Last updated: July 29, 2025

Introduction

Paricalcitol, a synthetic vitamin D analog, plays a pivotal role in managing secondary hyperparathyroidism (SHPT) in patients with chronic kidney disease (CKD), especially those on dialysis. Approved by the FDA in 2004, paricalcitol has gained prominence due to its targeted action and reduced risk of hypercalcemia compared to traditional vitamin D therapy. Its unique pharmacological profile has driven a dynamic market landscape characterized by regulatory, clinical, and economic factors. This report delineates current market conditions, competitive landscape, demand drivers, regulatory considerations, and forecasts future pricing trends.

Market Overview

Market Size and Growth Dynamics

The global paricalcitol market is integral to the broader vitamin D analogs segment, which is valued at approximately $620 million as of 2022, with projections indicating a compound annual growth rate (CAGR) of 5-7% through 2027 [1]. The predominance of end-stage renal disease (ESRD) in aging populations fuels demand for SHPT therapies, boosting paricalcitol's adoption. North America dominates market share, accounting for over 55%, driven by advanced healthcare infrastructure and high CKD prevalence.

Key Market Drivers

- Increasing CKD and ESRD Prevalence: The rising burden globally, primarily attributable to diabetes mellitus and hypertension, underpins consistent demand.

- Market Preference for SI-Active Vitamin D Analogs: Paricalcitol’s lower hypercalcemia risk favors its use over calcitriol and doxercalciferol.

- Innovation in Delivery and Formulations: Injection formulations and potential oral variants enhance patient compliance.

- Reimbursement Policies: Favorable reimbursement in core markets sustains sales.

Constraints and Challenges

- Pricing Pressures: Healthcare cost containment measures threaten profit margins.

- Generic Entrants: Patent expirations and generic proliferation threaten to reduce prices.

- Regulatory Hurdles in Emerging Markets: Stringent approval processes and registration delays impact regional growth.

Competitive Landscape

Major Industry Players

Leading pharmaceutical companies securing substantial market shares include AbbVie (Abbott), KemPharm, and Cipla. Abbott’s Zemplar is a branded paricalcitol formulation with notable market penetration. Generic manufacturers and biosimilars are increasingly entering the space, exerting downward pressure on prices.

Brand vs. Generic Competition

Post-patent expiry in key markets, generics capture a significant market segment, with wholesale price reductions of up to 30-50%. Premium branded formulations retain market share via clinical differentiation, though at higher prices.

Pricing Analysis

Current Pricing Dynamics

As of 2023, the average wholesale price (AWP) for paricalcitol injections in the U.S. ranges from $150 to $220 per 2-mL vial, varying by strength and manufacturer. Generic equivalents, once launched, typically reduce prices by approximately 20-35%. The drug’s high utilization in dialysis centers further influences bulk pricing strategies.

Factors Influencing Price Trends

- Patent Status: Loss of patent exclusivity precipitates price erosion.

- Regulatory Approvals: Expanded indications and formulations can command higher prices.

- Market Competition: Increased entries intensify price competition.

- Reimbursement Policies: Adjustments impact net obtainable prices for providers.

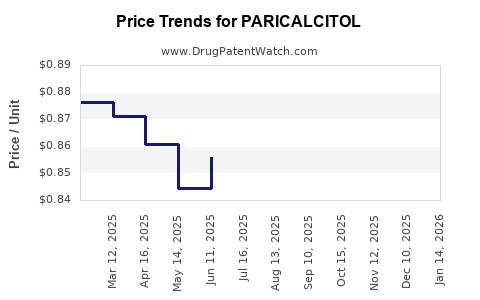

Price Projections (2023-2028)

Short-term Outlook (2023-2025)

The imminent patent expiration of branded paricalcitol is expected to induce a 25-30% price decline in developed markets, driven by generic saturation and cost negotiations. Healthcare payers are promoting biosimilar adoption, which could further reduce prices.

Mid-to-Long-term Outlook (2026-2028)

Innovations such as orally bioavailable formulations or extended-release variants could offset some price declines by offering clinical benefits. Moreover, emerging markets, characterized by less price sensitivity, may sustain higher price levels through localized approvals and reimbursement schemes.

Overall, a compound annual price decrease of approximately 4-6% is forecasted post-generic entry, stabilizing as markets adjust. However, niche applications and formulation premiums could temper the decline.

Regulatory and Market Considerations

- Regulatory pathways for biosimilars or generics will directly influence price reductions.

- Patent litigation might delay generic entry, prolonging premium pricing.

- Market expansion into Asia-Pacific, Latin America, and Africa presents growth opportunities, albeit at varying price points owing to differing healthcare systems.

Decision-Making Implications for Stakeholders

- Pharmaceutical companies should focus on differentiation through innovation—such as oral formulations or combination therapies—to command premium pricing.

- Healthcare payers are incentivized to favor biosimilars for cost savings, influencing market access strategies.

- Investors should monitor patent statuses, regulatory approvals, and market penetration rates to project profitability timelines.

Key Takeaways

- The paricalcitol market is poised for moderate growth driven by rising CKD prevalence, with a shifting landscape post-patent expiry.

- Price erosion is anticipated due to increasing generic competition, with multi-year declines of up to 6% annually.

- Innovation, formulary preferences, and regional market expansion will be vital to maintaining profitable margins.

- Stakeholders should prepare for heightened competition from biosimilars and generics, emphasizing differentiation and strategic market positioning.

- Price sensitivity varies regionally; emerging markets may offer stabilizing revenue streams, while mature markets will see sustained downward pressure.

FAQs

-

How does patent expiration impact paricalcitol pricing?

Patent expiry facilitates generic entry, leading to significant price reductions—typically 20-50%—due to increased competition.

-

Are biosimilars a threat to current paricalcitol formulations?

While biosimilars are emerging in the vitamin D analogs space, their adoption depends on regulatory approval, clinical acceptance, and pricing advantages.

-

What are the primary factors influencing future paricalcitol prices?

Patent status, regulatory approvals, competition from generics or biosimilars, regional reimbursement policies, and formulation innovations.

-

Is there potential for oral paricalcitol formulations?

Yes, oral formulations are under development, offering convenience and potential price premiums if clinically advantageous.

-

Which regions offer the most growth for paricalcitol?

Asia-Pacific, Latin America, and Africa present growth opportunities due to rising CKD rates and expanding healthcare access, though price levels may be lower.

References

[1] MarketsandMarkets, "Vitamin D Analogs Market by Product," 2022.