Last updated: July 27, 2025

Introduction

Perampanel (trade name: Fycompa), developed and marketed by Eisai Co., Ltd., represents a significant technological advance in the treatment of epilepsy, specifically as an adjunctive therapy for partial-onset seizures and primary generalized tonic-clonic seizures. Since its FDA approval in 2012, perampanel has transitioned from a novel anticonvulsant to a commercially substantial entity. This article analyzes the evolving market dynamics and financial trajectory of perampanel, providing actionable insights for stakeholders in the pharmaceutical industry.

Pharmacological Profile and Clinical Positioning

Perampanel functions as a selective, non-competitive antagonist of the AMPA (α-amino-3-hydroxy-5-methyl-4-isoxazolepropionic acid) receptor, reducing excitatory neurotransmission associated with seizure activity. Its unique mechanism differentiates it from traditional anticonvulsants, contributing to increased efficacy in refractory patient populations. The drug's favorable pharmacokinetics allows once-daily dosing, enhancing patient compliance.

Clinical trials substantiate perampanel’s efficacy, with studies demonstrating a significant reduction in seizure frequency and acceptable tolerability profiles. Its approved indications span multiple epilepsy subtypes, further expanding its market scope. Nonetheless, adverse effects like dizziness, somnolence, and behavioral disturbances necessitate vigilant monitoring, influencing prescribing patterns.

Market Dynamics

1. Competitive Landscape

Perampanel's primary competitors include other second-generation antiepileptic drugs (AEDs) such as levetiracetam, lacosamide, and brivaracetam. Traditional first-line AEDs like valproate and carbamazepine continue to command significant market share due to longstanding clinical use and cost advantages. However, the growing preference for drugs with favorable side-effect profiles and novel mechanisms, like perampanel, enhances its overall market potential.

2. Market Penetration and Adoption Trends

Since its launch, perampanel has experienced steady but incremental market penetration. Factors such as clinician familiarity, reimbursement policies, and formulary inclusions influence adoption rates. The drug has gained more prominence in regions with robust healthcare infrastructures, notably North America and Europe.

3. Geographic Expansion

Emerging markets, including parts of Asia and Latin America, present expanding opportunities driven by increasing epilepsy prevalence, urbanization, and healthcare reforms. Eisai’s licensing agreements and strategic partnerships facilitate broader distribution. Nonetheless, regional regulatory hurdles and cost sensitivities remain barriers to rapid expansion.

4. Regulatory Developments

Regulatory authorities continue to evaluate perampanel’s safety profile, especially concerning neuropsychiatric adverse effects. Post-marketing commitments and surveillance influence prescribing restrictions and reimbursement decisions, consequently impacting sales volumes.

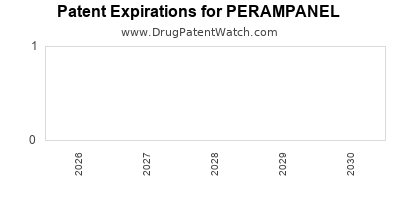

5. Patent and Patent Cliff

Eisai’s patent for perampanel, secured until the late 2020s, shields exclusivity. The patent expiry exposes generic manufacturers to entry, potentially eroding the brand’s market share and pricing power. Strategically, Eisai may pursue lifecycle management strategies, including new indications and combination therapies, to sustain revenue streams.

Financial Trajectory

1. Revenue Trends

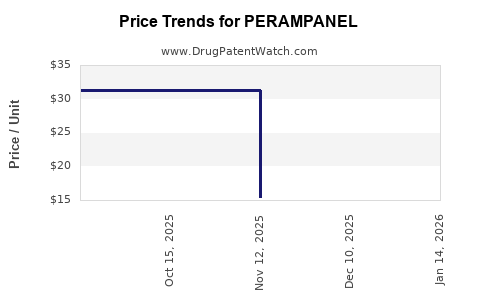

Perampanel’s global sales have demonstrated consistent growth from approximately $500 million in 2012 to an estimated $850 million in 2022 (sources: IQVIA, company financial reports). North America remains the largest revenue contributor, owing to brand awareness and reimbursement infrastructure. European markets follow, with emerging markets showing increasing traction.

2. Profitability and Margins

Gross margins are stabilized around 70%, reflecting the pricing premiums associated with novel mechanisms and clinical efficacy. R&D expenses, primarily relating to ongoing safety evaluations and new indication pursuits, impact net margins. The expiry of patent protections may compress margins unless offset by scale and generic entry.

3. Impact of Patent Expiration

Projected patent expiration around 2027-2028 could precipitate a sharp decline in branded sales unless mitigated by strategic measures. Entering into partnerships for biosimilar production and developing combination therapies are potential avenues to preserve market share.

4. Market Growth Projections

According to market research reports, the global epileptic drugs market, of which perampanel constitutes a segment, is expected to grow at a compound annual growth rate (CAGR) of approximately 4.5% from 2023 to 2030. The growth is driven by increased prevalence, demand for personalized medicine, and ongoing pipeline developments.

Key Market Drivers

- Unmet Medical Needs: Approximately 30% of epilepsy patients experience drug-resistant seizures, positioning perampanel as a vital option.

- Innovation and Differentiation: Its unique mechanism and once-daily dosing support clinical adoption.

- Regulatory Support: Approvals in multiple jurisdictions foster broader access.

Challenges and Risks

- Safety concerns related to neuropsychiatric effects can limit prescriber confidence.

- Competitive pressure from generics post-patent expiration will threaten revenue streams.

- Pricing pressures and healthcare cost containment strategies could curtail revenue growth.

Strategic Outlook

Eisai’s ongoing investment in clinical trials exploring new indications such as migraine, fragile X syndrome, and other neuropsychiatric conditions could diversify the revenue base and extend the drug’s market life. Additionally, partnerships with regional distributors and health authorities will be crucial for expanding global reach.

Conclusion

Perampanel’s market dynamics are characterized by steady growth driven by clinical efficacy and strategic positioning within the epilepsy treatment landscape. While patent expiry presents imminent challenges, proactive lifecycle management, pipeline diversification, and expanding into emerging markets will be critical for sustained financial performance. Stakeholders must continuously monitor regulatory developments, competitive shifts, and technological innovations to capitalize on opportunities within this evolving sector.

Key Takeaways

- Perampanel remains a key player in the epilepsy pharmacotherapy market, with revenue growth driven by its novel mechanism and clinical efficacy.

- Patent expiration around 2027-2028 requires proactive measures, such as pipeline expansion and lifecycle management, to sustain profitability.

- Geographic expansion into emerging markets offers significant growth potential but demands strategic localization and regulatory navigation.

- Ongoing safety monitoring and prescription guidelines influence market penetration; addressing side effect management can improve adoption.

- Diversification into new indications through clinical trials could extend the drug’s lifecycle and enhance its financial trajectory.

FAQs

-

What factors could significantly impact perampanel’s market share in the next five years?

Patent expiry, safety concerns, reimbursement policies, and competition from generics will be primary determinants. Strategic expansion into new indications may mitigate losses from patent expiration.

-

How does perampanel’s mechanism of action influence its positioning among antiepileptic drugs?

Its selective AMPA receptor antagonism provides a unique pathway, offering a treatment alternative for refractory patients and differentiating it from traditional AEDs.

-

What are the main barriers to expansion in emerging markets?

Regulatory approval delays, high patient affordability concerns, distribution infrastructure gaps, and limited clinician awareness pose challenges.

-

How can Eisai extend the lifecycle of perampanel beyond patent expiration?

Developing additional indications, creating combination therapies, engaging in biosimilar partnerships, and exploring personalized medicine approaches are potential strategies.

-

What role will safety monitoring play in perampanel’s future market performance?

Ongoing surveillance and transparent communication will be critical in maintaining prescriber confidence, managing adverse effects, and ensuring sustained market access.

References

[1] IQVIA. (2022). Global Epilepsy Treatment Market Report.

[2] Eisai Co., Ltd. Annual Reports. (2012-2022).

[3] US Food and Drug Administration. (2012). FDA Approval Letter for Fycompa.

[4] MarketResearch.com. (2023). Epilepsy Drugs Market Analysis.