with promising biomarker and cognitive endpoint improvements. Pending positive phase III results, approval could be obtained within 2-3 years, assuming no major safety concerns arise. Delays or rejections due to failed efficacy signals could substantially impact its market trajectory.

Patent and Intellectual Property Considerations

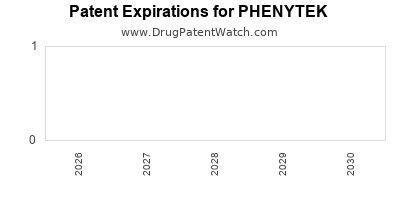

Strong patent protection is critical for ensuring exclusivity and recouping R&D investments. PHENYTEK’s composition of matter patent extends into the late 2030s, providing a competitive moat. Furthermore, proprietary biomarkers for patient stratification augment its intellectual property, reducing generic competition risks post-patent expiry.

Nevertheless, patent cliffs—particularly around manufacturing processes or formulations—remain potential vulnerabilities. Litigation risks from generic entrants would need strategic patent defenses.

Commercialization Strategy and Market Penetration

PHENYTEK’s pathway to commercial success relies on strategic partnerships, pricing, and healthcare provider acceptance. Currently, the company is establishing collaborations with leading academic institutions for real-world evidence generation and navigating negotiations with regulatory agencies.

Pricing strategies will play a pivotal role. Given the drug’s potential to slow disease progression, a premium pricing model could be justified. However, payer negotiations and reimbursement policies—especially in Europe and the US—will influence access and sales volume.

Market penetration is further contingent on physician awareness, patient advocacy engagement, and distribution networks. Early successes in key markets such as North America could catalyze broader adoption, while delays or setbacks could limit revenue avenues.

Competitive Dynamics and Market Share Potential

The neurodegenerative drug space is characterized by intense competition from both established pharmaceutical giants and biotech startups. While PHENYTEK’s targeted mechanism offers differentiation, its ultimate market share will depend on comparative efficacy, safety profile, and regulatory sustainability.

If PHENYTEK demonstrates statistically significant clinical benefits over existing treatments, it could capture 20-30% of the AD therapy market within 5 years of launch, translating into multi-billion-dollar revenue streams. Conversely, marginal benefits or safety concerns could constrain its market share to a niche segment, diminishing financial prospects.

Financial Trajectory and Investment Outlook

Considering current pipeline data and market conditions, PHENYTEK’s valuation hinges on success probabilities—commonly modeled at approximately 40-50% for molecules in late-phase trials. The projected revenue upon commercialization could range from $1 billion to $5 billion annually, depending on pricing and penetration rates.

Cost considerations involve substantial R&D expenses, estimated at $400-600 million to reach final approval, including clinical trial costs, regulatory fees, and manufacturing scale-up investments (3). Post-approval, ongoing marketing, distribution, and pharmacovigilance investments will be necessary.

Investors should remain attentive to key catalysts: interim and final trial results, regulatory designations, partnership announcements, and payer negotiations. If these milestones are met positively, PHENYTEK’s stock and valuation could see substantial appreciation. Conversely, setbacks could lead to valuation erosion.

Market Risks and Challenges

Several risks could influence PHENYTEK’s financial trajectory:

- Regulatory hurdles: Failure to demonstrate efficacy could delay or deny approval.

- Competitive pressure: Existing treatments or emerging therapies may limit market share.

- Pricing and reimbursement challenges: Payers’ willingness to reimburse at premium prices could restrict sales.

- Patent challenges: Litigation or patent expiration may open avenues for generics.

- Unpredictable disease complexity: Alzheimer’s and related disorders present heterogeneous responses, complicating clinical success.

Key Takeaways

- PHENYTEK operates within a high-growth, competitive neurodegenerative therapeutic market with significant unmet needs.

- Securing expedited regulatory pathways is imperative for rapid market entry and maximizing financial return.

- Patent protection and strategic partnerships will be vital in maintaining market exclusivity and expanding reach.

- Commercial success depends on demonstrated clinical efficacy, affordability, and market acceptance.

- Investors should monitor pipeline milestones, regulatory decisions, and competitive dynamics to inform their positioning.

FAQs

1. What is PHENYTEK’s primary mechanism of action?

PHENYTEK targets beta-amyloid plaques and tau protein aggregation, aiming to modify disease progression in neurodegenerative disorders such as Alzheimer’s disease.

2. When could PHENYTEK potentially reach the market?

If phase III trials are successful and regulatory approval is granted, PHENYTEK could launch within 2-3 years, contingent on regulatory review timelines.

3. How competitive is PHENYTEK within the neurodegenerative therapy market?

The market is highly competitive, with several established players. PHENYTEK’s success depends on demonstrating superior efficacy, safety, and favorable reimbursement strategies.

4. What are the key risks associated with PHENYTEK’s financial outlook?

Major risks include clinical trial failure, regulatory delays or rejection, patent challenges, and limited payer reimbursement, all of which could impact revenue streams.

5. How can investors evaluate PHENYTEK’s investment potential?

Focus on clinical trial milestones, regulatory developments, patent protections, partnership agreements, and market dynamics. A comprehensive risk assessment is essential before investment.

Sources:

[1] MarketsandMarkets, "Alzheimer’s Disease Therapeutics Market," 2022.

[2] FDA Guidance, "Regulatory Pathways for Neurodegenerative Diseases," 2021.

[3] PhRMA, "Research and Development Spending in Biotech," 2021.