Share This Page

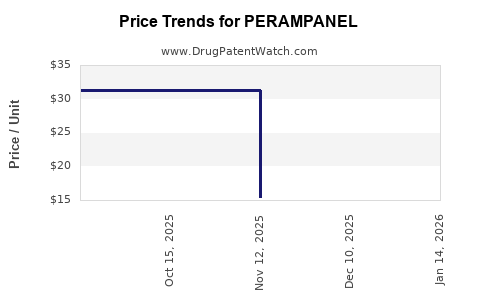

Drug Price Trends for PERAMPANEL

✉ Email this page to a colleague

Average Pharmacy Cost for PERAMPANEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PERAMPANEL 12 MG TABLET | 00480-7068-56 | 31.43261 | EACH | 2025-11-19 |

| PERAMPANEL 2 MG TABLET | 00480-7062-56 | 15.48120 | EACH | 2025-11-19 |

| PERAMPANEL 4 MG TABLET | 00480-7063-56 | 31.45517 | EACH | 2025-11-19 |

| PERAMPANEL 6 MG TABLET | 00480-7065-56 | 33.24687 | EACH | 2025-11-19 |

| PERAMPANEL 4 MG TABLET | 00480-7063-56 | 31.27847 | EACH | 2025-10-22 |

| PERAMPANEL 4 MG TABLET | 00480-7063-56 | 31.27847 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Perampanel

Introduction

Perampanel (marketed as Fycompa) is a prescription antiepileptic drug (AED) developed by Eisai Co., Ltd., primarily indicated for the adjunctive treatment of partial-onset seizures and primary generalized tonic-clonic seizures in patients with epilepsy aged 12 years and older. Since its FDA approval in 2012, perampanel has established a niche within the rapidly evolving epilepsy treatment landscape. This analysis explores the current market dynamics, competitive positioning, and future price projections for perampanel, factoring regulatory, clinical, and commercial considerations.

Market Landscape and Demand Drivers

Global Epilepsy Treatment Market

The global epilepsy market, valued at approximately USD 4.8 billion in 2022, is expected to grow at a CAGR of around 4.1% through 2030 [1]. Growing prevalence of epilepsy—estimated at 50 million affected individuals worldwide—and increasing awareness have fueled demand for diverse therapeutic options.

Epilepsy Prevalence and Patient Demographics

Epilepsy affects about 1% of the population globally, with partial seizures accounting for roughly 60%. The targeted age group for perampanel (adolescents and adults) aligns with significant patient segments, further expanding potential adoption.

Treatment Landscape and Competitive Environment

Perampanel faces competition from established AEDs including levetiracetam, lamotrigine, and topiramate. Recently, newer drugs like cenobamate and cannabidiol formulations (Epidiolex) have entered the scene, compelling manufacturers to demonstrate differentiation in efficacy, safety, and pricing.

Regulatory Approvals and Market Penetration

While primarily approved in the United States, Europe, and select Asian markets, the drug’s uptake varies, influenced by clinician preferences, approval status, and formulary inclusion. As of 2023, perampanel's global sales are approximately USD 150–200 million, with growth potential in emerging markets.

Pricing Dynamics and Revenue Projections

Current Pricing and Reimbursement Strategies

In the U.S., perampanel’s wholesale acquisition cost (WAC) is approximately USD 35–40 per 28-day supply (around USD 1.30–1.50 per pill). Insurance reimbursements and patient assistance programs influence net pricing, which varies among regions.

Factors Influencing Market Price

-

Generic Entry Potential: Patents for perampanel are set to expire by 2028, paving the way for generics that could reduce prices by 50–70%, depending on market conditions.

-

Pricing in Emerging Markets: Price sensitivity is higher; thus, perampanel’s price may range from USD 10–20 per month in lower-income regions, expanding access but compressing margins.

-

Formulation and Dosing Flexibility: Once the patent expires, manufacturers may introduce lower-priced formulations and combination therapies, influencing the market.

Forecasted Revenue Trajectory (2023–2030)

- 2023: USD 200 million globally; modest growth driven by increased adoption in developed markets and expansion into new regions.

- 2025: Estimated USD 250–270 million, assuming steady market penetration and minimal price erosion.

- 2030: Potential USD 350–400 million, contingent on broader acceptance, expanded indications, and a wave of generic competition.

Pricing Projections

Pre-Patent Expiry (2023–2028)

- Retail prices are expected to decline gradually, driven by market competition and formulary restrictions.

- The annual price per patient may decrease by approximately 10–15% leading into patent expiry, aligning with similar AEDs.

Post-Patent Expiry (2028 onward)

- Entry of generics could lead to a 50–70% price reduction.

- Manufacturer strategies may include introducing biosimilars or combination products to sustain margins.

Impact of Biosimilars or Alternative Formulations

Although biosimilar development is less common for small-molecule AEDs like perampanel, combination formulations or sustained-release versions could alter pricing dynamics upon leaving patent protection.

Regulatory and Market Expansion Opportunities

Regional approvals in key markets such as China, Russia, and Latin America will influence marketing strategies and pricing. Negotiated prices, especially in government-managed healthcare systems, will likely be lower than in private markets.

Key Challenges and Risks

- Patent Expiration: Accelerates price erosion.

- Market Penetration: Slow uptake due to clinician preference for existing therapies.

- Regulatory Barriers: Additional indications require approval and reimbursement negotiations.

- Safety and Tolerability Profiles: Competition based on side effect profiles may influence prescribing patterns and, consequently, pricing.

Strategic Recommendations

- Pricing Optimization: Employ tiered pricing strategies aligning with regional economic status.

- Formulation Innovation: Develop fixed-dose combinations or extended-release forms to enhance value.

- Market Expansion: Accelerate registration in emerging markets to diversify revenue streams.

- Cost Management: Prepare for patent expiry by fostering efficiencies and considering strategic collaborations pre- and post-generic entry.

Key Takeaways

- The global epilepsy market offers growth opportunities for perampanel, driven by rising prevalence and unmet needs.

- Current pricing is positioned within a competitive landscape with anticipated gradual declines due to patent expirations.

- The post-2028 period presents significant price erosion risks, but strategic innovation and market expansion can mitigate impact.

- Emerging markets constitute a key growth avenue, requiring tailored pricing models aligned with local healthcare economics.

- Proactive positioning prior to patent expiration is essential for maintaining profitability and market share.

FAQs

Q1: When is the patent for perampanel expected to expire?

A1: The primary patent protections for perampanel are anticipated to expire around 2028, opening the market for generics.

Q2: How will patent expiry affect the price of perampanel?

A2: Typically, generic entry leads to a 50–70% reduction in drug prices, significantly impacting revenues.

Q3: What are the main competitors to perampanel in epilepsy treatment?

A3: Established AEDs such as levetiracetam, lamotrigine, topiramate, and newer entrants like cenobamate and cannabidiol products.

Q4: Are there opportunities to extend perampanel's market exclusivity?

A4: Yes, through new indications, formulation enhancements, or combination therapies, which can encourage reimbursement and value perception.

Q5: What regional markets offer the greatest growth potential for perampanel?

A5: Emerging markets in Asia, Latin America, and Eastern Europe, where epilepsy prevalence is high and healthcare access expands.

References

[1] Grand View Research. Epilepsy Treatment Market Size & Trends; 2022.

More… ↓