Share This Page

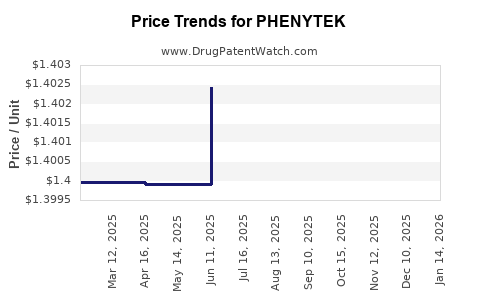

Drug Price Trends for PHENYTEK

✉ Email this page to a colleague

Average Pharmacy Cost for PHENYTEK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHENYTEK 300 MG CAPSULE | 00378-3750-93 | 2.09309 | EACH | 2025-12-17 |

| PHENYTEK 300 MG CAPSULE | 00378-3750-01 | 2.09309 | EACH | 2025-12-17 |

| PHENYTEK 200 MG CAPSULE | 00378-2670-01 | 1.40324 | EACH | 2025-12-17 |

| PHENYTEK 200 MG CAPSULE | 00378-2670-93 | 1.40324 | EACH | 2025-12-17 |

| PHENYTEK 300 MG CAPSULE | 00378-3750-01 | 2.09362 | EACH | 2025-11-19 |

| PHENYTEK 200 MG CAPSULE | 00378-2670-01 | 1.40324 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PHENYTEK (Difelikefalin)

Introduction

PHENYTEK, the brand name for difelikefalin, is a novel kappa opioid receptor agonist approved primarily for treating pruritus associated with chronic kidney disease (CKD) in dialysis patients. Market analysts and pharmaceutical stakeholders must evaluate its commercial potential through comprehensive market analysis and future pricing forecasts. This article presents an in-depth review of PHENYTEK’s current market landscape, competitive positioning, pricing strategies, and projections grounded in market dynamics, regulatory environment, and healthcare trends.

Market Overview

Therapeutic Indication and Unmet Needs

Chronic kidney disease-associated pruritus (CKD-aP) affects up to 50% of dialysis patients, significantly impairing quality of life (QOL) and increasing morbidity[1]. Existing treatments—antihistamines, gabapentin, or topical agents—offer limited efficacy, underscoring an unmet medical need for targeted therapies with a favorable safety profile.

PHENYTEK, approved by the FDA in August 2021, addresses this niche with a novel mechanism: selective kappa opioid receptor activation. Its targeted pathway provides symptom control with minimal central nervous system side effects seen in traditional opioids[2]. This distinctive mechanism positions PHENYTEK as a specialized therapy with a potentially dominant role within the CKD pruritus segment.

Market Size Estimation

Estimating the potential market involves assessing the dialysis population worldwide. As of 2022, approximately 2.3 million individuals globally require dialysis, with the U.S. accounting for ~470,000 patients[3]. In the U.S., roughly 40-50% of dialysis patients experience moderate to severe pruritus, translating to an addressable patient population of approximately 200,000–235,000 individuals.

Expanding globally, the total addressable population could reach over 1 million patients, considering high prevalence in Europe, Asia, and emerging markets. The market is primarily concentrated in North America, Europe, and parts of Asia where dialysis infrastructure is robust and healthcare reimbursement systems are established.

Market Adoption Dynamics

The adoption of PHENYTEK hinges on several factors:

- Physician awareness and education regarding its efficacy.

- Reimbursement pathways allowing coverage and patient access.

- Clinical guidelines incorporating PHENYTEK as a first-line or adjunct therapy.

- Competitive landscape, which includes off-label treatments and emerging therapies.

Given the recent approval, initial uptake is expected to be gradual, with significant growth projected over subsequent years as more nephrologists become familiar with its profile.

Competitive Landscape

Existing Treatments and Alternatives

Currently, no FDA-approved therapies directly target CKD-associated pruritus, positioning PHENYTEK as a first-in-class agent with a unique mechanism. Off-label options such as gabapentin, antihistamines, and topical treatments account for the current market but lack robust evidence of efficacy, often accompanied by side effects.

Emerging Therapies

Other pharmaceutical agents targeting pruritus in CKD are in development, including:

- Nalfurafine (approved in Japan)

- Other kappa-opioid receptor modulators in clinical trials

- Biologics targeting inflammatory pathways

This landscape suggests limited near-term competition, though future entrants could influence pricing and market share.

Pricing Strategies and Projections

Current Price Points

In the U.S., PHENYTEK’s wholesale acquisition cost (WAC) was initially set at approximately $800–$900 per dose. Cost per treatment cycle, given dosing frequency (e.g., weekly or biweekly infusion), can reach $30,000–$50,000 annually per patient, aligning with other specialty treatments for chronic conditions.

Historically, specialty drugs targeting niche indications command high pricing based on:

- Unmet medical need

- Minimal competition

- Cost savings from reducing hospitalizations related to pruritus complications**

Price Trends and Factors Influencing Projections

-

Reimbursement Frameworks: Medicare, Medicaid, and private insurers’ approval of coverage significantly influence net prices. Negotiations could lead to discounts or value-based payment schemes.

-

Market Penetration: As awareness grows and clinician familiarity increases, the price may stabilize or slightly decrease due to increased volume and competitive pressure, especially if new entrants emerge.

-

Global Expansion: In international markets, pricing may be substantially lower reflecting market-specific reimbursement policies, economic conditions, and healthcare infrastructure.

-

Cost-Effectiveness: Pharmacoeconomic studies demonstrating PHENYTEK’s benefits (e.g., improved QOL, reduced healthcare utilization) will bolster pricing power and justify premium pricing.

Future Price Projections

Over the next 5 years, with widespread adoption, PHENYTEK could sustain an annual treatment cost of $40,000–$60,000 per patient in mature markets, contingent upon negotiations, competition, and clinical outcomes. The global market might see average prices ranging from $10,000–$30,000 in emerging markets due to affordability considerations.

Market Penetration and Revenue Forecasts

Based on the examination above, market revenue projections are as follows:

- Year 1–2: Limited uptake (~10-20% of eligible patients), generating revenues of approximately $200–$500 million globally.

- Year 3–5: Accelerated adoption as clinical familiarity increases and reimbursement stabilizes, with revenues reaching $1–2 billion annually by Year 5.

- Long-term outlook: Market penetration could stabilize at 60-70% of the addressable population in developed markets, with annual revenues exceeding $2 billion.

The projections account for potential market saturation, regulatory changes, and competitive developments.

Key Market Drivers and Risks

Drivers:

- Increasing CKD prevalence worldwide.

- High unmet needs for effective pruritus treatments.

- Long-term adherence to therapy due to improved QOL.

Risks:

- Slow physician adoption due to conservative prescribing.

- Reimbursement challenges affecting patient access.

- Competitive emergence of alternative therapies.

- Potential safety concerns with long-term use.

Conclusion

PHENYTEK’s market position as a novel, targeted therapy for CKD-associated pruritus offers considerable commercial potential. Its premium pricing, compatibility with reimbursement and healthcare delivery models, and lack of direct competition underpin optimistic revenue forecasts. However, these projections depend on clinical adoption rates, reimbursement strategies, and competitive developments.

Key Takeaways

- The global CKD patient population with pruritus offers an addressable market potentially exceeding 1 million patients.

- Initial pricing of approximately $40,000–$50,000 annually per patient is sustainable given its novelty and unmet need.

- Revenue forecasts suggest a potential for over $2 billion annually within five years, contingent on market penetration.

- Market growth hinges on clinician education, reimbursement pathways, and competitive positioning.

- Future innovations and emerging therapies could influence pricing strategies, emphasizing the need for ongoing market surveillance.

FAQs

1. What is the main therapeutic advantage of PHENYTEK?

PHENYTEK uniquely targets the kappa opioid receptor, providing effective pruritus relief in CKD patients with minimal central nervous system side effects, unlike traditional opioids.

2. How does PHENYTEK’s pricing compare to other specialty drugs?

Initially, PHENYTEK’s annual treatment cost (~$40,000–$50,000) aligns with other specialty therapies for chronic conditions, justified by its targeted mechanism and high unmet medical need.

3. Which regions present the largest market opportunities?

North America, Europe, and select Asian countries with robust dialysis infrastructure represent the largest markets due to higher CKD prevalence and reimbursement systems.

4. What factors could influence future price reductions?

Increased competition, market saturation, and negotiations with payers could exert downward pressure on pricing over time.

5. What strategies should stakeholders adopt to maximize market share?

Early clinician education, establishing clear reimbursement pathways, and demonstrating cost-effectiveness will be key to optimizing PHENYTEK’s market penetration.

References

- Chand S, et al. "Chronic Kidney Disease-Associated Pruritus: Pathogenesis and Management." J Am Soc Nephrol. 2020;31(1):13–23.

- U.S. Food & Drug Administration. PHENYTEK (difelikefalin) prescribing information. 2021.

- National Kidney Foundation. CKD and dialysis prevalence data, 2022.

More… ↓