OPSUMIT Drug Patent Profile

✉ Email this page to a colleague

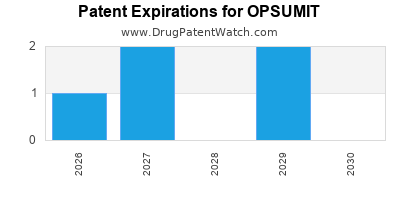

Which patents cover Opsumit, and when can generic versions of Opsumit launch?

Opsumit is a drug marketed by Actelion and is included in one NDA. There are five patents protecting this drug and one Paragraph IV challenge.

This drug has ninety-nine patent family members in thirty-four countries.

The generic ingredient in OPSUMIT is macitentan. There are ten drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the macitentan profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Opsumit

A generic version of OPSUMIT was approved as macitentan by ALEMBIC on August 18th, 2025.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for OPSUMIT?

- What are the global sales for OPSUMIT?

- What is Average Wholesale Price for OPSUMIT?

Summary for OPSUMIT

| International Patents: | 99 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 17 |

| Patent Applications: | 984 |

| Drug Prices: | Drug price information for OPSUMIT |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for OPSUMIT |

| What excipients (inactive ingredients) are in OPSUMIT? | OPSUMIT excipients list |

| DailyMed Link: | OPSUMIT at DailyMed |

Recent Clinical Trials for OPSUMIT

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| American Heart Association | Phase 4 |

| Janssen, LP | Phase 4 |

| Janssen Pharmaceutical K.K. | Phase 3 |

Pharmacology for OPSUMIT

| Drug Class | Endothelin Receptor Antagonist |

| Mechanism of Action | Endothelin Receptor Antagonists |

Paragraph IV (Patent) Challenges for OPSUMIT

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| OPSUMIT | Tablets | macitentan | 10 mg | 204410 | 11 | 2017-10-18 |

US Patents and Regulatory Information for OPSUMIT

OPSUMIT is protected by five US patents and two FDA Regulatory Exclusivities.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actelion | OPSUMIT | macitentan | TABLET;ORAL | 204410-001 | Oct 18, 2013 | AB | RX | Yes | Yes | 8,268,847*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Actelion | OPSUMIT | macitentan | TABLET;ORAL | 204410-001 | Oct 18, 2013 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Actelion | OPSUMIT | macitentan | TABLET;ORAL | 204410-001 | Oct 18, 2013 | AB | RX | Yes | Yes | 9,265,762*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Actelion | OPSUMIT | macitentan | TABLET;ORAL | 204410-001 | Oct 18, 2013 | AB | RX | Yes | Yes | 7,094,781*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Actelion | OPSUMIT | macitentan | TABLET;ORAL | 204410-001 | Oct 18, 2013 | AB | RX | Yes | Yes | 8,367,685*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for OPSUMIT

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Janssen-Cilag International N.V. | Opsumit | macitentan | EMEA/H/C/002697Opsumit, as monotherapy or in combination, is indicated for the long-term treatment of pulmonary arterial hypertension (PAH) in adult patients of WHO Functional Class (FC) II to III.Efficacy has been shown in a PAH population including idiopathic and heritable PAH, PAH associated with connective tissue disorders, and PAH associated with corrected simple congenital heart disease. | Authorised | no | no | yes | 2013-12-20 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for OPSUMIT

When does loss-of-exclusivity occur for OPSUMIT?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 2501

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07290099

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0715698

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 59770

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07002494

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1511365

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0131233

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 14735

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 59246

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 59246

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 0240045

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1054

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 33597

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 400046

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 7235

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 08113

Estimated Expiration: ⤷ Get Started Free

Patent: 10502588

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 4591

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09002057

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 704

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1308

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5702

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 2554

Estimated Expiration: ⤷ Get Started Free

Patent: 24059

Estimated Expiration: ⤷ Get Started Free

Patent: 091254

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 59246

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 59246

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 62249

Estimated Expiration: ⤷ Get Started Free

Patent: 09111378

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 59246

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0902164

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1473022

Estimated Expiration: ⤷ Get Started Free

Patent: 090057009

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 38792

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 88556

Estimated Expiration: ⤷ Get Started Free

Patent: 0823198

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering OPSUMIT around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 2010502588 | ⤷ Get Started Free | |

| Austria | 323079 | ⤷ Get Started Free | |

| Russian Federation | 2008113869 | ⤷ Get Started Free | |

| Portugal | 2059246 | ⤷ Get Started Free | |

| China | 100432070 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for OPSUMIT

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1345920 | CA 2014 00012 | Denmark | ⤷ Get Started Free | PRODUCT NAME: MACITENTAN OG FARMACEUTISK ACCEPTABLE SALTE HERAF; REG. NO/DATE: EU/1/13/893 20131220 |

| 2059246 | LUC00371 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF (A) MACITENTAN OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF AND (B) TADALAFIL OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; AUTHORISATION NUMBER AND DATE: EU/1/24/1859 20240930 |

| 2059246 | 832 | Finland | ⤷ Get Started Free | |

| 1345920 | 2014/018 | Ireland | ⤷ Get Started Free | PRODUCT NAME: MACITENTAN, THE STEREOISOMERS AND THE PHARMACEUTICALLY ACCEPTABLE SALTS THEREOF.; REGISTRATION NO/DATE: EU/1/13/893 20131220 |

| 1345920 | 14C0017 | France | ⤷ Get Started Free | PRODUCT NAME: MACITENTAN ET SES SELS PHARMACEUTIQUEMENT ACCEPTABLES; REGISTRATION NO/DATE: EU/1/13/893 20131220 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Opsumit (Macitentan)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.