Last updated: July 27, 2025

Introduction

Paricalcitol is a synthetic vitamin D analog primarily used to manage secondary hyperparathyroidism in patients with chronic kidney disease (CKD), especially those undergoing dialysis. As the global burden of CKD escalates—driven by increasing prevalence of diabetes, hypertension, and aging populations—the demand for targeted therapies like paricalcitol has surged. This article delineates the contemporary market dynamics and projects the financial trajectory of paricalcitol, emphasizing factors influencing its growth, competitive landscape, and future outlook.

Market Overview and Key Drivers

Epidemiological Trends Elevate Demand

Chronic kidney disease affects over 850 million individuals worldwide, with a rising prevalence over the last decade [1]. The progression of CKD often results in secondary hyperparathyroidism, a condition characterized by abnormal calcium and phosphate metabolism, leading to severe bone and cardiovascular complications. Paricalcitol, due to its selectivity and reduced hypercalcemic side effects compared to older vitamin D analogs, has become a first-line treatment in managing this condition, bolstering market growth.

Innovation and Regulatory Approvals

The approval of newer formulations and the expansion of indications bolster the drug’s market. In recent years, regulatory agencies like the FDA and EMA have approved paricalcitol for broader indications, including its use in earlier stages of CKD and various dialysis settings.

Rising Healthcare Expenditure and Access

Economic growth in emerging markets has expanded healthcare access, enabling increased prescription of specialty medications, including paricalcitol. Furthermore, government initiatives targeting CKD screening and prevention programs support early diagnosis and intervention, positively impacting demand.

Pricing Strategies and Reimbursement Policies

Pricing dynamics significantly influence market growth. Paricalcitol's cost-effectiveness, evidenced by reduced hospitalization and complication rates, has led to favorable reimbursement policies in many regions, driving uptake.

Competitive Landscape

Key Players

The market is predominantly occupied by generic manufacturers post-patent expiry, with some branded formulations still leading in specific geographies. Major players include Abbott Laboratories (now AbbVie), Fresenius Medical Care, and others producing both branded and generic products [2].

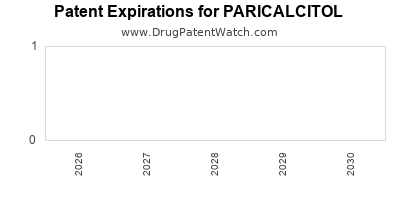

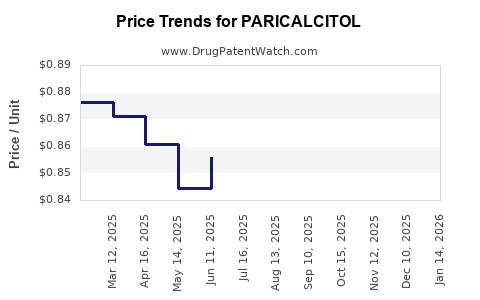

Genericization and Market Saturation

Patent expirations since the late 2010s have led to an influx of generic options, intensifying price competition. While this has reduced overall costs, it pressures profit margins for manufacturers. However, generics have increased accessibility, expanding the user base.

Innovations and Formulation Developments

Research is ongoing into new delivery systems, such as extended-release formulations and novel dosing regimens, aimed at improving patient adherence and minimizing side effects. These innovations could potentially command premium pricing and extend market exclusivity.

Regional Market Dynamics

North America

North America remains the largest market, driven by high CKD prevalence, advanced healthcare infrastructure, and widespread insurance coverage. The US holds a dominant position, with the government and private insurers facilitating access.

Europe

Europe demonstrates steady growth owing to comprehensive healthcare systems and increasing CKD awareness. Regulatory transparency and reimbursement policies favor market stability.

Emerging Markets

Asia-Pacific, Latin America, and Middle East & Africa showcase significant growth potential owing to rising CKD incidence, expanding healthcare access, and increasing healthcare expenditure. Countries like China and India are experiencing accelerated adoption, though regulatory and economic barriers persist.

Financial Trajectory and Forecast

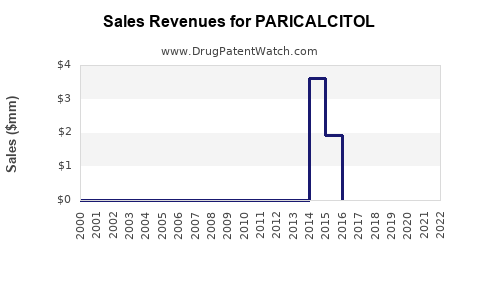

Market Size and Revenue Projections

The global market for paricalcitol was valued at approximately USD 250 million in 2022. Forecasts predict a compound annual growth rate (CAGR) of 7–9% over the next five years, driven by increasing CKD prevalence, expanded indications, and adoption in emerging markets [3].

Pricing and Cost Dynamics

As patents expire, price erosion due to generics is anticipated, potentially compressing margins but lowering costs for healthcare systems, thus supporting broader use. Investment in formulations offering improved safety profiles has demonstrated potential to sustain premium pricing.

Impact of Healthcare Policies

Reimbursement reforms, especially in the US and Europe, favor access to CKD-related therapies. Incentives for early intervention may shift prescribing practices, influencing sales volume and revenue streams.

Potential Disruptors

Emerging therapies, such as calcimimetics, and novel vitamin D analogs with improved efficacy, could encroach upon paricalcitol’s market share. Additionally, telemedicine and personalized treatment regimens may influence prescribing behaviors.

Regulatory and Patent Landscape

Patent expiries for key formulations occurred between 2018 and 2021, catalyzing generic entry. Vigilant monitoring of patent litigations and exclusivity periods is essential for forecasting revenue peaks and declines.

Challenges and Opportunities

Challenges:

- Price erosion due to generics.

- Competition from alternative therapies.

- Navigating regulatory processes in emerging markets.

- Managing side effect profiles and optimizing dosing strategies.

Opportunities:

- Development of novel formulations with enhanced safety or ease of administration.

- Expansion of indications to earlier CKD stages.

- Strategic partnerships for market penetration.

- Integrating digital health tools for adherence and monitoring.

Conclusion

Paricalcitol's market is poised for steady growth driven by the increasing global burden of CKD, evolving treatment paradigms, and expanding access in emerging economies. While patent expiries and generic competition present challenges, ongoing innovation and strategic market positioning can sustain profitability. Stakeholders investing in paricalcitol should emphasize formulary access, competitive pricing, and pipeline development to capitalize on future opportunities.

Key Takeaways

-

The escalating prevalence of CKD enhances paricalcitol’s demand globally, especially in mature markets like North America and Europe, and rapidly growing regions such as Asia-Pacific.

-

Patent expiries have introduced significant generics competition, exerting downward pressure on prices but widening access and expanding the user base.

-

Innovative formulations and expanding indications offer avenues for premium pricing and market differentiation.

-

Healthcare policies emphasizing early CKD management and reimbursement reforms will influence market access and sales trajectories.

-

Strategic stakeholder engagement, including partnerships and R&D investments, is crucial to navigate a competitive and evolving landscape.

FAQs

1. What factors are driving the increased demand for paricalcitol globally?

The rising prevalence of CKD, particularly due to diabetes and hypertension, advancements in therapeutic indications, and expanding access in emerging markets are primary drivers.

2. How has patent expiry affected paricalcitol’s market dynamics?

Patent expiries have led to the entry of generic manufacturers, resulting in price reductions, increased competition, and broader market access, though they have pressured profit margins.

3. What are the key challenges facing paricalcitol manufacturers today?

Major challenges include intense price competition from generics, potential competition from new therapies, regulatory hurdles in emerging markets, and side effect management.

4. Are there upcoming innovations that could influence paricalcitol's market share?

Yes. Development of extended-release formulations, combination therapies, and safer analogs aims to improve efficacy, adherence, and safety profiles, potentially influencing market dynamics.

5. What regions offer the most growth opportunities for paricalcitol?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant growth prospects due to increasing CKD burden and expanding healthcare infrastructure.

References

[1] Source: Global CKD prevalence statistics, Global Kidney Health Alliance, 2022.

[2] Source: Market research reports, Evaluate Pharma, 2022.

[3] Source: Analyst projections, IQVIA, 2023.